⭐Upside: Exclusive Web 3.0 (NFT, Metaverse) Strategy survey: 9 Key Takeaways

The NFT/Metaverse space, which is part of the web 3.0 landscape, has been one of the most hyped topics in the past year. In the past 12 months we have talked to lots of sports organizations in order to try to understand what their web 3.0 strategy is. In parallel to that, we recently surveyed some top sports organizations operating across various leagues (Premier League, Ligue 1, Series B, Olympic organizations, etc..) and sports (soccer, basketball, tennis, rugby, golf, track and field..) to ask them their opinion and plan regarding their web 3.0 strategy.

Here are some of the key takeaways of our web 3.0 strategy survey:

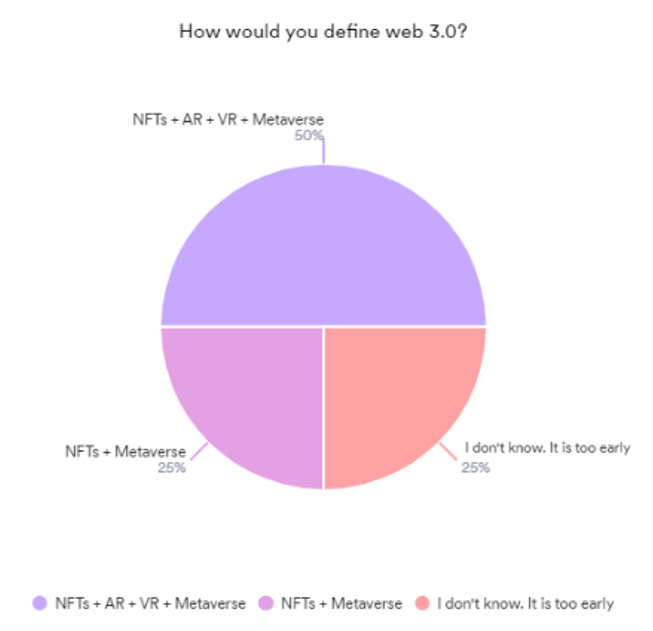

Finding #1: Web 3.0 survey: No consensus on what Web 3,0 is. 50% of respondents believe that the metaverse is NFTs + AR + VR + Metaverse Vs 25% believes it is NFTs + Metaverse.

When we asked the question “How would you define web 3.0?”, we found that:

50% of respondents believe that the metaverse is NFTs + AR + VR + Metaverse.

25% of respondents believes it is NFTs + Metaverse

25% of respondents don’t know what web 3.0 is.

Source: Upside Global, confidential, July 2022.

And as shown in the graph below, when we asked the sports organizations how they would define their web 3.0 strategy, all of them said that they did not know what their web 3.0 strategy was and that it was too early.

Source: Upside Global, confidential, July 2022.

⬆️ The Upside: Clearly there is no real consensus on what web 3.0 is. For some it is NFTs, coupled with AR, VR, and the metaverse. For others it is just NFTs and the metaverse, and quite frankly that’s ok. So why don’t we have a consensus here? There are a couple of reasons: (1) We are still in the first innings of what the web 3.0 space is. Up until 6 months ago most people never heard of buzz words like the metaverse but then everything changed when Facebook renamed itself as Meta. (2) There has been a lot of hype about the web 3.0 and especially the world of NFTs and the metaverse. (3) Most executives in the world of elite sports are not expert in web 3.0. Moving forward we believe that the majority of sports organizations will continue to be confused on what web 3.0 is. Plus they just need time to figure out what they want to do in this space.

Finding #2: 75% of respondents believe that we are still in the early stage of web 3.0 and that it is too early to assess the true potential yet. All respondents don’t know how to fully define their web 3.0 strategy yet.

Another key finding that came out of our web 3.0 strategy survey, was that, as shown in the graph below, 75% of the respondents believe that it is hard to assess the true potential of web 3.0 yet. Only 25% of them believe that web 3.0 has a bright future.

Source: Upside Global, confidential, July 2022.

⬆️ The Upside: The fact that only 25% of respondents believe that web 3.0 has a bright future was a bit surprising to us. But then again it goes back to the fact that we are still in the first inning of web 3.0. There is still a lot of hype and we have yet to find the killer use case for web 3.0. Execs within sports organizations are also not experts in this area. Sports organizations are simply waiting to see how the web 3.0 space is going to shape out in the coming years.

Finding #3: 70%+ of respondents have not started deploying their web 3.0 strategy. 50% of respondents have already engaged with web 3.0 vendors.

When we asked the question “Have you already started deploying your web 3.0 solution(s)?”, we found that:

71% of respondents have not started deploying their web 3.0 strategy.

25% already started deploying their web 3.0 solution(s).

Then we asked the sports organizations if they are already working with some web 3.0 vendors (e.g. Sorare, Dapper Labs, AR/VR companies..) and 50% of them said that they have already engaged with web 3.0 vendors.

Source: Upside Global, confidential, July 2022.

⬆️ The Upside: Again it comes as no surprise as most sports organizations are just starting to shape their web 3.0 strategy. And given the fact that we are seeing new web 3.0 vendors popping up every month it is no surprise that 50% of the sports organizations have already started engaging with web 3.0 vendors.

Finding #4: One size does not fit all. 43% of respondents plan to deploy their web 3.0 solution in the next 12 months Vs 43% in the next 24 months Vs 14% in the next 6 months.

When we asked the question “What is your timeline to deploy your web 3.0 solution(s)?”, we found that:

43% of respondents plan to deploy their web 3.0 solution in the next 12 months.

43% of respondents plan to deploy their web 3.0 solution in the next 24 months.

14% of respondents plan to deploy their web 3.0 solution in the next 6 months.

Source: Upside Global, confidential, July 2022.

⬆️ The Upside: Clearly depending on how important is web 3.0 to a sports organization and the level of resources of the sports organization, it was not a surprise that each sports organization has its own timeline. Some sports organizations want to move fast while others want to take their time to deploy the right web 3.0 strategy. And that’s totally fine. This is not a race. But the fact that 86% of the sports organizations surveyed plan to deploy their web 3.0 solution(s) in the next 12-24 months indicates that this is a long term play and they are still working on defining their web 3.0 strategy, their product roadmap and so on.

Finding #5: 70%+ of respondents plan to buy and deploy their web 3.0 solution in 2023 Vs 14% in 2022 vs 14% in 2024.

When we asked the question “When do you plan to deploy your web 3.0 solution?, we found that:

71%+ of respondents plan to buy and deploy their web 3.0 solution in 2023.

14% of respondents plan to buy and deploy their web 3.0 solution in 2022.

14% of respondents plan to buy and deploy their web 3.0 solution in 2024.

Source: Upside Global, confidential, July 2022.

⬆️ The Upside: The majority (71%) of the sports organizations we surveyed are looking to launch their web 3.0 solution(s) in 2023. It should not come as a surprise as it typically takes 12-18 months for any companies to build a product entirely. It just takes time to go from the evaluation of the various web 3.0 vendors, to the concept phase, pilot phase all the way to the full commercial deployment. Plus there is no reason for sports organizations to rush things right now as the web 3.0 market is still shaping up.

Finding #6: Overcoming the web 3.0 hype, creating a mass market and getting a solid ROI, among the best challenges to overcome with web 3.0.

When we asked the question “What do you think will be the biggest challenges to overcome when deploying web 3.0 solutions?, we found that:

26% of respondents believe that creating a mass market for web 3.0 solutions will be the biggest challenge to overcome.

26% of respondents believe that getting a solid ROI on web 3.0 solutions will be the biggest challenge to overcome.

26% of respondents believe that overcoming the hype surrounding web 3.0 solutions (NFTs, metaverse..) will be the biggest challenge to overcome.

11% of respondents believe that working with web 3.0 companies that have a solid business model will be the biggest challenge to overcome.

11% of respondents believe that fully monetizing their web 3.0 solutions will be the biggest challenge to overcome.

Source: Upside Global, confidential, July 2022.

⬆️ The Upside: It did not come as a surprise to us that sports organizations see the hype surrounding the web 3.0 space, creating a mass market for web 3.0 solutions and getting a solid ROI from web 3.0 solution(s), among the biggest challenges to overcome in the web 3.0 space. As we mentioned before there are a lot of web 3.0 vendors without a solid business model or no business model at all. Many times these web 3,0 companies (NFT, metaverse..) are former AR/VR vendors that pivoted and are calling themselves metaverse companies but these are still the same companies that do not have a clear strategy and a solid business model. They are seeing the web 3.0 / metaverse space as a way to try to revive their business.

But we expect to see a large number of those web 3.0 companies to shut down or be acquired in the next 24 months years. Only the vendors with the right business model, solid financials and a differentiated product, will survive. And quite frankly there are just too many vendors for a small number of clubs that are fighting for the same deals. On top of that some sports organizations are looking at web 3.0 (NFTs, metaverse..) as a way to get money upfront by offering jersey deals for $100k-$500k a spot. One cannot blame sports organizations for that, but for the vendors, especially the small vendors, this is not sustainable for many of them.

Finding #7: 46% of respondents aim at increasing fan engagement with web 3.0 solutions Vs 36% expect to get higher fan monetization.

When we asked the question “Which goal(s) do you want to achieve through web 3.0 solutions?”, we found that:

46% of respondents aim at increasing fan engagement through web 3.0 solutions.

38% of respondents aim at increasing fan monetization.

8% of respondents hope to bring more sponsors.

8% of respondents aim at increasing brand activations.

Source: Upside Global, confidential, July 2022.

⬆️ The Upside: It was not a surprise to us that sports organizations’ primary goals with web 3.0 solutions is to increase fan engagement and fan monetization. At the end of the day it comes down to money. And we are still in the middle of a COVID-19 pandemic and most sports organizations are trying to recover from COVID-19. So web 3.0 is part of their overall strategy to grow their top line. Now, on the other end, we would also point out that there is a growing number of sports organizations that are looking at web 3.0 (NFTs, metaverse..) as a way to be creative and engage their fans in a new way through royalty programs. NFTs and the metaverse are a great new way to enable that.

Finding #8: No consensus on expected ROI from Web 3,0 is. 33% of respondents expects to earn $1M Vs 33% expect a ROI of $100k-$250k.

When we asked the question “How much do you expect to earn from your web 3.0 solution(s)?”, we found that:

33% of respondents expect to earn $1M+ from their web 3.0 solutions.

33% of respondents expect to earn $100k-$250k from their web 3.0 solutions.

17% of respondents expect to earn $500k to $1M from their web 3.0 solutions.

17% of respondents expect to earn $250k to $500k from their web 3.0 solutions.

Source: Upside Global, confidential, July 2022.

⬆️ The Upside: Clearly there is no consensus from the sports organizations when it comes to the expected ROI from web 3.0. Like we said before it depends on their level of commitment when it comes to web 3.0. For some clubs it is a key part of their overall strategy while for others it is a minor part of their strategy. It also depends on the types of web 3.0 solutions that those sports organizations plan to deploy. Launching a simple NFT solution as opposed to launching a full NFT + metaverse + AR + VR solution with a royalty program is a lot more complex to execute. For some of those sports organizations, the payoff and ROI could be a lot bigger there long term.

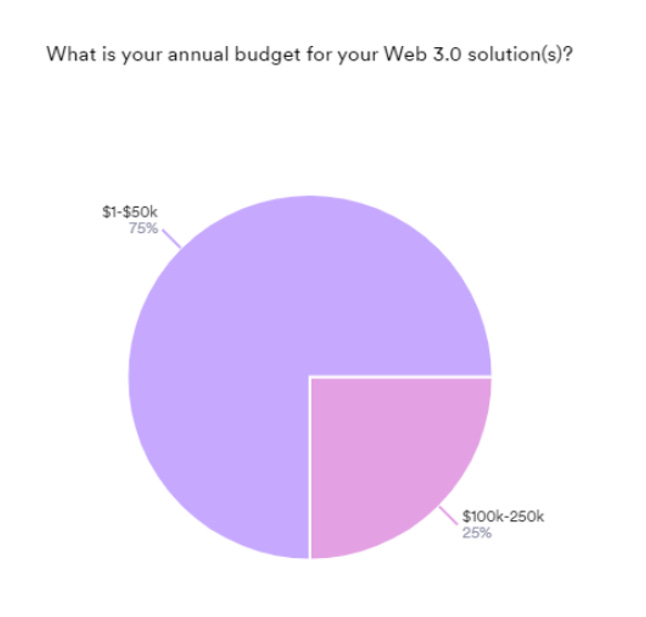

Findings #9: 75% of respondents have an annual budget of $50k for their web 3.0 solutions.

When we asked the question “What is your annual budget for your web 3.0 solution?, we found that:

75% of respondents allocated no more than $50k to implement their web 3.0 solutions.

25% of respondents allocated $100k -$250k to implement their web 3.0 solutions.

Source: Upside Global, confidential, July 2022.

⬆️ The Upside: Again we are in the first innings of web 3.0 so the fact that the majority (75%) of the sports organizations that we surveyed plan to allocate no more than $50k to implement their web 3.0 solution, should not come as a surprise. Most of those sports organizations are likely taking a conservative approach in the short term before fully committing to web 3.0 long term. They are waiting to see how the web 3.0 market is going to shape up, which vendors will emerge as the winners and which vendors will fall apart. Quite frankly sports organizations are taking a risk too especially in markets like NFTs that can sometimes be very speculative.

Bottom line: There is no real consensus among sports organizations on what web 3.0 is today. On top of that, most sports organizations are taking a conservative approach with web 3.0. Also let’s not forget that many of those sports organizations have spent a lot of time and money deploying AR/VR solutions a few years ago without getting a tangible ROI so they are now a bit more conservative with web 3.0 before fully committing to it. We cannot blame them for that. Now in the next 12 months we expect to see the emergence of truly innovative web 3.0 solutions with royalty programs that will become a new driver for many sports organizations. We also expect to see the emergence of a new wave of web 3.0 companies with solid business models and a unique value proposition. When that happens the web 3.0 space will reach its full potential and sports organizations will be able to fully benefit from it in terms of fan engagement, and fan monetization.

You may also like:

🔮 2022 Upside Top Sports Tech Predictions (NFT/Metaverse, Sports Performance, IPOs/M&As..)

🔗 🔥 Upside Analysis: NFTs Vs Crypto Vs Digital Currency, How Are They Different?

🔥 Upside Chat: Dave Hancock, CEO, Apollo (Leading Athlete Management Systems (AMS) vendor)

🔥Upside Chat: Alexi Pianosi, Strengths and Conditioning Coach, Pittsburgh Penguins (NHL)

🔥Upside Chat: Pierre Barrieu, High Performance Director, Toronto FC (MLS)