📈 Upside Analysis: Women’s Sports Tech Ecosystem Analysis: Key Trends, Drivers, Challenges, Vendors and Recommendations to Pro Teams

Women’s Sports Tech Ecosystem Analysis

The Women’s sports tech ecosystem is something that we have covered extensively in 2024. We have done group podcast interviews and organized panel discussions with top female executives, coaches, startup founders. It has become clear to us that there is a lack of resources, technologies and research in the world of women’s sports tech. But it does not mean it cannot be changed. We at Upside believe that there is a huge upside in the world of women’s sports tech. So we thought that, as we are nearing the end of 2024, it would be a good idea to do an analysis on the Women’s sports tech ecosystem to discuss the market size opportunity, the key trends, drivers, challenges, vendors with recommendations to pro teams.

Market Size and Growth

Global Sports Tech Market Overview:

The global sports technology market was valued at around $25 billion in 2022 and is projected to grow at a CAGR (Compound Annual Growth Rate) of 20-25% through 2030, reaching approximately $60-$75 billion by the end of the decade.

Women’s sports tech is estimated to make up a significant, but still relatively smaller portion of this total market. The women’s sports tech market could be worth between $1.5 billion and $3 billion by 2025, with annual growth rates of 15-25%.

Key Growth Drivers:

Increased Investment in Women’s Sports: Over the past decade, there has been a marked rise in investment in women’s sports across various domains, including media rights, sponsorships, and infrastructure. For example, the WNBA, women’s soccer leagues, and women’s tennis have all seen increased revenue streams and viewership, which in turn creates demand for technology solutions tailored to female athletes.

Rising Popularity and Visibility: As more women’s leagues gain visibility through media partnerships and fan engagement, there is a growing recognition of the need for tech solutions that can improve performance, health, and fan experiences. For instance, the National Women’s Soccer League (NWSL) and WTA Tennishave become major focal points for fan engagement technology.

Focus on Female Athlete Performance and Health: There’s a growing recognition of the physiological differences between male and female athletes, leading to a demand for products that cater to female-specific needs. This includes tools for menstrual cycle tracking, wearable tech designed for women, and training programs tailored to female athletes' unique biomechanics.

Corporate Sponsorship and Support: Leading sports brands, including Nike, Adidas, and Under Armour, are increasingly developing women-focused products. This investment extends to technology, including wearables and apps designed specifically for female athletes, which also stimulates the tech ecosystem.

Key Trends

Wearable Technology: There has been a surge in wearable tech tailored for female athletes, considering unique physiological differences. Devices like heart rate monitors, performance trackers, and recovery monitors are becoming more popular.

Data Analytics & Performance Metrics: Advanced data analytics is helping female athletes track and enhance performance. AI and machine learning models are being leveraged for personalized training programs, injury prevention, and recovery optimization.

Fan Engagement & Social Media: Women’s sports leagues are increasingly adopting digital platforms and apps to engage fans. The use of augmented reality (AR), virtual reality (VR), and live-streaming technology is also helping boost visibility and fan interaction.

Gender-Specific Training Tools: Technologies that focus on understanding and addressing female biomechanics, nutrition, hormonal cycles, and injury risks are expanding. Tools like menstrual tracking apps and female-specific fitness programs are growing in popularity.

E-Sports & Gaming: The rise of women in e-sports and gaming is driving innovation in training tools, mentorship programs, and esports performance tracking technologies.

Key Drivers

Increased Investment in Women’s Sports: More funding is being directed to women’s sports from both private and public sectors. Corporate sponsorships and media coverage are on the rise, leading to the need for advanced technology to support growth.

Growing Popularity and Professionalism: As women’s sports become more competitive and mainstream, there’s a greater demand for innovative technologies to optimize training, improve performances, and enhance fan experience.

Female Athletes’ Wellness Focus: A growing recognition of the importance of mental and physical wellness in women’s sports is driving the development of technologies that offer better health monitoring, injury prevention, and recovery solutions.

Technological Advancements: Innovations in artificial intelligence, big data, and machine learning are providing solutions tailored for women’s sports needs, helping to close the gender gap in sports performance analytics and health tech.

Advocacy for Gender Equity: Movements advocating for gender equity in sports are pushing for equal access to advanced sports technologies for female athletes.

Key Challenges

Lack of Female-Specific Data: Most existing sports technologies have been developed with male physiology in mind, leading to a gap in data that specifically caters to women’s sports needs.

Limited Funding & Sponsorship: While investment in women’s sports is growing, it still lags behind the male-dominated sports market, which hinders the widespread adoption of cutting-edge technologies.

Gender Bias in Tech Development: There is often a lack of diversity in tech development teams, which means that many technologies do not fully address the unique needs of female athletes.

Inadequate Market Awareness: Many sports organizations and athletes are still unaware of the potential benefits of tech solutions designed for women’s sports.

Affordability & Accessibility: Many of the latest technologies are expensive, making them less accessible to smaller teams and less-established leagues.

The percentage of research focused on women's teams within the broader field of sports research is still relatively small but is steadily growing. While precise figures are difficult to pinpoint, estimates based on available data and industry reports suggest the following:

Key Insights on Research in Women’s Sports

Overall Research Focus in Sports:

The global sports research market spans a wide range of disciplines, including sports performance, biomechanics, nutrition, injury prevention, sports psychology, wearables, fan engagement, and more. In many cases, the focus has historically been skewed toward male athletes, especially in elite professional sports, leading to a larger share of research funding and attention directed at male-dominated sports (e.g., football, basketball, rugby).

Research Allocation in Women’s Sports:

General Estimate: As of recent studies, it’s estimated that around 5-10% of sports research is dedicated specifically to women’s sports and female athletes. This includes both academic and applied research (such as applied sports science, performance analytics, and health research for women in sports).

Recent Shifts and Growth:

Over the past decade, the percentage of research focused on women’s sports has seen a significant uptick. This shift is largely due to increased visibility, more investment in women’s professional leagues, and a growing recognition of the physiological differences between male and female athletes. As the need for female-specific performance optimization, injury prevention, and health solutions (such as menstrual cycle tracking or hormonal considerations) becomes more apparent, more research funds are being allocated to this area.

Some estimates suggest that research focused on female athletes might be increasing at a rate of 10-20% annually in specific sectors like sports science and technology.

Sports Science and Medical Research:

Within sports medicine, only about 5-6% of studies have focused on female athletes (a figure reported by journals like the British Journal of Sports Medicine). This has been a key concern for organizations like the Women’s Sports Foundation and the American College of Sports Medicine (ACSM), which advocate for a more equitable approach in research.

In biomechanics, performance analytics, and technology (e.g., wearables, AI-driven performance tracking), the number of women-specific studies is still relatively small but has started to increase, as companies and institutions acknowledge the importance of female-specific data in training and recovery programs.

Industry-Specific Research Funding:

Corporate Investment: Major sportswear brands and tech companies (like Nike, Adidas, Under Armour, and WHOOP) are increasingly funding research into women’s health, performance technology, and fitness tracking for female athletes. However, the percentage of their total sports research budget dedicated to women’s research remains modest. Estimates suggest around 15-20% of the R&D budgets of sportswear companies may be allocated to female-specific products, which includes everything from sportswear designto health tracking technologies (e.g., wearable tech and apps that cater specifically to women).

Recent Developments:

With the growing emphasis on gender equity in sports, initiatives like the Women in Sport Initiative and collaborations between sports tech companies, universities, and female sports organizations are beginning to address these gaps. Universities like Harvard and Stanford are ramping up their focus on women’s sports research, and funding for female athlete health and performance has become more of a priority in grant-making from both public and private sectors.

So net net, currently, 5-10% of sports research is dedicated to women’s sports and female athletes, with this percentage growing due to increasing recognition of the need for gender-specific data in performance, health, and injury prevention. As investment in women’s sports continues to grow and the demand for female-specific technology (such as menstrual cycle tracking and wearables) increases, research dedicated to women’s teams and athletes will likely continue to rise and potentially reach 15-20% by the 2030s.

Key Vendors in Women’s Sports Tech Ecosystem

Here’s a comparison of some key vendors that provide technology solutions for women’s sports:

Picture: Upside Global, confidential, 2024

Pictures: Oura, Fitbit, Catapult Sports, OvulaRing, 2024

Pictures: Whoop, 2024

Picture: DaVinci Wearables, 2024

Picture: FitrWoman (Orreco), 2024

Key Insights on DaVinci Wearables:

Targeted Features: DaVinci Wearables provide cutting-edge smart sensors that track real-time performance, movement, and biometrics, offering athletes detailed feedback on their training sessions and biometrics. It is known for its advanced sensor technology, which measures a range of metrics including movement efficiency, joint stress, and more, helping athletes refine their technique and reduce injury risks.

Price: The pricing model for DaVinci Wearables is custom and depends on the needs of the team or individual athletes. Pricing is typically negotiated based on volume (team size) and the level of customization required.

Unique Selling Point: DaVinci Wearables stands out for its highly advanced biometric and performance tracking sensors that provide real-time feedback on movement patterns, posture, and even joint stress, which is critical for preventing injuries. These wearables can be highly beneficial in both training and recovery phases.

Key Insights on Orreco:

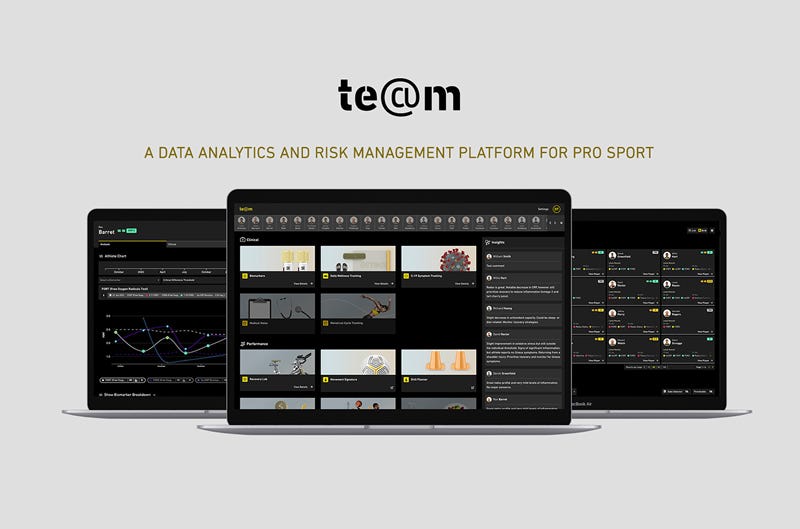

Orreco Te@m platform, which has menstrual cycle tracking embedded but also levels the playing field with cutting edge AI now available to women teams. Menstrual cycle phases and symptoms can now be quickly mapped against GPS training data, match stats, jump data etc. This type of support had historically be restricted mainly men’s teams. Orreco are helping change the game in this regard by making same these cutting edge tools available to womens teams, athletes and performance staffs.

Picture: Orreco Te@m platform

Key Insights on Vivosense Medical (OvulaRing):

Targeted Features: Vivosense Medical focuses on tracking the menstrual cycle and ovulation phases for female athletes. By understanding hormonal fluctuations, this technology provides valuable insights into how these phases affect performance, recovery, and injury risk. The wearables help athletes optimize their training schedules based on their menstrual and ovulation cycles.

Price: Vivosense Medical’s pricing is customized based on usage and the needs of the individual or team. It generally involves discussions around volume and personalized features, making it suitable for professional teams and individual athletes looking for specialized insights.

Unique Selling Point: The technology focuses on the link between hormonal cycles and athletic performance, which is critical for female athletes to achieve optimal results. The insights from this wearable can assist in tailoring training to peak performance during different phases of the cycle, and also prevent injuries by understanding when the body is more susceptible to strain

Recommendations for Teams

Invest in Wearables & Analytics: Teams should prioritize wearable devices (e.g., Oura, Catapult Sports) that provide comprehensive data on performance, recovery, and injury prevention. These tools help personalize training and optimize athlete performance while reducing injury risk.

Leverage Gender-Specific Tech: Teams should consider using tech designed with female athletes in mind, such as FitrWoman for menstrual cycle tracking and Oura Ring for sleep and recovery. This will help tailor training and recovery strategies for women athletes’ specific physiological needs.

Adopt Recovery Tools: Recovery is critical in elite sports. Technologies like PowerDot and WHOOP can provide effective muscle recovery solutions and help athletes maintain peak performance levels, especially during heavy training cycles.

Promote Data-Driven Decisions: Encourage teams to integrate video analysis tools like Hudl for tactical analysis and feedback, and use AI-driven platforms such as Tempo to monitor and optimize training regimens, helping athletes improve faster and smarter.

Add menstrual cycle monitoring together with advanced analytics: Encourage teams to add menstrual cycle monitoring together with advanced analytics (e.g. Orreco) engines (e.g. mapping with match data, GPS data, jump testing in Te@m) to level up the playing field.

Create Customizable Wellness Programs: Since wellness plays a key role in performance, consider apps like MyFitnessPal or FitrWoman for creating personalized nutrition and training programs that align with athletes' health cycles and needs.

Make Tech Accessible for All Levels: While cutting-edge tools like Catapult may be out of budget for some smaller teams, it's worth exploring more affordable options like Fitbit or Strava for tracking fitness, training, and recovery at different levels.

Conclusion

The women’s sports tech ecosystem is rapidly evolving, with key innovations in wearable tech, performance analytics, and wellness tracking. The demand for female-specific technologies is rising, and teams must focus on leveraging these tools to enhance performance, prevent injuries, and foster wellness. However, challenges related to funding, accessibility, and data gaps remain. By strategically adopting these technologies and considering the unique needs of female athletes, teams can stay competitive and contribute to the continued growth of women’s sports.

You may also like: