⭐ Upside Analysis: The Emerging Vagus Nerve Stimulator Market: Evidence, Key Vendors, and Strategic Insights for Elite Sports Teams

Over the past few months we have been testing a number of vagus nerve stimulators. Vagus nerve stimulation (VNS) refers to techniques that activate the vagus nerve — a major cranial nerve that strongly modulates parasympathetic (“rest & digest”) responses. Historically VNS was performed with surgically implanted stimulators for epilepsy and depression; over the last decade non-invasive/ transcutaneous VNS (tVNS / nVNS / auricular VNS) devices (neck or ear) have proliferated into clinical and consumer wellness markets for headache, anxiety/stress, sleep and recovery. Device designs range from FDA-cleared medical handheld units (e.g., gammaCore) to consumer wearables (e.g., Pulsetto, Hoolest, Nurosym).

Market size & growth

Estimates vary by source and definition (medical implantable + noninvasive consumer devices vs strictly clinical devices). Representative figures:

Grand View Research estimated the VNS market at ~USD 434M (2022) with projection toward ~USD 970M by 2030 (CAGR ~10.6%). (Source: Grand View Research)

Fortune Business Insights reports a larger forecast (reflecting different scope), citing strong CAGR and multi-billion projections toward 2030–2032. (Source: Fortune Business Insights)

Takeaway: the market is growing rapidly (high single-digit to low double-digit CAGR). Growth drivers: expanded clinical indications, consumer wellness adoption, more accessible non-invasive devices, and rising interest in autonomic modulation for recovery and mental resilience. (Source: Grand View Research)

Key studies & scientific evidence

Below are important, representative peer-reviewed works and reviews that teams should read. (I list high-impact reviews and more recent trials that relate to exercise, recovery, stress and clinical safety.)

Critical review of tVNS — Yap et al., 2020. Comprehensive review of mechanisms, clinical evidence and limitations of tVNS. Useful for understanding where evidence is strong vs preliminary. (Source: PMC)

taVNS — applications & review (2024) — Förster et al., 2024. Overview of clinical uses and mechanistic insights for cardiovascular, mental and autoimmune uses. (Source: PMC)

Auricular VNS & sports/recovery review — Özden et al. (review discussing auricular VNS potential to speed exercise recovery). Good for teams interested in recovery uses. (Source: JournalAgent)

tVNS and exercise capacity (2025) — Ackland et al., 2025 (study testing whether non-invasive VNS improves exercise capacity). Important early work connecting VNS to physical performance endpoints. (Source:PMC)

Transcutaneous VNS randomized trials — Bauer et al. (2016) and related clinical trials on epilepsy/depression; they demonstrate that while implanted VNS has established clinical efficacy for certain pathologies, evidence for many consumer/sports uses remains emerging and variable. (Source: PubMed)

Important evidence note: while many small trials and mechanistic studies show promise (HRV increases, reduced sympathetic activity, improved subjective stress), large-scale, long-term RCTs for athletic performance and routine recovery use are still limited. Teams should therefore treat many consumer claims as promising but preliminary. (Source: PMC)

Key use cases (for teams & athletes)

Acute stress / autonomic down-regulation: rapid sessions to reduce arousal before competition, during high-stress moments, or after an acute stressor. (Evidence: HRV and state-anxiety improvements in some trials.) ( (Source: PMC)

Post-exercise recovery: potential to accelerate autonomic recovery (HR/HRV normalization), reduce perceived fatigue and speed parasympathetic rebound. Early exercise-focused studies are encouraging. (Source: PMC)

Sleep improvement: used as part of pre-sleep protocols to facilitate onset and sleep quality (small RCTs and vendor data reported). (Source: Pulsetto)

Mental resilience / anxiety management: adjunct for mental skills programs, coping with travel stress, performance anxiety. (Source: PMC)

Clinical indications for staff/players: some devices are FDA-cleared for headaches/migraine (gammaCore) — relevant for medical teams treating athletes with refractory headache conditions. (Source: gammacore)

Key benefits for teams to use VNS

Fast autonomic modulation — sessions of minutes can produce measurable HRV changes or subjective calm in some users. (Source: PMC)

Non-invasive, portable options — many devices are compact and usable in locker rooms, planes, or sideline tents. (Source: Pulsetto)

Complement to existing recovery toolbox — can be integrated with cold water immersion, compression, sleep hygiene and mental skills work. (Source: Frontiers)

Clinical backup for specific disorders — some devices are medical grade (e.g., gammaCore) with regulatory approvals for headache — useful for team medical staff. (Source:gammacore)

Here ia a video explained how vagus nerve stimulation works:

Caveat: efficacy varies between individuals and between devices; some experts caution that consumer tVNS devices do not always reliably engage the vagus nerve (implanted devices remain the gold standard in certain clinical contexts). Teams should pilot, measure (HR/HRV, subjective scales), and evaluate ROI. (Source: New York Post)

Interpretation & What These Numbers Mean in Practical Terms

A +1.04 mL/kg/min increase in VO₂peak is modest but meaningful in many contexts — for instance, it might translate into better endurance, faster recovery, or more buffer during high-intensity efforts. For highly trained athletes, even small gains can matter.

A +1.9 ms/mmHg increase in baroreflex gain implies improved autonomic responsiveness. In heart failure settings this could correlate with better cardiovascular stability and potentially fewer symptoms.

HRV improvements (RMSSD, SDRR, etc.) and emotional / sleep score improvements tend to relate to subjective well-being, better recovery, reduced fatigue, better stress handling, which are less “headline” but cumulatively important for athlete performance and availability.

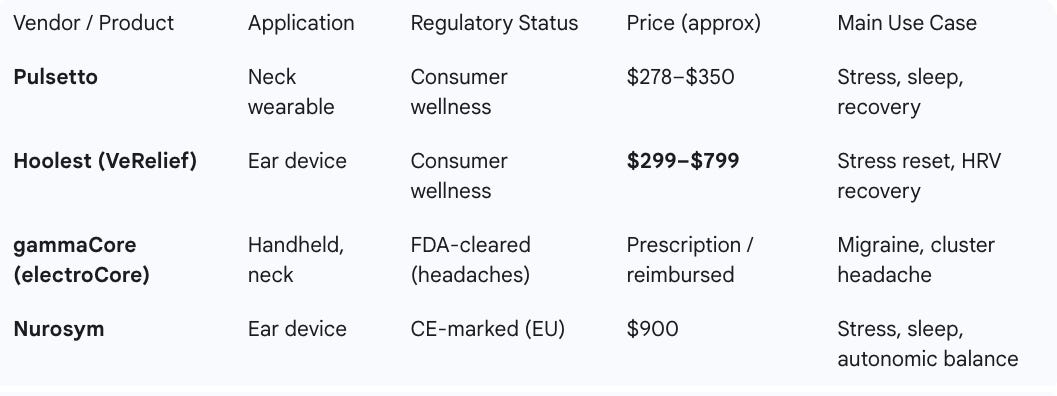

Key vendors — comparison table

Source: Upside Global, Companies’ websites, September 2025

Pulsetto (pulsetto.com): Pulsetto offers a neck-worn wearable paired with an app that delivers non-invasive vagus nerve stimulation. It is marketed as a consumer wellness device for stress reduction, sleep improvement, and recovery. While evidence is still emerging, it is positioned as an accessible entry-level option for individuals and teams. NBA players such Domantas Sabonis as have been using and endorsing the Pulsetto device.

Hoolest (VeRelief) (hoolest.com): Hoolest’s VeRelief devices use ear-based tVNS to deliver higher-dose stimulation in short sessions. They are designed for rapid stress reset, HRV improvements, and recovery after travel or exertion. The company highlights versatility for athletes, first responders, and wellness users. Based on our early test on the Hoolest Pro, it is one of the best and most effective vagus nerve stimulators out there.

gammaCore (electroCore) (gammacore.com): gammaCore is an FDA-cleared handheld nVNS device primarily prescribed for cluster headache and migraine. It has the strongest clinical evidence among non-invasive options, backed by multiple RCTs. However, it requires a prescription and is less accessible as a general wellness or recovery tool for teams.

Nurosym (nurosym.com): Nurosym delivers auricular VNS via ear electrodes and is CE-marked for use in the EU. It is marketed for stress reduction, sleep, and general autonomic balance. The device has been used in clinical studies, though broader independent validation is still ongoing.

Future trends & likely evolution

More clinical trials targeting athletic outcomes — we’re already seeing exercise capacity and recovery RCTs (2024–2025), and expect more sport-focused research. (Source: PMC)

Hybrid ecosystems — devices plus apps, telemetry and HR/HRV integration so teams can log and analyze responses at scale. (Vendors already add apps and subscription content.) (Source: Pulsetto)

Regulatory convergence — a split will remain: some devices will pursue medical device clearances (gammaCore model) while many wellness companies pursue CE/FCC/commercial channels; this will affect clinical adoption and reimbursement. (Source: FDA Access Data)

Personalized stimulation protocols — algorithmic personalization based on HRV, sleep and subjective response. (Source: Pulsetto)

Integration with bioelectronic medicine — as research into anti-inflammatory and metabolic modulation grows, VNS could be tested for broader recovery and health-span applications. (Source: PMC)

Practical recommendations to teams

Start small with a pilot — 8–12 athletes/staff, clear objectives (e.g., pre-competition anxiety, post-match HRV recovery, secondary sleep improvement). Use a randomized crossover where possible.

Select device by use case & evidence:

For clinical headache indications or when a prescriber is involved → consider FDA-cleared gammaCore (electroCore). (Source: gammacore)

For wellness/recovery pilot → Hoolest or Nurosym are lower-cost, consumer options to trial; treat vendor efficacy claims cautiously and measure outcomes.

Measure objective outcomes — HR/HRV, sleep metrics (actigraphy), perceived readiness/fatigue, and performance metrics where applicable. Pre-define success thresholds. (Source: PMC)

Protocolize use — length, timing (e.g., 4–10 minutes post-match; 20 minutes pre-sleep), contraindications screening (implants, arrhythmias, pregnant athletes), and medical oversight for players with health conditions. Vendor recommended protocols vary; align to medical staff. (Source: PMC)

Document safety & adverse events — many consumer devices report low rates of severe events, but teams should track any dizziness, skin irritation, or autonomic oddities. PMC

Evaluate ROI — track time saved vs therapist sessions, travel recovery improvements, player-reported benefit, and adoption rates.

Risks, limitations & cautions

Heterogeneous evidence base — strong for implantable VNS in certain clinical indications; mixed and still nascent for many non-invasive consumer claims (especially performance enhancement). (Source: PMC)

Device variability — different stimulation sites (cervical vs auricular), intensities, and waveforms — not all tVNS devices stimulate the same fibers or to the same depth. Experts warn some surface devices may not reliably engage the vagus. (Source: New York Post)

Regulatory & reimbursement complexity — medical devices (gammaCore) differ from consumer wellness devices in oversight; teams must avoid positioning consumer devices as medical treatments without clinician involvement. (Source: FDA Access Data)

Conclusion

Non-invasive VNS is a rapidly growing, promising area for teams’ recovery and mental resilience toolkits. Evidence supports autonomic modulation (HRV, reduced state anxiety, headache indications) and small, emerging studies suggest benefits for exercise recovery and capacity — but large, sport-specific RCTs are still limited. Teams should adopt a measured approach: pilot promising consumer devices (Pulsetto, Hoolest, Nurosym) for wellness use while relying on medical-grade, FDA-cleared devices (gammaCore) when treating clinical conditions. Always measure objective outcomes, document safety, and align use to medical staff guidance.

You may also like: