Monarch Collective is a venture capital firm dedicated to investing in women's sports. Launched in 2023 by Kara Nortman and Jasmine Robinson, the firm initially raised $100 million, with backing from notable investors such as Billie Jean King, Laela Sturdy, and Cindy Holland. As of March 2025, Monarch Collective expanded its fund to $250 million, reflecting growing interest in the sector. The firm focuses on investments in women's sports teams, leagues, and related businesses, with current holdings including minority stakes in National Women's Soccer League clubs Angel City FC and the San Diego Wave.

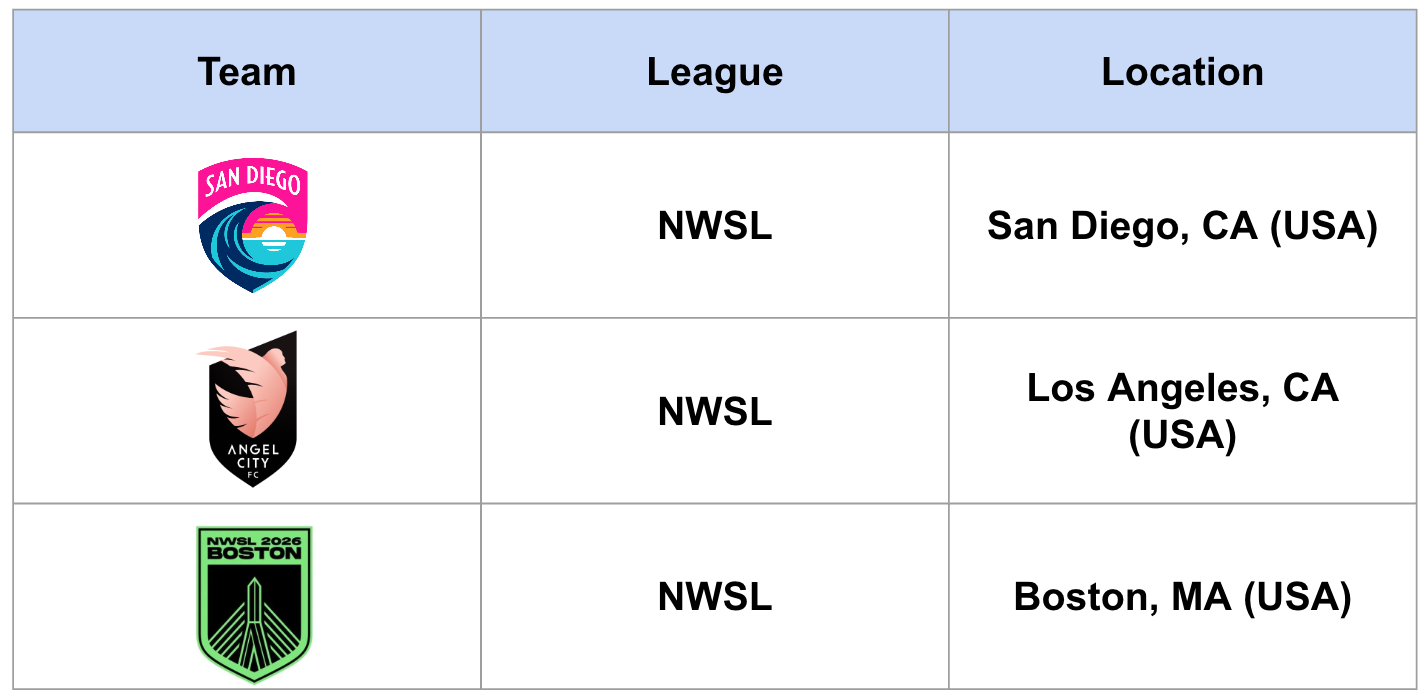

Here is a recap on their past investments:

This week, we interviewed Jasmine Robinson, Managing Partner at Monarch Collective, a $250M investment fund exclusively focused on investing in women sports. We discussed her background, investment thesis, and what she is typically looking for when investing in women teams. She also gave us her advice to raise money and to start a career in sports investment.

Here is a summary of the best quotes of our interview with Jasmine:

Q1. Can you please tell me about your background?

"I've been a big sports fan my entire life—my dad played in the NFL, so I grew up in and around sports. I started my career in management consulting at Bain & Company, but I always knew I wanted to work in the sports ecosystem. That opportunity came when I joined the San Francisco 49ers at an exciting time when we were developing Levi’s Stadium. It wasn’t just about building a billion-dollar-plus stadium—it was also about redefining the business. We were bringing outsourced business lines in-house, launching new ventures, and rethinking the entire fan experience and commercial approach. That was an incredible learning experience.

During that time, the 49ers’ ownership group launched a family office to invest in sports teams and technology. I moved to the investing side, looking at sports tech and team investments alongside the ownership group. That was my first experience in sports investing, and I’ve been in the space ever since—first through Causeway, a growth-stage sports investing fund, and now through Monarch Collective, which I co-founded."

Q2. Can you please tell me about Monarch Collective?

"We launched Monarch in early 2023 and raised $250 million because my partner Kara and I saw tremendous growth happening in the women’s sports ecosystem, yet no funds were focused on providing the necessary capital to fuel that growth. Women’s sports have been undervalued for so long, and we wanted to change that by bringing in dedicated investment and strategic expertise.

Monarch is not just about writing checks—it’s about being hands-on, active partners in building the future of women’s sports. Many traditional private equity firms approach sports investing in a more distant way, but we wanted to be deeply involved, bringing industry knowledge and operational support to our investments.

My partner Kara was one of the three co-founders of Angel City FC, the most valuable women’s sports club, so she brings first-hand experience in building a women’s team from the ground up. I bring the operating and investing background from my time with the 49ers and Causeway. Together, we launched Monarch with a mission: to help build the leading women’s sports institutions that inspire and unite by creating communities that reflect this pivotal moment in history."

Q3. What is your sports investment philosophy? Why did you decide to invest in women’s teams like Boston NWSL, Angel City FC, and San Diego Wave?

"At Monarch, we focus on three core areas within women’s sports: teams, leagues, and related rights. Our investment philosophy is based on a long-term belief that women’s sports are massively undervalued and poised for explosive growth.

When we look at teams to invest in, we focus on three key factors. First, we want to partner with strong, independent ownership groups that are committed to building a high-quality women’s sports franchise, not just treating it as an extension of a broader sports platform. We believe in teams that stand on their own and prioritize the growth of women’s sports.

Second, market dynamics matter. We invest in teams located in major sports markets where we see long-term potential for success. That’s why we’ve invested in Boston, LA, and San Diego—these are proven, passionate sports cities with strong fan bases.

Third, stadium infrastructure is crucial. A team’s ability to thrive is heavily influenced by its stadium situation—having the right venue, in the right location, with the right amenities, sets the foundation for long-term success. If a team doesn’t have a great stadium setup, it’s much harder to change that down the line.

Ultimately, we invest in teams that align with our values, have visionary leadership, and are positioned for sustained growth in the evolving landscape of women’s sports."

Q4. What are the things you are looking for when deciding to invest in women’s teams?

"One of the biggest factors we consider is the strength of the league the team plays in. A league’s governance, infrastructure, and ownership structure all play a huge role in whether its teams can be successful. We want to see leagues that have strong leadership, thoughtful expansion strategies, and committed owners.

For example, the NWSL has seen incredible growth in recent years. It has attracted top-tier owners from both inside and outside the sports world—whether that’s owners with experience running other major professional teams or operators with strong business expertise. Having those high-caliber people at the table makes a huge difference in a league’s ability to scale and succeed.

We also focus on sports that have a high-growth trajectory and global appeal. Women’s soccer is a great example because it’s a global sport with a passionate fan base and significant room for commercial growth. That’s why leagues like the NWSL, the WSL in the UK, and the WNBA are so attractive—they check the boxes of strong ownership, league infrastructure, and global potential.

At the end of the day, we look for leagues and teams that have the right mix of strong leadership, scalable infrastructure, and market potential to succeed in the long run."

Q5. What advice would you give to anyone looking to start a career in sports tech investment?

"I came into investing from the operating side, having worked within a sports team, and I think that experience was invaluable. Learning how to be a great investor is something you can pick up over time, but learning how to be a great sports operator is much harder to develop on the job.

When we hire at Monarch, we prioritize candidates with deep experience in operating sports teams or businesses. We look for people who know what it takes to scale a sports organization, build strategic partnerships, and drive revenue growth. Our investment approach is highly hands-on, so we need people who can be active partners to the teams and leagues we invest in.

That’s different from what a lot of other funds look for. Many traditional investment firms prioritize people with backgrounds in banking, consulting, or finance. But for us, having an operating mindset and real-world experience in sports is a huge asset.

For anyone looking to break into sports tech investment, I’d advise gaining hands-on experience in the sports industry first—whether that’s working for a team, league, or sports-related company. That operational foundation will make you a much stronger investor in the long run."

Q6. What are your goals in the next 12 months?

"Our fund is highly concentrated—we’re only making six to eight investments total, so we are extremely selective. Each year, we’ll likely only make one to three investments, and they have to be high-conviction opportunities where we believe we can add real value.

In the next 12 months, we’re particularly focused on opportunities in the WNBA and European women’s football. We’ve been spending a lot of time in the UK and across Europe, evaluating potential investments in leagues and teams that fit our strategy.

Beyond new investments, we’re also focused on helping our existing portfolio companies scale. We’re investors in the Boston NWSL team, which will launch in 2026, so a big milestone for us in the next year is helping that team prepare for its inaugural season. We’re also working closely with Angel City and San Diego Wave to take their commercialization and operations to the next level.

Ultimately, our goal is to continue making strategic investments that push women’s sports forward while also ensuring that the teams we’ve already invested in reach their full potential."

You may also like: