⭐ Upside Analysis: Why the NCAA is the Next Big Opportunity for Startups

We have been working with teams in the MLS, NBA, NFL, NHL, MLB, NCAA, European soccer leagues, pro tennis, pro rugby as well as Olympic teams for over 10 years. Historically most sports tech startups have focused on the top professional teams (NBA, NFL, MLS, MLB, NHL). However, in the past few years we have seen a large number of sports tech startups increasingly focusing their efforts on the collegial/NCAA market. Why is that? In this analysis, we will do a deep dive into why this shift is happening.

The NCAA has 1000+ teams Vs 154 teams for the US major leagues (NBA, NFL, MLS, NHL, MLB)

Before we we get into the NCAA revenue opportunity for startups, let’s run some numbers. The NCAA is a massive opportunity for startups. As illustrated in the table below, There are over 1000 NCAA teams across the D1, D2 and D3.

By Comparison, there are 154 teams across the NBA, NFL, MLS, NHL, MLB today.

This is why many sports tech startups are now heavily focusing on NCAA teams which is 10 times bigger than the major US Sports leagues (NBA, NFL, MLS, MLB, NHL). NCAA teams represent a bigger TAM and a bigger revenue opportunity for them long term.

490k NCAA athletes vs 5K athletes in the major US Sports leagues (NBA, NFL, MLS, MLB, NHL)

Now in terms of total athletes, as show in the table below, the NCAA has 490,000 student athletes across all divisions (D1, D2, D3). It is worth pointing out that Division III schools have a larger number of athletes, but they do not offer athletic scholarships.

By comparison, as illustrated in the table below, there are ~5K athletes across the NBA, NFL, MLS, MLB, and NHL.

So again with 100 times more student athletes in the NCAA, compared to the US Major sports leagues, it should not come as a surprise that many sports tech startups are trying to make inroads into the NCAA.

NCAA teams’ annual revenue can be as high as $125M

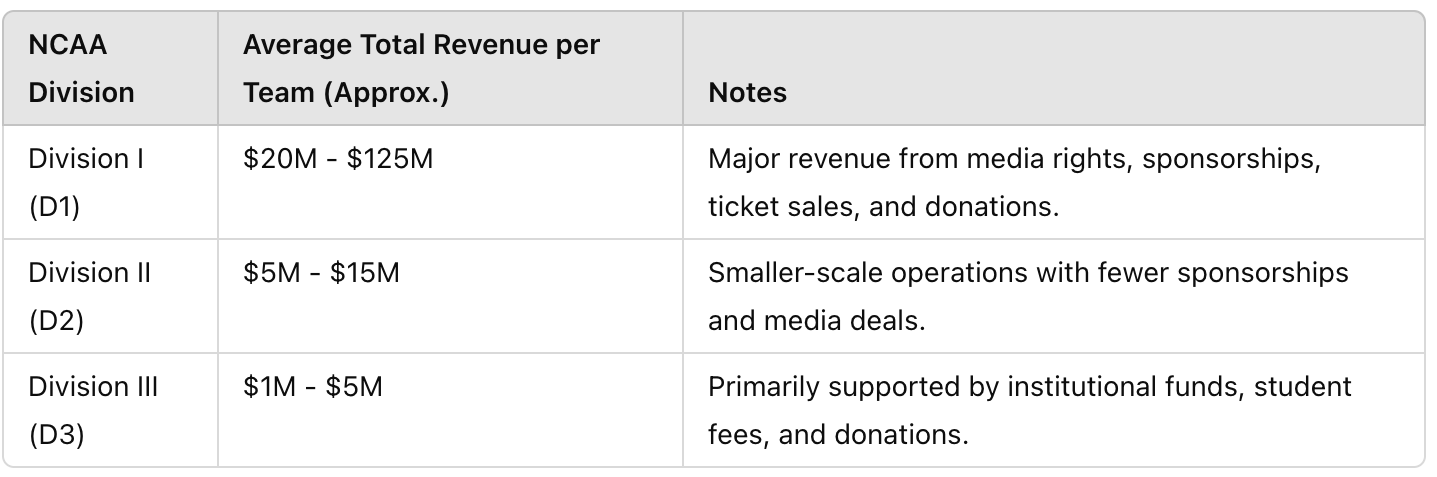

Now we looked at the number of teams and athletes. Let’s take a look at the revenue opportunity with the NCAA.

As shown in the table below, D1 schools generate on average anywhere between $20M and $125M in annual revenue while D2 schools generate an average $5M-$15M per year. Not surprisingly D3 schools’ average annual revenue is typically less, between $1M and $5M per year.

Source: Average annual revenue per NCAA teams per division (D1, D2, D3), confidential, 2024

The point here is that some NCAA teams can generate as much as $125M in annual revenue so there is a good opportunity for sports tech startups there to tap into this revenue opportunity.

Broadcasting rights, tickets sales, fund raising, donations, sponsorship generate 75% of NCAA teams’ revenues

Now here is the next question: How do those NCAA teams make money?

As illustrated in the table below, 75% of the NCAA teams’ revenues come from broadcasting rights (25%), ticket sales (20%), donations & fund raising (15%), sponsorship & advertising (15%).

Picture: Funding source by NCAA teams, Upside Global, confidential, 2024

Please note that percentages are approximate and may vary significantly depending on the school and division (e.g., Division I schools rely more on broadcast rights and sponsorships, while Division III leans on institutional support and student fees.

NCAA teams’ football and basketball programs capture up to 80% of NCAA teams’ annual sports revenues

Now in the NCAA it is common knowledge that typically football and basketball are the biggest programs. But how much revenue do those programs typically generate for NCAA teams?

As shown in the table below, on average NCAA teams’ football program generate anywhere between $25M and $70M per year which is about 35%-50% of NCAA teams’ revenue. By comparison, NCAA teams’ basketball program usually generate $10M-50M per year in revenue which is about 20%-30% of the NCAA’s total revenue.

It is worth pointing out that these numbers reflect the average annual revenue per NCAA team based on sport type, primarily focusing on Division I programs. In addition, Football’s and Basketball’s dominance in terms of revenue generation is due to media rights, sponsorships, and high attendance. With that in mind this is why sports tech startups tend to focus primarily on NCAA’s teams football and basketball programs.

Source: Average annual tech revenue per NCAA team per sports type, confidential, 2024

Some NCAA teams have performance tech budgets per sports program as big as pro teams (NBA, MLB, NFL, NHL)

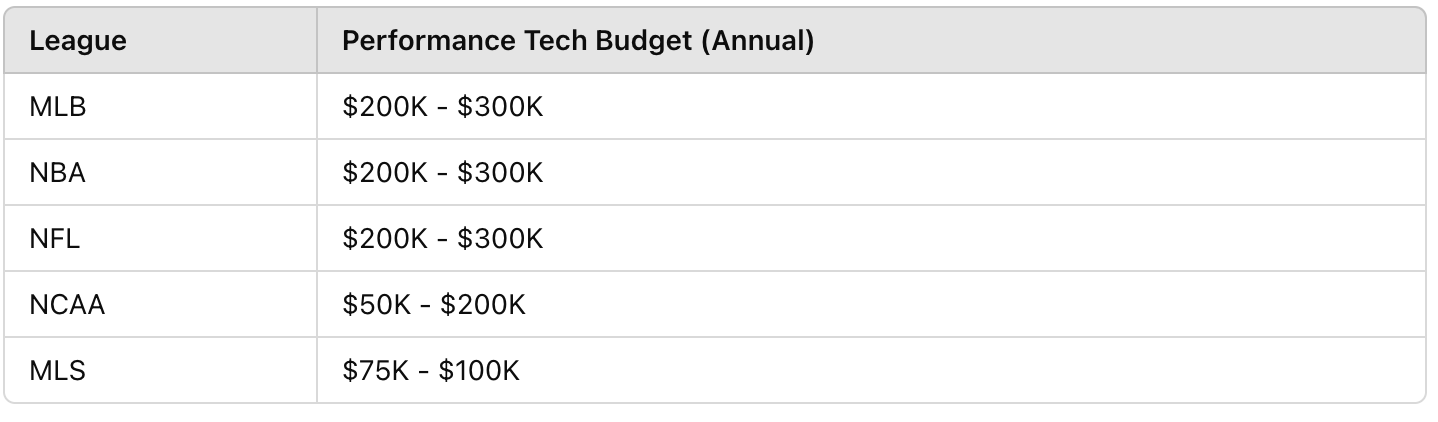

So how do annual performance tech budgets of NCAA teams compared with budgets from NBA, NFL, MLS, MLB teams?

Before we get into that, please note that the performance tech budget is usually comprised of budgets spent to purchase technologies such as GPS, HR monitors, AMS platform, sleep tech, rehab tech, etc.

Now, based on the data survey from teams captured from our Upside tech scouting platform, NCAA teams’ performance tech budget varies from $50k per year per sports type (Basketball, football, baseball..) up to $200k per year per sports type. So say we are talking about a top NCAA D1 organization, their overall sports performance tech budget across various sports (Basketball, football, baseball..) could be in the $500k-$600k range per year which would be higher than a top NBA team ($200k-$300k per year) in terms of overall performance tech budget.

By comparison, as shown in the table below, based on the data survey from teams captured from our Upside tech scouting platform, which gathered survey team data from 200 pro teams (NBA, NFL, MLS, MLB, NHL NCAA, Premier league, Laliga, Pro tennis, pro rugby..), the average annual performance tech budget per team for NBA, MLS, NFL, MLS teams is typically in the following price range:

Source: Upside Tech scouting platform, Annual sports tech budget per team per sports type, confidential, 2024

Now keep in mind that when it comes to digital products (mobile, apps, VR/AR..), ticketing systems, IT systems…NCAA teams have annual tech budgets in the millions of dollars so we are talking about much bigger tech budgets. This is comparable to the budgets from US Pro teams (NBA, NFL, MLS, MLB..) and top European soccer teams.

You want to see more survey team data? Please click on the button below and reach out to us to learn more.

NCAA teams have multiple sports (Basketball, football..) which amplifies the opportunity for sports tech startups

As mentioned earlier, unlike major US sports teams (NBA, MLS, MLB, NFL), NCAA teams have teams across various sports (football, basketball, baseball..). So from a TAM perspective the opportunity is a lot bigger.

So instead of selling their products to one team focusing on one sports type, in the NCAA, they can sell the same product to multiple teams which amplifies the revenue opportunity. Now there tends to be more red tape and it is a longer sales cycle in the NCAA, which we will get into in the coming section. But for sports tech startups focusing on the NCAA market, this is an attractive market with significant revenue opportunities long term.

NCAA teams use technologies as a recruiting tool to attract the best student athletes

Based on our conversation with NCAA teams, one thing that NCAA teams kept saying to us is that in the NCAA they cannot compensate most student athletes (although the NIL is allowing some student athletes to generate some revenue). As a result, they are using technologies as a recruiting tool.

For example when trying to recruit a new student athlete, the director of the athletic department of an NCAA team would make sure to mention to new potential recruits that they are using the latest technologies such as cryochambers, hyperbaric chambers..as a way to attract those student athletes.

Why does it matter? Because these technologies could allow student athletes to perform better, and recover faster which long term would increase their chance of making it to the bigger leagues (NBA, NFL, NHL, MLB..). So these are compelling arguments for student athletes when they are trying to make a decision on which NCAA program to join.

But NCAA teams have a longer sales cycle compared to US pro teams

Based on our conversation with NCAA teams, the sales cycle to sell new technologies into NCAA teams is typically longer than when selling technologies to pro US teams (NBA, NFL, MLS, MLB, NHL). In some occasion it can take years for some new technologies to be approved and deployed across a large campus in the US. We will get into that in the next section.

That being said, it can sometimes take a few months to get new technologies approved depending on the type of technology. Lastly, the process is usually faster if a new technology is going to be used across many teams (football, basketball, baseball, soccer..). It is a more compelling argument for committees of those universities to approve and deploy new technologies if there is interest across multiple teams and sports.

…NCAA teams have a more complex process to adopt new technologies

Based on the conversations we had with a number of NCAA teams, there is a lot of red tape involved to get new technologies approved and deployed within NCAA teams. Now another thing to keep in mind is that the approver of new technologies within NCAA teams is not always the user (Head athletic trainer, head S&C..) of such technologies. So what is the typical process for NCAA teams to adopt new technologies? Which departments typically approve new technologies? The NCAA teams' approval process to adopt new technologies is typically as follow:

Step #1: Pilot phase: During that phase which can last several weeks, NCAA teams typically conduct pilots to test new technologies in the field. The idea here is to see if this technology is relevant for their programs, works as advertised, and if it fits the workflow of their teams.

Step #2: Sports science community approval: Once the field testing is done, most NCAA teams would have to get in front of the sports science community to get approval.

Step #3: University approval: Assuming that that the sports science community does approve a new technology, the next typical step would be to get approval from the whole university.

Step #4: IT approval: The 4th step typically consists in getting approval from the IT department as new technologies are often connected to an IT network. The IT department just wants to make sure that a new technology won’t affect the IT network and that there is the right IT protocol in place to support it.

Step #5: Procurement approval: The final step of the approval process within NCAA teams typically involves getting approval from the procurement team as they want to do their due diligence on new technologies and make sure that there won’t be any issues.

Bottom line: At the end of the day we believe that NCAA teams, especially D1 schools, represent a significant opportunity for sports tech startups. Let’s face it is a much bigger opportunity in terms of TAM than the US major sports market (NBA, NFL, MLS, MLB, NHL). but it is typically a longer sales cycle and it also tends to be a more complex process. In the long term we expect to see more sports tech startups focus their efforts on NCAA teams. However, we expect most sports tech startups to continue to initially focus on NBA, NFL, MLS, MLB, NHL teams to land major sports organizations as customers to establish credibility in the world of elite sports. By doing that, these startups can then leverage those relationships and big names to help them land deals in the larger NCAA market.

If you are a startups looking to get traction with pro teams, raise money, or get guidance on your product, feel free to contact me at julien@upsideglobal.co

Best,

You may also like: