⭐ 🚴Upside: The Connected Fitness Ecosystem: From Smart mirror, treadmill, Bike..to Smart Rowing

Over the past 2 years, especially with the COVID-19 pandemic a growing number of teams have started to adopt connected fitness products to enable their athletes to stay in shape remotely. We have seen a variety of connected fitness equipments from smart mirrors, treadmills, bikes to smart rowing products.

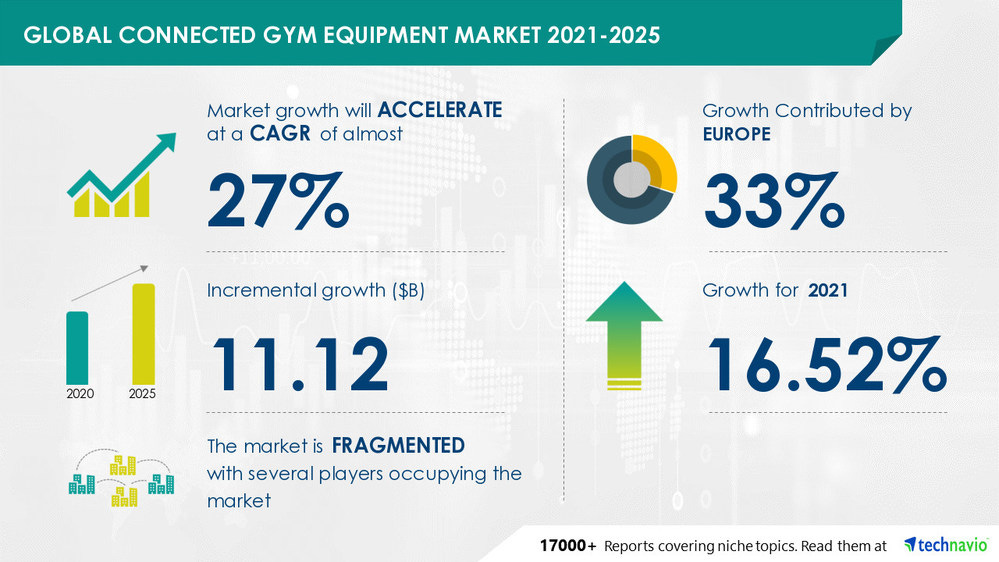

Global Connected fitness Equipment Market expected to grow by $11B during the 2021-2025 Period

So how fast is the market expected to grow? According to Technavio, the connected gym/fitness equipment market is expected to grow by $11.12B during the 2021-2025 period with a CAGR of 27%.

Source: Technavio, 2022.

16% of athletic trainers plan to invest in connected fitness products, according to our 2020 Upside Global survey.

As shown in the graph below, 16% of the athletic trainers we surveyed in 2020 planned to invest in a connected fitness equipment (Tonal, Peloton..) in the future. This compares to 44% of the athletic trainers looking to invest in GPS systems and 48% in sleep tech products in the future. This does not come as a surprise as connected fitness is a growing category. These types of products are also usually a bit more expensive than other products on a unit basis. But we expect the adoption rate among athletic trainers to continue to grow in the coming years.

Source: Upside 2020 Top Coaches Sports Tech Budget Survey Results (n=42 pro teams), April 2020.

Growing demand for digital fitness coaching solutions

Over the past few years there has been a growing demand for “digital fitness coaching” such as “at-home fitness” apps and connected fitness equipments (Peloton, Tonal, MIRROR).

—- “At-Home fitness” solutions: Nowadays, there is a growing demand for “At home fitness” solutions such as connected equipments and gear (e.g. Peloton, Hysko, Fightcamp, etc.), workout apps (ClassPass, Aaptiv, Asana Rebel), and at home fitness tech (e.g. Mirror, Fiit).

One of the key players in the space has been Peloton. Over the past few years Peloton has started to acquire several startups (NeuroTic) and launched its standalone digital app in order to further differentiate its offering and scale its business faster. Peloton, which became a public company in 2020, is now going through some financial difficulties. As a result of that, the Peloton (ticker: PTON) stock went down 76.4% in 2021.

Picture: CB Insights

Not surpassingly, as shown in the graph below, due to the success of companies like Peloton, we are now seeing the emergence of a myriad of Peloton’s type competitors such as Tonal ($450M raised) for strength training, Crew ($58M raised) for rowing, or Eon for pilates and Crossfit.

Source: CB Insights

Similar to Peloton, Tonal is without a doubt one of the most talked about fitness connected startups out there. Tonal looks like an interactive mirror and can be installed on walls and offers personalized workouts through it. Tonal also provides workout plans, such as build muscles, balances strength, and athletic performance based on individual requirement. Tonal also offers live-recorded classes by coaches. Users can start using Tonal for as low as $63 per month. You can check out the video below to see how it works:

Of note, Tennis star Serena Williams has endorsed Tonal. You can see the TV ad below.

Video: Tonal, Serena Williams.

Another hot startup in this area is MIRROR. Like Tonal it offers an interactive mirror with digital coaching capabilities. Users can get access to live and on-demand fitness classes in a variety of workout genres. Users can start using MIRROR for as low as $42 per month. Of note, Lululemon acquired Mirror for $500 million in 2020.

Video: Mirror

Another fast growing startup in the space has been FightCamp, an at-home Boxing and Kickboxing leader in connected fitness, which raised $90M in funding backed by a group of celebrity investors (Mike Tyson, Floyd Mayweather, Georges St-Pierre and Francis Ngannou) and venture capitalists.

Video: Mike Tyson, FightCamp

Here is a full review of the FightCamp product.

Bottom line: We believe that these types of connected fitness equipments can be a great way for players to stay in shape remotely. We also expect the market to consolidate in the future with some startups being acquired or shut down in the coming years. We also expect to see new entrants (e.g. Apple, emerging startups) in this emerging space over time which will help fuel innovation in the coming years.

You may also like:

⭐Sports Performance Roles & Best Practices (Head of Performance, Head Athletic Trainer..)

🔮 2022 Upside Top Sports Tech Predictions (NFT/Metaverse, Sports Performance, IPOs/M&As..)

🔗 🔥 Upside Analysis: NFTs Vs Crypto Vs Digital Currency, How Are They Different?

🔥 Upside Chat: Dave Hancock, CEO, Apollo (Leading Athlete Management Systems (AMS) vendor)

🔥Upside Chat: Alexi Pianosi, Strengths and Conditioning Coach, Pittsburgh Penguins (NHL)

🔥Upside Chat: Pierre Barrieu, High Performance Director, Toronto FC (MLS)