⭐ Upside VC Spotlight: Aser Ventures

Investment platform name: Aser Ventures

Headquartered: London, United Kingdom

Founded: 2015

Partners: 49ers Enterprises, Corrum Capital

Website: https://www.aser.com

Sectors: Sports, media, entertainment

VC type: Investment platform

Typical investment range: Aser Ventures are not tied to a particular stage or scale of investment, from incubating new businesses to working with globally known names. Aser invests in potential, and helps its partners to do the same.

Total number of investments: 12 core investments.

Total number of exits:

New investment in Leeds United from 49ers Enterprises. Details here. (January 25, 2021). Aser still holds a majority stake in the club.

Team Whistle acquired by the ELEVEN Group. Details here. (March 29, 2021). Team Whistle remains within the Aser group, as part of ELEVEN.

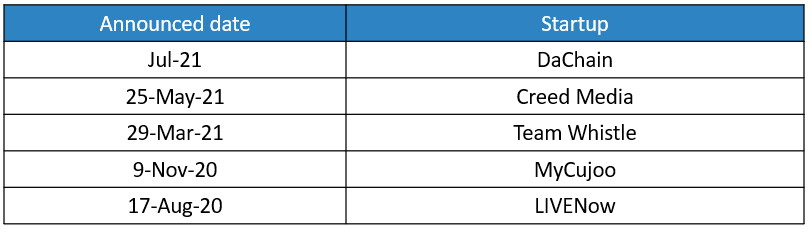

Recent investments: Creed Media (May 25, 2021); Team Whistle (March 29, 2021, acquired by ELEVEN); MyCujoo (November 9, 2020, acquired by ELEVEN); LIVENow (August 17, 2020); DaChain (July 2021).

Source: Aser Ventures, Upside Global, Confidential, September 2021

This week, we interviewed Massimo Marinelli, Board director at Aser Ventures, to discuss his investment platform’s investment thesis, area of focus, and what he is typically looking for when investing in startups.

Q1. What are the areas of investments that your group is focusing on?

We focus on the sports and media sectors primarily. Our objective is to create an ecosystem of companies that can add value to one another and support each other’s growth - from rights owners to distribution platforms, to agencies.

These synergies can be very powerful. For example, Leeds United came together with our production company NEO Studios to create the club docu-series Take us Home for Amazon Prime. And the complementary capabilities of our media companies ELEVEN and Team Whistle led to Team Whistle becoming part of the ELEVEN Group earlier this year.

We want to continue to foster an environment of collaboration between our companies, and pool the expertise that exists across the Aser group to create new value for our businesses and their end users.

Q2. Why sports and media?

Our management team has a huge amount of expertise in sports and media and can provide hands-on support to companies operating in these sectors. Our founder Andrea Radrizzani has more than 20 years experience building sports and media businesses and negotiating sports rights deals. Our Board Director Marc Watson was previously CEO of BT TV and led the launch of BT Sport. He also co-founded the ELEVEN Group with Andrea. Our Chief Corporate and Financial Officer Graham Wallace has held leadership roles with Manchester City, Glasgow Rangers and others. By focusing on sports and media, we can make our experience and network available to the companies in which we invest, to ensure we’re adding as much value as possible.

Another key reason is that we see a huge amount of potential for growth in sports and media. The sports industry is becoming more professional all the time but there is still scope to apply outside learnings to the sector to generate significant growth. From a media point of view, consumption habits are changing fast and we think there is a huge opportunity for innovation in the sector - to serve audiences with the content they want in more dynamic and accessible ways. That’s the principle that our media businesses ELEVEN and LIVENow were founded on.

Q2. What are you typically looking for when investing in startups?

We invest in businesses at every stage of development - from incubating our own media companies like LIVENow and ELEVEN to investing in established organisations with the potential to continue growing like Leeds United.

When making an early stage investment we are looking for a few key things.

One is a belief in the leadership team of that business: we evaluate their vision and their ability to execute on it. We’re in the fortunate position of being exposed to lots of fantastic ideas. But what often sets the business that will go on to succeed apart is their ability to deliver on that idea.

The second criteria is that we at Aser need to be well placed to support the company in an active way. We always want to do more than simply provide capital.

We also want to ensure that new companies coming into the portfolio will sync in well with the rest of the group. Companies that can add new capabilities and synergies to our existing portfolio are always exciting to us.

Q3. What do you think is the state of the sports tech industry after a year with COVID-19?

I think the sports tech sector has proven to be pretty robust in the face of the challenges of the past year and a half.

Those companies who have been able to innovate and find solutions to the fast changing environment we’ve found ourselves in have generally done well. This period has acted as a catalyst for digital first businesses so for many it’s been a period of significant growth.

Looking at Aser’s portfolio - ELEVEN has actually grown very aggressively through the pandemic through both organic and inorganic opportunities. In particular, ELEVEN has come through this period with a stronger rights portfolio, a new global streaming service and hugely expanded production, distribution and commercial capabilities following the acquisitions of MyCujoo and Team Whistle.

Similarly, LIVENow has been able to connect fans with their favorite artists, entertainers and sport at a time when it’s been impossible to go and experience live events in person. So their offering has been more powerful in some ways, because of the restrictions that have been in place.

The pandemic has been brutal in so many ways but for innovative businesses with the ambition, flexibility and resources to continue growing, it’s created the conditions to grow faster than would otherwise have been the case.

Q4. What advice would you give to any startups looking to raise money right now?

Be as practical and tangible as you can with your pitch. Having a brilliant idea is great but what will likely make you stand out is being able to demonstrate clearly and succinctly how you are in a position to execute that idea and to create new value from it.

Q5. What advice would you give to anyone interested in starting a career in the sports investment world?

The toughest stage is to get on the ladder in the first place. My advice would be to focus on getting into the industry wherever you find an opening. Work hard, show your value and then navigate towards the sector or company that you’re particularly interested in being a part of. But the key thing is to get some experience and get stuck in rather than waiting for the perfect opportunity to come along.

⭐ Upside VC Spotlight: Causeway Media Partners

⭐ Upside VC Spotlight: Courtside Ventures

Upside Chat: Vasu Kulkarni, Partner (Courtside Ventures)

Upside Chat: Kai Bond, Partner, Courtside Ventures, on the Gaming/Esport Marke