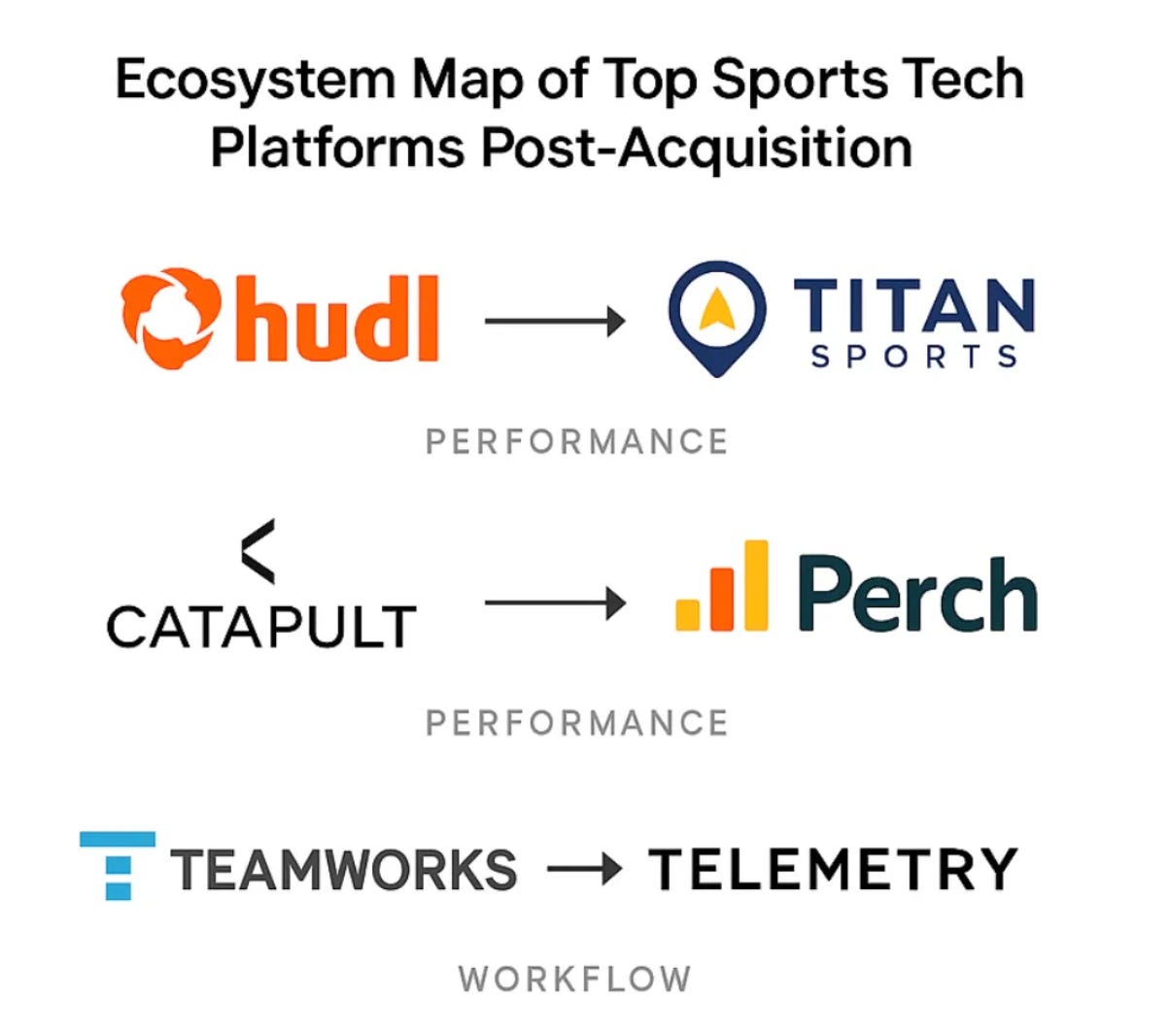

🧩 Upside Special Report: Consolidation Nation: Hudl Acquires Titan Sports, Catapult Grabs Perch, Teamworks Snags Telemetry Sports—What It Means for Teams and the Future of Sports Tech

In a span of just a few weeks, three major M&A deals have reshaped the sports tech landscape:

Hudl acquires Titan Sports (GPS & player tracking)

Catapult acquires Perch (velocity-based training via computer vision)

Teamworks acquires Telemetry Sports (NFL-level analytics & modeling)

Each of these companies was already a leader in its niche. But together, these moves signal something bigger: a race to control the full stack of athlete data—from physical movement and strength output to video analysis, scheduling, and tactical decision-making.

We're witnessing the platformization of performance, where previously siloed technologies are being merged into unified ecosystems. The goal? To own more of the athlete lifecycle—and to deliver value across coaching, operations, medical, and analytics departments from a single interface.

Let’s explore what these deals mean—and why they matter—for teams, the tracking and performance sectors, and the innovation economy of sports.

⚙️ 1. Hudl x Titan Sports: Merging Vision with Velocity

Hudl, historically dominant in video analysis—especially in high school and college sports—has now made a deliberate push into real-time performance data. By acquiring Titan GPS, Hudl is expanding from "what the eyes see" to "what the body does."

Strategic unlocks for Hudl:

Contextual performance review: Imagine a coach watching a sprint and immediately seeing peak velocity, acceleration, and deceleration markers layered onto video.

Integrated workload management: Hudl can now serve as a lightweight performance platform for smaller programs without full-time performance staff.

Youth and long-tail market expansion: Hudl may bring affordable GPS solutions to a massive under-served demographic: youth and sub-elite teams.

In short, this acquisition shifts Hudl from a video-first company to a 360° performance solution—an especially valuable position as more coaches seek to understand not just what happened on the field, but why.

🏋️ 2. Catapult x Perch: Strength Data Joins the Movement Map

Catapult, one of the pioneers of GPS and inertial tracking, now adds Perch's strength training intelligence to its performance arsenal. Perch uses computer vision to measure bar speed and power output during lifts, providing coaches with real-time neuromuscular insights without the need for wearables or force plates.

Why this matters:

Unifying physical output data: Catapult can now correlate external field loads (GPS) with internal gym loads (VBT), painting a more complete picture of athlete readiness.

Closing the strength-monitoring gap: Many performance departments still struggle to quantify how athletes are adapting in the weight room—this solves that.

Injury mitigation and return-to-play: Expect smarter rehab progressions and load return curves with combined gym-field insights.

This acquisition positions Catapult to compete more directly with end-to-end performance platforms by combining strength, movement, and load monitoring under one roof.

🧠 3. Teamworks x Telemetry Sports: Admin Meets Analytics

Teamworks’ initial rise was fueled by solving logistical headaches—calendar syncs, team messaging, and travel planning. But with the Telemetry Sports acquisition, it’s signaling a shift from logistics provider to strategic performance layer.

Telemetry Sports’ expertise lies in game modeling, play tagging, and predictive analytics, particularly within the NFL. Its IP allows coaches and analysts to generate more accurate game plans and scouting reports using historical data and opponent trends.

Impact of this move:

Full performance-stack consolidation: Teamworks now touches the daily schedule, medical notes, and game plan intelligence all in one platform.

Data intelligence as a differentiator: This signals a clear intent to become more than an ops tool—more like a unified control tower for team management and performance insights.

This deal could be a signal of where the next frontier is headed: toward data-enabled decision-making that spans the entire organization—from GMs to performance coaches to operations directors.

⚠️ 4. The Risks of Consolidation: Fewer Options, Less Leverage for Teams

While these acquisitions bring efficiency and cleaner integrations, they also introduce serious trade-offs for teams—particularly when it comes to market power, pricing leverage, and vendor choice.

Here are some potential negative impacts:

Decreased bargaining power: As vendors consolidate, teams may find themselves locked into ecosystems with fewer options to switch or negotiate pricing.

Loss of best-of-breed flexibility: Teams that once customized their stack (e.g., combining Catapult + EliteForm + independent video tools) may be forced into one-size-fits-all platforms.

Higher switching costs: Integrations, workflows, and historical data are sticky—changing vendors becomes riskier and more expensive over time.

Risk of innovation slowdowns: Larger firms may deprioritize R&D or niche features that matter most to elite teams but not the mass market.

Data portability concerns: Teams must ask hard questions about how easy it is to export and retain access to their performance data if they choose to exit a platform.

For high-performance environments—particularly in pro sports where competitive edges are often found in customization—these risks can have long-term consequences.

📡 5. Broader Trends: Why This Wave of M&A is Just Getting Started

These deals are part of a broader consolidation wave sweeping sports tech and athlete performance markets. Why now?

Teams are overwhelmed: There are too many siloed tools. Staff want unified platforms, not fragmented dashboards.

VCs are pushing exits: Many early-stage startups in the space are maturing, and investors are looking to cash out or scale via acquisition.

Platform value > point solution value: Investors and strategics are betting on platforms that own multiple pieces of the value chain.

AI needs integration: AI is only as good as the data it ingests. Acquiring upstream data sources (e.g., GPS, VBT) allows platforms to apply AI meaningfully downstream (e.g., injury prediction, workload recommendations).

Expect more M&A as wearable startups, analytics vendors, and workflow platforms seek to expand, differentiate, and defend their moats.

🔮 6. What’s Next? A Converging Battle for the Athlete Data Stack

We’re now seeing three kinds of players emerge in the battle for control over the performance ecosystem:

Performance-first platforms – e.g., Catapult, STATSports, Orreco, ActionApps: leading with tracking and physiological data.

Workflow-first platforms – e.g., Teamworks, Hudl: expanding from communication and video into data and performance.

Analytics-first platforms – e.g., Telemetry (pre-acquisition), Orreco, ActionApps, Genetrainer: offering predictive insights and tactical modeling.

These players are converging fast. The ones that win will be those that can offer:

End-to-end workflows

Real-time insights

Open data integrations

Sport-specific customization

Strong AI/ML capabilities without alienating practitioners

💬 Final Thoughts: Opportunity and Caution in a Consolidating Market

This new phase in sports tech isn’t just about tools—it’s about infrastructure. Teams, leagues, and federations are no longer just choosing a product; they’re committing to an operating system for athlete care, coaching, and decision-making.

Teams stand to benefit from simplified workflows, tighter data integration, and more holistic insights. But they must also be more strategic in vendor selection—prioritizing interoperability, data control, and long-term flexibility.

And for startups, this should be a wake-up call: the bar has been raised. Future success will depend less on novel features and more on how seamlessly those features plug into larger systems of truth.

The sports tech ecosystem is consolidating. The real question now is: who will be the leader in the sports tech performance space, and who will be left behind?

You may also like: