⭐ Upside Analysis: Media sharing tools in Elite Sports: Market Size, Key Drivers, Challenges, Stats, Vendors, Recommendations to Teams

In today’s digital-first sports industry, professional teams are no longer defined solely by their on-field performance. The way organizations capture, manage, and distribute content—whether photos, videos, or behind-the-scenes moments—has become a central part of their identity. These tools not only shape fan engagement but also impact sponsorship value, internal communication, and athlete branding. As the competitive environment grows, teams are investing in specialized content-sharing platforms to streamline operations, reduce inefficiencies, and maximize both reach and monetization opportunities.

This expanded analysis explores the market size, adoption trends, key statistics, drivers, challenges, vendor ecosystem, case studies, and tailored recommendations for professional sports teams.

Market Size and Adoption

The sports technology market is experiencing explosive growth, fueled by increased investment in fan engagement and digital transformation.

According to Grand View Research, the global sports technology market size is projected to reach $18.85 billion in 2024, with a projected CAGR of 21.9% from 2025 to 2030.

🔗 Grand View ResearchIn the United States, the market generated $3.57 billion in 2023 and is expected to grow to $13.14 billion by 2030, at a CAGR of 20.5%.

🔗 Grand View ResearchMuch of this growth is directly linked to digital media consumption patterns, where fans increasingly demand real-time highlights, player-driven content, and immersive access to their favorite teams.

Content-sharing platforms are highly adopted in leagues such as MLS, NBA, NFL, and European football, where real-time storytelling is crucial for maintaining global fan bases.

Key Drivers

Digital Transformation

Teams are adopting AI-powered tagging, cloud-based storage, and live distribution systems to streamline workflows.

Digital platforms provide real-time performance metrics on content reach, helping teams adapt strategies instantly.

Fan Engagement

Content is the primary connector between athletes and fans.

Research by PwC shows over 70% of Gen Z sports fans prefer short-form digital highlights over full games, pushing teams to adopt rapid distribution tools.

Revenue Generation

Branded content and sponsor activations drive ROI for partners.

Teams monetize through exclusive digital packages, premium content subscriptions, and merchandise sales tied to media platforms.(Source: Technavio Report)

Athlete Branding

Athletes increasingly act as content creators—building their personal brands and extending the reach of the team.

Tools like Greenfly and ScorePlay allow athletes to instantly access game-day content for posting.

Challenges

Integration Complexity

Many teams operate with fragmented tech stacks (broadcast, CRM, digital asset management).

Integrating new solutions requires change management, staff training, and IT resources.

Data Security & Rights Management

With high-value media assets, protecting IP against leaks or piracy is critical.

Vendors must provide end-to-end encryption, watermarking, and controlled sharing protocols.

Cost & Scalability

Advanced systems can cost six to seven figures annually, making ROI evaluation essential.

Smaller clubs must balance investment with expected gains in fan reach and revenue.

Key Statistics

90% of U.S. sports fans consume sports via digital platforms weekly (Statista, 2024).

58% of fans say that “behind-the-scenes” content increases their loyalty to a team (PwC Sports Fan Study, 2023).

75% of global sports sponsorship value is now linked to digital/social content activation (Nielsen, 2024).

Teams using automated content-sharing platforms report 40–60% faster content turnaround times (internal vendor data from ScorePlay & Greenfly).

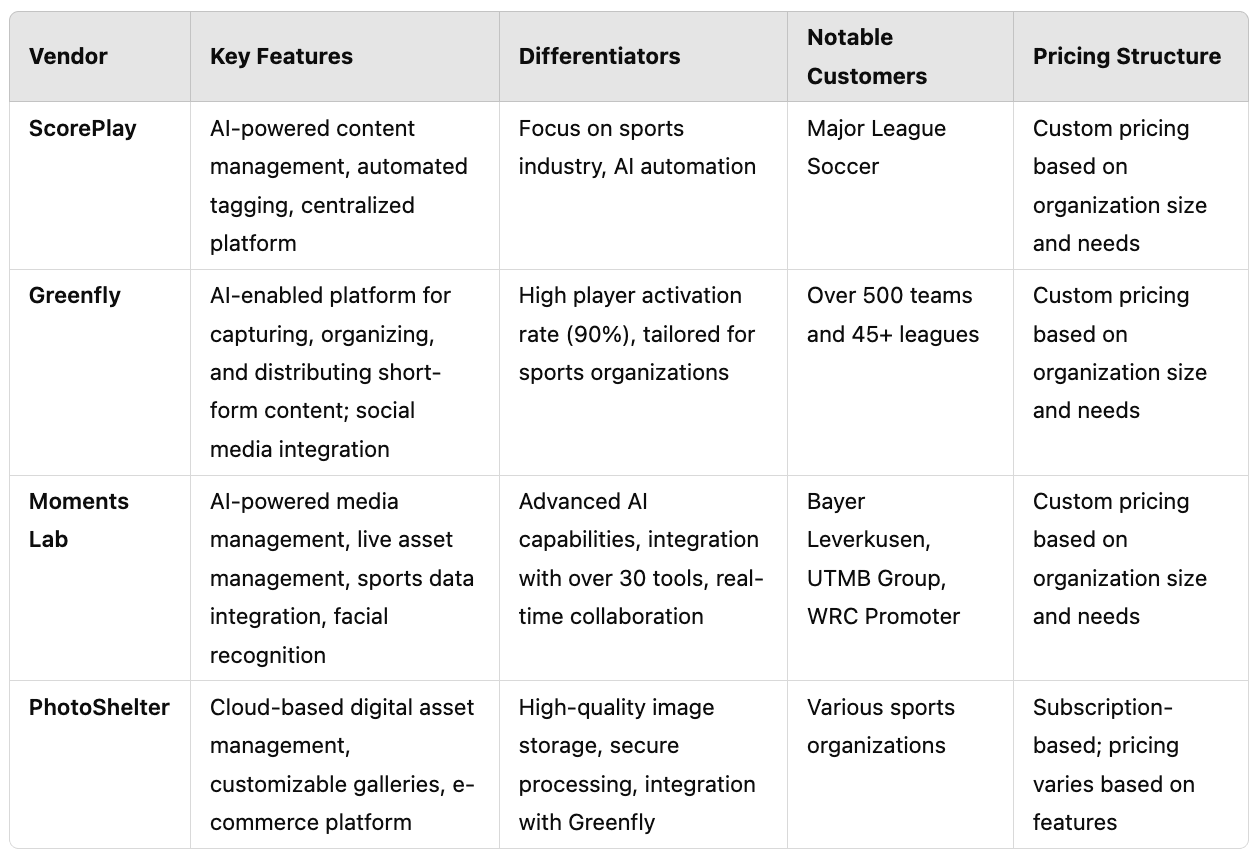

Vendor Analysis

Vendor Analysis

ScorePlay is a leading content management platform designed specifically for sports organizations. Its AI-powered automation allows teams to efficiently tag, organize, and distribute media content. The platform’s centralized system ensures seamless collaboration among various stakeholders, making it a valuable tool for large leagues like Major League Soccer. Of note, ScorePlay has 200+ sports-related partners.

Greenfly specializes in enabling teams to capture and distribute short-form content efficiently. The platform’s high activation rate among athletes and extensive social media integration make it an ideal solution for engagement-driven teams. With more than 500 teams and 45+ leagues using Greenfly, its focus on rapid content distribution sets it apart.

Moments Lab offers a comprehensive AI-driven platform for media management. It stands out with its advanced facial recognition and live asset management features, allowing teams to manage and share content in real time. The company’s partnerships with European sports teams highlight its ability to integrate with a variety of professional sports organizations.

PhotoShelter is a well-established digital asset management solution with a strong reputation for secure and high-quality image storage. It enables teams to create customizable galleries and offers an e-commerce platform for selling media content. Its integration with Greenfly enhances its utility for teams looking to maximize their digital content distribution.

Case Studies

MLS & ScorePlay: MLS teams use ScorePlay’s automation to tag every photo and clip by player within minutes, giving athletes instant access to content after games. This improves both team storytelling and individual athlete branding.

NBA & Greenfly: NBA franchises rely on Greenfly to push out sponsor-branded highlights within seconds of key moments. Athletes then repost on social channels, extending sponsorship reach exponentially.

European Football & Moments Lab: Clubs like Paris Saint-Germain leverage facial recognition to identify players in live footage, creating near-instant highlight reels for both broadcast and social media.

NCAA & PhotoShelter: College athletics departments use PhotoShelter for archiving historical media, building digital galleries, and monetizing through merchandise-linked photography.

Recommendations for Professional Teams

Assess Needs by Scale

Large franchises (NBA, NFL, EPL) benefit from enterprise-grade AI-driven systems.

Smaller clubs may adopt modular solutions with lower upfront costs.

Prioritize Athlete Experience

Platforms should allow frictionless athlete access—empowering them to amplify the team’s content strategy.

Integrate Across the Tech Stack

Choose tools that integrate with CRM, broadcast systems, ticketing, and sponsor platforms.

Security First

Ensure vendors provide multi-layered security, usage rights tracking, and custom access controls.

Measure ROI via Sponsorship Value

Track metrics such as sponsor impressions, athlete-driven reach, and fan engagement growth to justify investments.

Conclusion

Content-sharing platforms have evolved from nice-to-have tools to strategic assets in elite sports organizations. With the rapid growth of digital-first fandom, the ability to deliver authentic, timely, and monetizable content is now a core competitive advantage. Vendors like ScorePlay, Greenfly, Moments Lab, and PhotoShelter are shaping this new era, helping teams not only streamline internal operations but also unlock new revenue streams and strengthen global fan communities.

For professional sports teams, adopting these technologies is not simply about efficiency—it is about staying relevant in an attention economy where content is king.

You may also like: