⭐🏟️ Upside European Tour of Pro Teams: Our Key Takeaways From Conversations on Innovation, Performance, Recovery and More.

Dear colleague,

We just got back from Europe where we spent the month of August catching up with clubs, academies and national teams. It was a great opportunity to sit down with practitioners, sports executives, and coaches and discuss the latest trends in the world of sports and tech, performance, recovery, and innovation in general. It also gave us the opportunity to present some innovative technologies, understand the needs and challenges faced by those sports organizations. Here is a recap on the key takeaways of our conversations with clubs and national teams:

1. Like in the US, European teams are also looking for cutting edge technologies…to get that 1-2% performance advantage

Based on our conversations with teams in Europe it appears quite clear that just like teams in the US (NBA, NFL, MLS, MLB..) the performance and medical staff of European sports organizations are more than ever looking for innovative products that can give them that 1-2% advantage and that can help them improve their athletes’ performance, sleep, recovery, etc. Now when it comes to cutting edge technologies they are also looking for proven technologies that are backed by solid studies and used by other pro teams. They are typically not interested in early stage technologies.

Picture: Santiago Bernabéu Stadium (Real Madrid), Madrid (Spain)

2.Sleep management, injury reduction, load management, rehab / return to play remain top priorities for teams.

Not surprisingly European sports organizations are still very much focused on adopting technologies in areas that can help them improve their athletes’ sleep , optimize their load management, and fasten their athletes’ rehab / return to play process. The room for mistakes is very small and with the heavy schedule required by some pro soccer teams where teems have to play every 2-3 days every single details counts and the room for mistakes is very small. The same is true with US teams (NBA, NFL, MLS, NHL..).

Picture: Parc des Princes (PSG), Paris (France)

3.GPS, HR monitoring, video analysis, sleep tech, AMS and athletes’ injury reduction remain the most common types of technologies used by pro teams in Europe.

Not surprisingly, based on our conversations with European sports organizations, GPS, HR monitoring systems, video analysis solutions, sleep technologies, AMS platforms, and athletes’ injury reduction tools, remain the most common types of technologies used by pro teams in Europe. s shown in the graph below, this correlates with the Upside survey that we did back in 2020 with a large number of teams (Premier League, Ligue 1, Laliga..). Back then sleep tech (48% of teams surveyed), GPS (44%), HR monitoring tools (32%), video analysis (32%), were the top technologies that teams planned to invest in in the future.

When it comes to GPS, vendors like Catapult, Statsports, WIMU, among others, remain some of the most popular GPS vendors in Europe. It is also important pointing out that some teams prefer using GPS vendors that can integrate with other vendors (HR, EMG..). When it comes to HR monitoring systems, Firstbeat (24% of teams surveyed), and Polar (39% of teams surveyed), as shown in the table below, based on our 2022 HR vendor survey report, remain the top HR vendors used by European pro teams today.

Video analysis solutions also remain one of the most common types of technologies used by European teams. There are various flavors when it comes to video analysis solutions. Some video analysis solutions are optical tracking camera based, video tagging or AI video based. You can check out our full analysis on the video analysis vendor ecosystem here. In Europe the most popular vendors are Hudl, SkillCorner, Dartfish, Footvision, Stats Perform, Second Spectrum, just to name a few. To learn more bout this topic, you can checkout our 2022 Video analysis vendor ecosystem analysis here.

Source: Upside Globl, 2022 Video analysis vendor ecosystem analysis.

AMS platforms also remain among the most popular types of technologies used by European pro teams. But in our view the European AMS market remain extremely fragmented with various sub categories: (1) the large AMS Vendors like Teamworks / Smartabase, Edge 10, Kitman Labs, Orreco (2) the mid size AMS platforms like Apollo, among others. And (3) the small AMS vendors like Soccer System Pro, Iterpro, ProSoccerData, MyCoach Football, among others. But one thing is clear: the European AMS vendor market has become even more competitive. We will discuss this more in an upcoming section. To learn more about the AMS market, you can check out our AMS Vendor ecosystem analysis here.

Source: Upside Global, 2023 AMS Vendor ecosystem analysis

Then there are the AI based injury reduction platforms like Orreco and Zone7. There is a growing interest from teams towards this emerging area . We think this is a really exciting area.

4.Growing interest from teams towards vendors focusing on hydration and concussion assessment, pain management, thermography, biomechanics assessment, nutrition optimization, and data driven rehabilitation tools.

Based on our conversations with European sports organizations, there is growing interest from teams towards the following emerging sports tech sectors:

Non invasive hydration assessment tools: In the summer, pro athletes in sports like soccer, rugby or tennis, oftentimes have to train under fairly hot conditions. Typically teams collect athletes’ urine samples which is quite labor intensive. This is why there is currently a lot of interest from European sports organizations towards non invasive hydration assessment tools. Teams can choose from variety of options depending on their team environments and requirements. Vendors such as Intake Health (Sensors into urinals), LogicInk (Quick PCR type test), Flowbio (smart hydration patch), Nix Biosensors (smart hydration patch), just to name a few, are good options for teams depending on their requirements, budgets, and team environments.

Concussion assessment tools: We also saw a growing mount of interest towards concussion assessment tools. Let’s face it, in contact sports like rugby, or even soccer, concussion issues is a growing concern among teams. This is why teams are looking for innovative ways to effectively and quickly assess concussions events. There is a growing number of vendors focusing on this sector. In this sector, teams can choose from a variety of options such VR cognitive tests, or quick PCR type tests.

Pain management tools: Athletes, especially in contact sports like rugby, or soccer, have to find new modalities to quickly manage athletes’ pain. This is why we also saw a lot of interest from European teams towards pain management solutions. Teams can help athletes manage their pain in a variety of ways by using CBDA lotions from companies like Kriva. They can also use nanotechnology devices using acupuncture and light therapy from companies like Taopatch. Another option would be to use therapeutic kinesiology tapes from companies like Heali Medical, which offers a special tape infused directly with magnesium and menthol. The point here is that teams have a lot of options to choose from.

Thermography: Better assessing athletes’ injury risk is always top of mine within European teams, which are always looking for new ways to reduce athletes’ injuries any ways they can. As result of that we also saw some interest from teams in Europe towards thermography. The leading thermography software vendors include companies like ThermoHuman, Monilabb, Kelvin +, Aivision.

Biomechanics assessment & motion capture analysis tools: Based on our conversations with leading European teams we also saw lot of interest towards biomechanics assessment tools and motion capture analysis tools. Teams are looking for ways to detect any symmetries or movement issues with their athletes: To do so, teams have lot of options. Leading vendors in this are include companies like Uplift Labs, Qualisys, DARI Motion, Reboot Motion, just to name a few.

Athletes’ nutrition optimization: There is also a growing appetite from European teams towards solutions that can help those teams better track their athletes’ calories, figure out the optimal meal plan for each athletes, and optimize nutritional strategies to help improve athletes’performance. To do so, European teams can use nutritional paltform from vendors like Notemeal (now part of Teamworks), Hexis, Prevess, among others. Teams can also use glucose monitoring patches from vendors like Supersapiens to better monitor their athletes’ glucose level and figure out the best meal plan for each of their athletes.

Data driven rehabilitation tools: Being able to measure and monitor in real time the athletes’ progress is very important to European teams. This is why we saw a lot of interest from teams towards data driven rehabilitation tools. We believe that companies such as Kinvent (sensors measuring force, balance, motion, strengths, muscle activities..), Plantiga (smart insoles measuring force, asymmetries, mapping pressure on the foot), or The Quick Board (visual training and rehab technology), or 1080 Motion (professional grade digital motorized strengths training system), among other tools, are very valuable options for teams.

5.Assessing players from academies via advanced technologies is becoming a must have among pro teams

This is a new trend that we saw this time during our trip in Europe. Now seeing sports academies evaluate and assess athletes is not ne. This has been done for decades both in the US and Europe. What is new is the role that technologies is playing in it to help assess players’ mental toughest, cognitive reaction time, and performance on the field. There are a number of startups that can play in this emerging area.

For example company like Sports Dynamics is a startup that works with lots of teams (LA Galaxy/MLS, OL/Ligue 1, RC Lens/Ligue 1, Troyes/Ligue 1, West Ham fc/EPL, etc.) to assess players psychologically and recruit talent. Another company is this space is Sure Athlete, which combines the science of Prism psychometrics, anonymous survey feedback and behavioral analytics to increase the Emotional, Relational and Team intelligence (ERT-i®) of coaches and athletes.

Another vendor to keep an eye on in this space is Rezzil that uses AR/VR to help teams and academies assess and scout young athletes that go through academies. We expect more academies in Europe and the US to follow suit and adopt a similar strategy in order to help them find the next Leo Messi, Christiano Ronaldo , Roger Federer or Lebron James.

Picture: Centre de Formation du Havre (Ligue 1), Le Havre France.

6.Teams learning from other sports and leagues

Another continuous trend that we saw during our trip is that teams and sports organizations in Europe continue to learn from other sports organizations in other sports and leagues. This not surprising as some leagues (e.g. Premier League…) have historically been pioneers when it comes to technologies. This is why teams leverage their network in other leagues and sports to learn from them, see what Technologies they use to try to apply new practices and technologies to their organizations and improve athletes’ performance and recovery, and their internal processes.

Picture: Civitas Metropolitan Stadium (Atletico Madrid), Madrid (Spain)

7.Allowing teams to transfer their players’ historical data is critical and a big ask from European teams

Another trend that we saw during our trip in Europe was the ask from teams to transfer their athletes’ historical data when migrating to a new software platform (AMS, GPS…). This is where sometimes some vendors fall short, or promise teams that they can migrate all their athletes’ historical data into their new platform. But what those vendors sometimes omit to mention to teams is that it takes a little while to migrate all the data or that they are unable to transfer the data into the new software. In our view it is best to be honest up front about those things.

8.Top European teams highly interested in vendors with high quality products, pricing flexibility and top customer support

As we mentioned before, teams, when looking to adopt a new technology, will focus on vendors that can offer high quality products, pricing flexibility and top customer support. Vendors who can fit those criteria will stand out from the competition.

If you are a team which is interested in getting visibility into vendors’ rating by teams in terms of quality of the products, pricing flexibility and customer support you can check out our Upside Tech scouting platform which provides unbiased team data on specific vendors in terms of product quality, pricing flexibility and and customer support. You can subscribe to our Upside tech scouting paltform here.

9.Studies and scientific evidence remain top of mind for European sports organizations

Similar to two years ago, when we visited some European teams, as much as teams like technologies, the first thing they always ask about new technologies is: “Where is the scientific evidence? Have you published any studies to support your claim? This can be explained by the fact that there are more pro teams teaming up with universities than there are in the US. This is part of the European culture.

10.Growing number of teams building their own internal AMS platforms

Another new trend that we saw was the growing number of pro teams building their own internal MS paltform using their own IT resources, or tools like Power BI. This can be explained by a variety of reasons: (1) Some teams don’t have the budget or financial resources to buy a 3rd party AMS paltform. (2) Some teams want an AMS paltform that is highly customizable to their need which is something that many 3rd party AMS platform vendors are not willing to commit to. (3) Some teams have a culture of building everything in house as much as they can. Moving forward we expect this trend to continue among pro teams in Europe.

11.Competition among AMS vendors is intensifying in the AMS space. It is a race to the bottom.

One thing we clearly saw during our trip to Europe was: The competition among AMS vendors is intensifying. And we think that it is a race to the bottom. Many of the AMS vendors, especially the small vendors, are competing on price to try to attract pro teams. This is putting increasing pressure on the larger AMS vendors and especially their top line. Therefore we expect some larger AMS vendors to reduce their staff. We re already seeing signs of that. And at the some time we expect a growing number of small AMS vendors to simply go bankrupt or get acquired by other AMS vendors trying to gain market share in select markets.

In the end, we believe that only the AMS vendors who have solid financial resources will survive. On the bright side we think that it will elevate the quality of the AMS platforms and fuel innovation in the space and force AMS vendors to innovate to survive.

12.Technologies need to fit the teams’ culture and workflow

As we mentioned before, technologies need to fit the teams’ culture and workflow. This is where many times some vendors fail. We had a number of discussions with pro teams and sports organizations about this during our European trip. This is where many vendors need to do a better job. Ultimately, it is not about building the greatest technology in the world. It is about building technologies that fit the teams’ workflow and address their needs. If this technology does not fit the workflow of the teams, or if it is disrupting the teams and athletes’ routing, it is non starter. We cannot stress that enough.

13.Growing interest among teams towards biofeedback. Remains secret sauce for many teams

Some European teams like AC Milan, Real Madrid or Chelsea fc, are notorious for being pioneers when it comes to the use of biofeedback. For example, the AC Milan was one of the first teams to build the Mind Room, led by Dr Bruno Demichelis, to help players get stronger mentally and be in the zone during games.

Picture: Paolo Maldini lifts the 2007 Champions League trophy - at the age of 38

Backed by Silvio Berlusconi and hailed by a succession of Milan managers from Arrigo Sacchi to Carlo Ancelotti, the Mind Room helped underpin an unprecedented run of success as the Rossoneri won 21 major trophies during the 23 years it was operational from 1986.

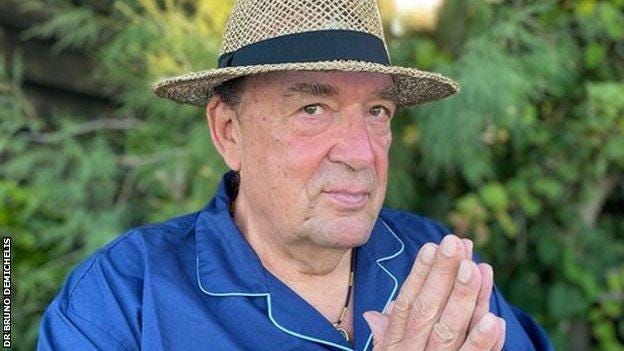

Picture: Dr Bruno Demichelis

The Mind Room acted as part-sanctuary, part-mental training ground. Groups of up to eight first-team members - sat in state-of-the-art zero gravity chairs - were hooked-up to equipment including polygraph machines, used to monitor indicators such as blood pressure and breathing rates. A glass divide separated the players and a studious Demichelis, who was looking for physiological signs of a player's state of mind (or what he termed "objective data in the 'mental area'").

For example, if a player said he felt inhibited or lacking in confidence because of a muscle strain, Demichelis would conduct an electromyogram test to measure muscular electrical activity.

The readings enabled him to quantify conditions such as post-game 'tightness' and take proportionate remedial action, including carefully calibrated breathing training. In doing so, the Mind Room was not only aiding physical recovery and performance, but also supporting the development of psychological characteristics such as confidence.

Demichelis also used results from Mind Room tests to devise cognitive training exercises. These involved the use of biofeedback devices, such as electrodes, which, when placed on a person's scalp, can monitor the brain's electrical activity. By seeing how an individual's neurons behave, it becomes possible to focus on strengthening synapses associated with skills such as problem-solving. This type of therapy is designed to help players reconfigure the type of negative 'inner talk' that can affect them in high-pressure situations. Baresi, Baggio and Donadoni were among those treated.

The point we re trying to make here is that during our trip in Europe, we saw a growing interest among pro teams towards the use of biofeedback. We expect this trend to continue in the coming years as technologies are getting better and cheaper and teams are looking for new techniques that can give them an edge not just physically but also mentally on the field.

Bottom line: Overall we thought that the appetite from European sports organizations towards sports performance technologies was as high as ever. The bottom line is that nowadays European teams are always looking for innovative technologies that can give them a competitive advantage in terms of athletes’ performance, recovery, or sleep. Like in the US, teams are also willing to buy innovative technologies and look for extra budgets outside of their regular budget if they feel like this is a must “have”. There is also a growing interest from teams towards vendors focusing on hydration and concussion assessment, pain management, thermography, biomechanics assessment, nutrition optimization, and data driven rehabilitation tools. On the vendor side, sectors like AMS are becoming increasingly competitive and we expect the phenomenon of consolidation in the space to accelerate. The recent acquisition of Smartabase by Teamworks, is the perfect example of that. We could not be more excited and bullish about the world of sports and tech. And teams are just as excited as we are.

As always, if you have any questions, feel free to reach out to me.

Bes,

You may also like:

⭐⚽ Upside League Profile: Brazilian National Soccer Team & Chat with Guilherme Passos, Sports Scientist On His Favorite Technologies, The Best Players/Coaches He Worked With.

🔥 Upside Chat: Dave Hancock, CEO, Apollo (Leading Athlete Management Systems (AMS) vendor)

🔥Upside Chat: Alexi Pianosi, Strengths and Conditioning Coach, Pittsburgh Penguins (NHL)

🔥Upside Chat: Pierre Barrieu, High Performance Director, Toronto FC (MLS)

🔮 2022 Upside Top Sports Tech Predictions (NFT/Metaverse, Sports Performance, IPOs/M&As..)