🔮 2022 Upside Top Sports Tech Predictions (NFT/Metaverse, Sports Performance, IPOs/M&As..)

Dear colleague,

First off, we would like to wish you and your family a happy holiday and all the best for 2022. Make sure to stay safe during the holidays. This is now time for our 2022 top sports tech predictions. A lot has happened in 2021 in the world of sports and tech. 2021 saw the emergence of NFT/Metaverse startups unicorns such as Sorare and Dapper Labs. The Metaverse has become the new “buzzword” in the world of sports and tech with many startups pivoting into this space and literally every single major tech companies, sports apparel companies and brands announcing their Metaverse/Web 3.0 strategy. Now that fans are back in stadiums, sports teams and leagues are now looking at NFT/Metaverse as a way to improve fans engagement but most importantly as a way to drive their top line to continue to mitigate the impact of COVID-19. But, as we noted previously in our Metaverse sports analysis, most clubs and leagues are still trying to figure out their web 3.0 strategy and the majority of the Metaverse sports startups do not have a solid business model or no business model at all.

In the world of wearables, in 2021 we saw a continued adoption of wearables (smart watches, fitness bands..). but pro teams are now looking for next generation wearables embedded with advanced sensors and capable of providing actionable health insights. Injury prevention tools, sleep technologies and mental health devices and solutions, remained top of mind for teams in 2021 as well. In the following section we will discuss our Upside 2022 Top sports tech predictions.

A. Fans experience predictions:

1. Metaverse/NFTs/Web 3.0:

a. The majority of the biggest sports leagues will set guidelines on how to deploy NFT/Metaverse solutions (Premier League, Laliga, Calcio, AFL, MLB, MLS, NHL, NCAA..) in 2022. Most teams will deploy a Metaverse/NFT/AR/Web 3.0 solution in the next 12 months: In 2022 we believe that most major sports leagues will set guidelines for clubs on how to successfully deploy NFTs and metaverse experiences. This is already happening behind the scene with leagues such as the Premier League, which created a special committee to provide guidance to clubs. At the end of the day, those leagues want to replicate the success of NFT experiences such as the NBA Top Shot in order to bank on the fast growing NFT/metaverse market and drive their top line. They have the audience, the fans, so now they just have to put the pieces together, and work with the right NFT/Metaverse partners to enable their vision. In addition, we expect the majority of the clubs and leagues to deploy web 3.0 solutions with NFT/Metaverse/AR at the core in the next 12 months. Granted, right now the majority of the teams that we talked to are still trying to figure out their Web 3.0 strategy and they are currently evaluating a large number of NFT/Metaverse/Web 3.0 startups to help them execute on their strategy in the next 12 months. With that in mind, we believe that some leagues and teams will work with Metaverse/NFT technology enablers such as Venly, Dachain.io, and others, to deploy their own white label NFT/metaverse experiences with their own branding. Why? These tech enablers provide a full end-to-end SaaS type NFT /metaverse platform which allows teams and leagues to create their own branded wallet, marketplace, NFTs and even AR experiences. By doing so it will be easier for those teams and leagues to deploy their NFT/Metaverse solutions by using those white label NFT/metaverse platforms as opposed to try to build everything from scratch from various third party NFT/Metaverse companies.

b. The Metaverse/NFT bubble will burst in the next 12 months. As we noted in our previous Sports metaverse ecosystem analysis, we believe that there are a large number of sports metaverse/NFT startups that have no solid business models. These are companies that pivoted (from the AR/VR space) to focus on the metaverse space. Now there are some great NFT/metaverse companies out there with solid business models, great teams and solid GTM strategy but these are a rare breed.

For example, Utah based Metaverse/NFT RTFKT, which got bought this month by Nike, is among the NFT/metaverse startups that have built a solid business model. They sold 20k avatars for $80M. In collaboration with teenage artist FEWOCiOUS, RTFKT sold real sneakers paired with RTFKT’s virtual ones, and managed to sell 600 pairs/NFTs in just six minutes, netting $3.1M. RTFKT’s 2021 total revenue are being estimated at $100M.

Picture: RTFKT, Upside Global, 2021.

Based on the growing number of NFT/Metaverse that have no solid business model, we expect to see a growing number of NFT/Metaverse startups shut down or get bought in 2022 and beyond. Only the best metaverse/NFT startups will remain and it will set the bar in terms of user experience, business model, and so on. This will benefit the industry as a whole in the long run. Btw this is typically what happens in any new emerging markets where there is a huge hype in the early stage of the market. The point here is that the NFT/Metaverse market is no different that any “overhyped” emerging markets. Ultimately, this is why we believe that the Metaverse/NFT bubble will burst in the next 12 months.

c. New Metaverse/NFT unicorn startups likely to emerge in 2022. 2021 saw the emergence of some NFT/metaverse unicorn startups namely Sorare and Dapper Labs, which raised $739M and $607M, respectively, and now have a combined valuation of nearly $12B. We expect to see the emergence of new Metaverse/NFT unicorn startups in 2021. This is just inevitable. VCs are edging their bets, looking for the next NFT/metaverse startup unicorns, and NFT/Metaverse startups are looking to bank on the hype surrounding the space, so we have a perfect storm set to happen in the next 12 months. Which NFT/Metaverse startups will become the next startup unicorn? This is the $1 Million question right now. For example just this week, Social Virtual Reality platform Rec Room raised $145M at a $3.5B valuation. We will see many of these in 2022.

d. Growing number of players and athletes set to launch their own Metaverse/NFT platforms. Just like in the VR space, we expect to see major athletes to launch their own NFT/Metaverse channels in 2022. The idea there is for them to have special NFT drops (video clips, special collections, VIP passes..) on their channels (Instagram, Tiktok..FB, Twitter, Snap) and leverage their large social media followers. By doing so they will be able to better monetize NFTs and get a piece of the action. Dream VR, for example, offers VR/360 video based athletes channels. More precisely, Dream VR enables athletes (e.g. Dani Alves) to have their own VR/360 channel where they can provide exclusive “behind the scene” virtual VR/360 video content and associated content (jerseys, hats, VIP events..) or provide virtual lessons to their fans. Each fan can just pay a fee per month to get access to all the content. Dream VR is now creating immersive NFTs for Dani Alves (see picture below) related to the experiences and will be located in a small Museum of each city so that they may be purchased at a NFTs Marketplace. Furthermore, users will be able to get inside of those NFTs as if they were part of them.

Picture: Dream VR, Dani Alves’ NFT. Dani Alves is a Brazilian soccer player (Ex Barca, PSG..)

In 2022 we expect many more athletes to follow suit and launch their own NFT/metaverse channels to sell their own NFTs. This could become a great new revenue generator for many athletes across the globe. It will also be a great way for athletes to better interact with their fans, brands and partners.

Now let’s assume that only 1% of Ronaldo’s 315M followers bought Ronaldo’s special NFTs for $20 each. That would bring $63M to Ronaldo in additional revenue each year.

We believe that many athletes will adopt such models in the coming years in order to improve the fans engagement but more importantly drive their top line.

e. Fragmentation in the metaverse space and regulation from gambling regulators set to become a restraining growth factor for future growth in the metaverse space. As we mentioned in our analysis on the Sports metaverse ecosystem fragmentation is set to become a major headache for many developers. The main reason being that most of the major tech players (Apple, Facebook/Meta, Samsung, Microsoft..) will want to create their own silo metaverse ecosystems. Now we also expect to see the emergence of companies that will help developers write their Metaverse application “once” and then be able to port the same app across various metaverse ecosystems. Basically what happened with Android will happen again here with the NFT/Metaverse space. That being said we expect blockchain technology to help mitigate the impact of fragmentation over time.

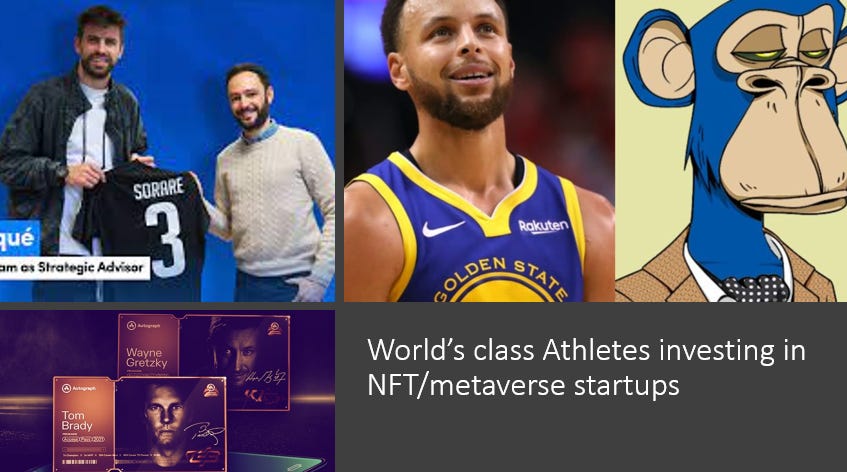

f. More athletes will become investors and ambassadors of NFT/metaverse startups. In 2021 we saw a large number of world’s class athletes invest in NFT/Metaverse startups. For example, soccer stars Gerard Pique and Antoine Griezmann invested in NFT/Metaverse unicorn startup Sorare. NFL star Tom Brady also launched its own NFT platform called 'Autograph', together with Japanese tennis star Naomi Osaka, pro golfer Tiger Woods and pro skater Tony Hawk, to facilitate digital ownership of sports memorabilia by sports fans. Some other athletes went as far as going on a spending spree and buy NFTs. This was the case of three-time NBA champion and two-time MVP Stephen Curry who decided to join the Bored Ape Yacht Club, picking up one of their NFTs for 55 ETH ($180,000). In 2022, we expect to see more athletes invest in NFT/metaverse startups and become ambassadors in order to bank on the NFT/Metaverse opportunity and leverage their large base of social media followers along the way.

Picture: Upside Global, December 2021.

g. Growing number of second tier NFT/Metaverse startups to focus on other sports in order to grow their business. In 2022, we also expect to see a growing number of NFT/metaverse startup to start focusing more on sports like rugby, tennis, cricket, handball, volleyball, moto GP, racing, F1, etc..to grow their business and mitigate the dominance of large NFT metaverse startups (Dapper Labs, Sorare..). Let’s face it! These startups have a lot less capital and resources than these startup unicorns. So they have to find a way to grow elsewhere where there is less competition and more opportunities for them. Their future depends on it.

h. Major tech companies (Meta, Google, Apple..), apparel companies (Nike, adidas, Under Armour..) to go on a M&A spree in the NFT/Metaverse space to try to bank on the opportunity. In 2021 we started to see a growing number of major tech companies, and apparel companies make strategic M&As in the NFT/Metaverse space. For example, as we noted earlier, Nike bought metaverse startup RTFKT this month. Meta bought Within as well. The point here is that these tech and sports apparel giants need to make big bets in the metaverse space on who they believe will be the next metaverse startup unicorn. They need to acquire startups with unique technologies, strong momentum and engineering and leadership teams to help them shape their metaverse strategy and win in the metaverse space. This is why we expect to see many of these large companies to go on a M&A spree in 2022 starting with adidas, Under Armour, Apple, Google, Facebook, Microsoft, Niantic and many others.

i. Clubs and leagues set to introduce metaverse/NFT startups accelerators and launch their own tech funds focusing on metaverse/NFT startups. In 2022 we also expect major clubs, leagues and tournaments to launch their own metaverse/NFT startup accelerators. Many of these clubs and leagues have already launched startup accelerators . They know how to launch such programs, mentor startups and organize pilots. This is why we believe that this is a no brainer that some of the largest sports teams and leagues (NBA, NFL, MLS, Premier League..) will announce their own metaverse/NFT accelerators in 2022. Others will go as far as launching their own tech fund to invest in metaverse/NFT startups. Why? They have the footprint with millions of fans and they have strong brands. They can attract startups and help startup scale and do pilots. Some of them also have tremendous resources and revenues. Clubs and leagues will want to get a piece of the Metaverse space, just like VCs do, and find the next metaverse/NFT startup unicorn. In 2021 we already witnessed such trend. For example, Tennis Australia, which oversees the Australian Open Tennis, launched its own Tech fund called Wildcard Ventures, led by Techstars MD Todd Deacon, Tennis Australia execs Dr Machar Reid and Lauren Coridas.

Picture: Wildcard Ventures

They launched their new startup accelerator program in association with TechStars back in 2020. One of their focus is on NFT/metaverse startups. Speaking to SportsPro in June, Tennis Australia chief executive Craig Tiley said investments in emerging technologies are a key focus for the national governing body as it looks to diversify its business beyond tennis-related activities.

Tiley revealed that Tennis Australia is actively exploring the commercial possibilities around NFTs and cryptocurrencies, two burgeoning yet largely untapped areas which could offer a new avenue for monetization around the organisation’s “great content and assets”.

We expect to see a growing number of clubs, leagues and tournaments follow suit in 2022.

j. Most broadcasters will launch metaverse/NFT experiences during live games. In 2022 we expect to see more broadcasters offering in game NFT/metaverse experiences which will enable fans to interact live during games but more importantly fans will be able to buy unique NFTs only available during those games. Those NFTs could be sponsored by teams’ main sponsors and partners. We already saw examples of that in 2021 with Socios.com offering live games NFTs. To do so, they teamed with AC Milan and invited its soccer fans to predict the score in order to get a chance to win in game NFTs. Let’s face it! Broadcasters have large audiences. Sports leagues and teams want to get a piece of the NFT/metaverse action so Live TV + In game NFT is the perfect storm.

Picture: Socios.com, AC Milan, 2021.

In 2022 in game NFT/Metaverse experiences is set to become the norm among sports broadcasters. This will help broadcasters, advertisers, teams, leagues and brands to further drive their top line and engage fans in a new way.

2. AR/VR/MR:

a. Hybrid AR/VR glasses with NFT/Metaverse, advanced digital assistant, digital coaching systems and WiFi 6/5G capabilities set to become a “must have” to enhance the fans experience within stadiums. In 2022, we expect to see the emergence of hybrid AR/VR consumer glasses embedded with advanced digital assistants, and WiFi 6/5G. Now let’s close our eyes for a second, and let’s imagine a fan sitting on the sideline of the Patriots Vs 49ers game and wearing a pair of hybrid AR/VR glasses. The fan would say: “Ok Alexa, show me the best highlights of the Patriots quarterback”. That’s step 1. Now step 2 would be this type of experience where a fan wearing the glasses would be able to say: “Ok Alexa, what are the odds that the Patriots quarterback will successfully throw the ball to his wild receiver and score a touchdown?”.

The digital assistant (e.g. Alexa) would then say: “There is a 70% chance that he will score a touchdown! Do you want to bet on it?”. Now this is from a fans experience perspective.

What about an AR/VR experience from a coach’s perspective?

Let’s imagine the Patriots coach sitting on the sideline of the Patriots Vs 49ers game and wearing those AR/VR glasses. The digital assistant embedded into the glasses would tell the coach “Coach! Player #12 is getting tired. His load (KM ran) is up 40% compared to the last game, There is a 60% chance that he might get injured if he remains in the 4th quarter. Do you want him to rest?”.

Granted this is unlikely to happen in 2022 but we believe that this is where the industry is heading. Why? Because we are getting at a point where AR/VR glasses will soon be capable to offer those types of experiences. Digital assistants such as Google or Alexa are also fairly advanced and can enable advanced dialogs and queries. Most teams also use AMS systems, GPS systems, and HR monitors. The only 2 challenges will be to get access to live biometric and statistical data during live games. For example, broadcasters, together with Zebra’s in field’s player tracking technology (based on RFID + UWB), typically give NFL teams access to players’ biometric data (speed, acceleration, velocity..) 4 hours after each NFL games. but if this changes and NFL teams start getting access to such data in real time during NFL games, we believe that we could see the emergence of such AR/VR experiences in the next 2-3 years. It is not a matter of “if” but a matter of “when”.

Nowadays we are already seeing glimpse of what this type of fans experience could look like. For example ShotTracker currently has an AR app which allows fans at a stadium to hold their phone and look at a player on the field and see their statistical data just as an AR overlay simply by looking at them at a live sports event. You can see below the ShotTracker AR app and watch the video of this AR app here.

Picture: Shottracker, 2021.

b. In 2022, the consumer AR glasses market for the masses will start to take off, driven by Apple, Microsoft and others (Samsung, Snap, nreal..Google). We believe that 2022 will see the emergence of a mass market for AR consumer glasses. As we noted in our Metaverse sports ecosystem analysis, according to our sources, all major tech companies (Apple, Microsoft, Facebook/Meta..) are working on launching consumer AR glasses that are set to be introduced in 2022. For example, Apple is rumored to introduced some hybrid AR/VR glasses in 4Q21. Microsoft is also likely to launch a low cost version of the Microsoft Hololens glasses next year. As we noted previously, we believe that as soon as Apple introduce their AR/VR glasses in 4Q22, his competitors (Samsung, Facebook, Microsoft, Google, Snap, nreal…) will follow suit with a competing product. This will help create a mass market for AR/VR glasses. Some vendors like Samsung will want to compete on price against Apple. That’s usually what they do by offering multiple versions (low, mid, premium) of its products. The same will happen here with the consumer AR/VR hybrid glasses market.

Picture: Nreal glasses, 2021.

Now, more precisely, we believe that some vendors will offer standalone AR consumer glasses (Snap, Microsoft) while others (Apple, Facebook, Samsung..) will offer hybrid AR/VR glasses or both. With that in mind, we expect to see a price war in the AR/VR consumer glasses market between OEMs which will further intensify in 2023. This will help spur innovation in the AR/VR space. Ultimately, that’s good news for consumers who will have more choices and differentiated products to choose from.

c. New AR form factors (AR contact lenses..) will start to emerge. 2022 will also see the emergence of new AR form factors such as AR contact lenses. For example Mojo Vision, a well funded SF based startup, is building the world’s first AR contact lenses. Granted we think we are probably still 2 years away before we see AR contact lenses for the masses. Also, not every one will want to wear AR contact lenses as only 22% of Americans wear contacts, according to the Vision Impact Institute research. But we believe that there is a niche market for AR contact lenses for sports like cycling, running, tennis, golf and so on. You can check out our podcast interview with Dave Hobbs Director of product management at Mojo Vision where he speaks about Mojo Vision, his vision of the market, the sports use cases, and so on. You can click here to listen to our Upside podcast interview with Mojo Vision.

Video: Mojo Vision video, 2021.

d. NFT/Metaverse will help further drive the adoption of mobile AR.

While everyone is waiting to see a mass market for AR consumer glasses, the reality is that the mobile AR market has become a real market over the past few years thanks to companies like Snap, Google and many others.

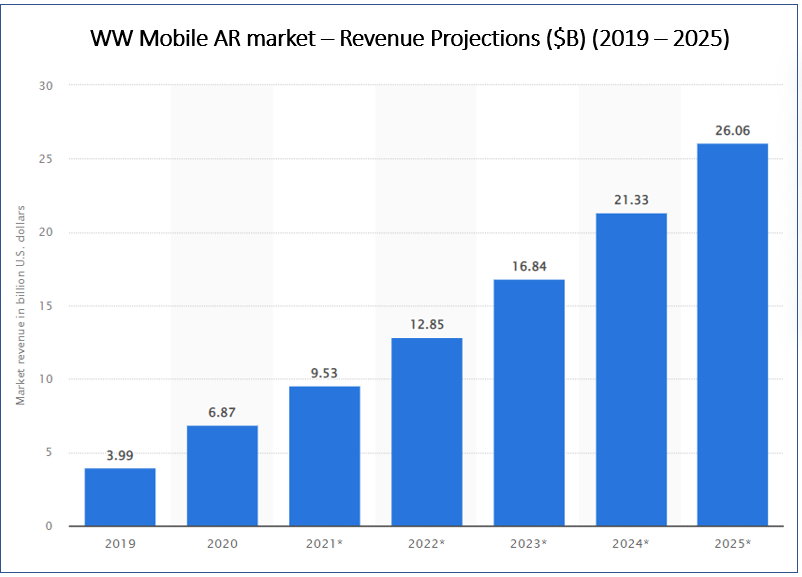

According to Statista (see graph below), the global mobile augmented reality (AR) market was worth $6.87B in 2020. It is forecasted to rise to $9.53B in 2021, before jumping to over $26B by 2025.

Source: Statista, 2021

Over the years, mobile AR has become a great way for sports brands and teams to interact with their fans and drive brand activations. For example, in 2019 Nike teamed up with Snap to launch a Snapchat AR experience showcasing Lebron James at the core. It gathered 2M+ hits, 57k+ likes and 9.3k retweets. You can watch the video below to learn more.

Video: Snap, Nike, Lebron James’ Mobile AR experience, 2021.

In 2022, we expect the metaverse and NFTs to help drive the future growth of mobile AR market with athletes and teams offering AR based NFTs drops (Special videos of plays, dunks…) that fans will be able to purchase in real time.

e. More VR/AR startups expected to pivot to focus on the metaverse as a way to further drive sales and raise new round of funding. Ever since Facebook renamed itself to Meta we have seen VR/AR startups literally pivoting to focus on the metaverse space. Some other startups even went as far as renaming their company’s name using the word “Verse” in their new name to try to drive future sales and appeal to VCs and potential investors. We have seen this on a daily basis. But let’s not be native here. These same VR/AR startups who were struggling to survive in the AR/VR space due to the lack of solid business model, traction, and other factors, are set to face the same challenges in the metaverse space, which has now become extremely competitive in the past 3 months. In our view, VCs will have to do their due diligence to distinguish the startups with a solid business versus the ones who do not. With that in mind we expect to see in 2022 a growing number of startups pivoting to the metaverse space in order to raise money and gain traction.

B. Sports performance predictions:

3. Wearables:

a. Apple is likely to launch an Apple watch with hydration/electrolyte measurement capability in 2022. Other OEMs (Samsung, Google, Garmin..) to follow suit. Other OEMs will follow suit with competing products. According to our sources we believe that in 2022 Apple is very likely to launch a new version of the Apple watch with hydration/electrolyte measurement capabilities. Of note, several years ago there were already speculations that Apple built an Apple watch that could measure the hydration level. Kobe Bryant was one of the few athletes who was able to try this special version of the Apple watch at the time. Based on our sources, Apple is currently working with various 3rd party companies to offer such feature. They are looking to see which approach will be the best to enable this. When this new version of the Apple Watch becomes available we expect competing OEMs (Samsung, Google, Garmin, etc..) to offer similar capabilities. Over time, hydration/electrolyte measurement on smart watches will become the norm in the world of elite sports but also in the consumer market space. By then we expect many pro teams and leagues to focus on hydration/electrolyte measurement as new way to better assess their athletes’ performance, health and readiness. Why? Because there has been several studies showing the impact of dehydration on athletes’ performance. All this will have a positive impact on startups such as Flowbio, Nix, Intake.health and others, that offers solutions to measure hydration and, in some cases, electrolyte.

b. GPS/HR monitors, AMS & video analysis systems will continue to be among the teams’ most commonly used sports performance technologies in 2022. But sleep tech, mental health, hydration/electrolyte assessment tools will continue to grow in popularity. In 2022 we expect GPS systems, HR monitoring systems, AMS and video analysis systems to remain among the most common types of technologies used in the world of elite sports. However, we expect more teams to invest in emerging tech such as sleep tech, mental health and hydration/electrolyte assessment tools (e.g. smart patches).

As shown in the graph below, 48% of the athletic trainers/Performance directors of the 31 pro teams (NBA, NFL, MLS, NCAA, Premier League, Ligue 1..) that we surveyed in 2020 were planning to invest in sleep trackers in the future. 44% of them were also planning to invest in neurotech & mental health devices in the future. This does not come as a surprise as being in quarantine likely affected some players’ sleep and mental health and trainers want to make sure that they can address any mental issues moving forward. Hydration/electrolyte monitoring solutions also gathered a lot of interest with 24% of the respondents indicating their plan to buy hydration/electrolyte monitoring solutions.

Source: Upside 2020 Top Coaches Sports Tech Budget Survey Results, April 2020.

b. A new wave of wearables with advanced wearables with advanced biosensing and actionable insights will become the norm. In 2022 we also expect to see the emergence of new types of wearables with advanced biosensing capabilities (lactate, Blood pressure, hydration/electrolyte measurement..). As we mentioned earlier Apple is likely to introduce a new Apple that can measure hydration/electrolyte. Apple is also working with a chip IR sensor company that can measure lactate as well. Measuring lactate is important as it is one of the biomarkers that could indicate the potential risk of injuries. The point here is that we will see wearables capable of measuring biosensing beyond HR/HRV.

Now we also expect to see wearables capable of delivering actionable insights. For example these wearables will be able to tell a user insights such as “You are burning too much calories. You should slow down”, or “You are 60% dehydrated. You should take a water break and intake 6 ounces of electrolyte during your training session”.

To enable this OEMs will build advanced algorithms capable of identifying patents in order to deliver such insights. These wearables will also be able to understand the “baseline” of each player. Ultimately, we believe that these are the types of actionable insights that athletes and coaches are looking for. This will also help increase the stickiness of these wearables over time.

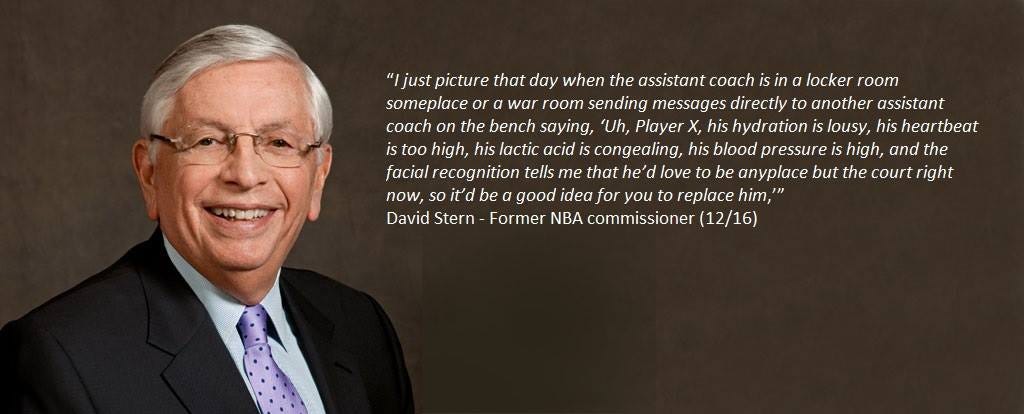

Wearables, once allowed during live games such as basketball, could give an edge to pro teams in order to make better decisions and ultimately win more games. A few years ago, former NBA commissioner David Stern, explained his vision: “I just picture that day when the assistant coach is in a locker room someplace or a war room sending messages directly to another assistant coach on the bench saying, ‘Uh, Player X, his hydration is lousy, his heartbeat is too high, his lactic acid is congealing, his blood pressure is high, and the facial recognition tells me that he’d love to be anyplace but the court right now, so it’d be a good idea for you to replace him’.

Picture: Former NBA commissioner David Stern,

c. Contactless biosensors (HR, BP, sleep..) set to grow in popularity among pro teams. In 2022 we also expect to see more teams using sleep tech devices using contactless biosensors in order to better track athletes sleep. Sleep tech devices using contacless biosensors are typically devices that are embedded with a tiny radar (based on technologies like UWB) and advanced algorithms that can measure athletes’ biometric data (e.g. HR, sleep apnea, stress, anxiety, HRV, blood pressure, etc) without any contact to the skin. Leading players in the space include companies like SleepScore, Blumio, Elfi Tech, Circadia Tech, and Xandar Kardian.

Picture: SleepScore Max, using contactless biosensors to measure light, deep sleep, REMs.

d. Wearables/sports betting:

i. NBA to allow the use of wearables during live NBA games, driven by sports betting. NBPA, NBA teams, to get a rev cut of sports betting.

As noted in our analysis on how sports betting could be a key catalyst to allow the use of wearables during live NBA games, we believe that the NBA could soon allow the use of wearables during live games. Based on our conversation with an NBA executives a few months ago, sports betting is set to become the biggest driver for NBA teams, NBAPA to allow it. Why? NBA agents, players and NBAPA would allow it if they get a cut of the sports betting revenue opportunity.

ii. Sports betting to become a new key revenue generator for most sports leagues.

We believe that in 2022 sports betting will become a new key revenue generator for most sports leagues. For example, as we noted previously, the NFL, who historically, has been against sports betting, is the perfect example of a league who has historically against sports betting and is now all in.

So how much revenue is the NFL expected to generate from sports betting this year? The league is expected to generate $270M in revenue this year from their sports-betting and gambling deals, according to a person familiar with the league’s finances.

“You can definitely see the market growing to $1 billion-plus of league opportunity over this decade,” said Christopher Halpin, an executive vice president for the NFL who is its chief strategy and growth officer.

4. Sleep tech:

a. New sleep tech form factors (smart mask, bracelets..) set to grow in popularity among pro teams. Sleep has become a growing issues for many teams due to stress and anxiety. The pandemic has accelerated this trend. Oftentimes athletes cannot fall asleep after games due to the adrenalin following the game. This is why in 2022 we also expect to see more teams using sleep tech devices using new form factors such as smart sleeping masks. For example Sana health offers a smart sleeping mask that uses pulses of lights and sounds that makes athletes fall asleep after 15-20 minutes of use. Silentmode, on the other end, offers the Powermask a smart sleeping mask that uses pulses of sound with breathing exercises (via a mobile app) that can make athletes fall asleep in the same amount of time. We have tried both devices and tested it with some teams and we can attest that these devices work.

Picture: Silentmode Powermask (left), Sana mask (right).

In 2022 we will also see new form factors such as bracelets capable of making athletes fall asleep. A leading player in this space is Remedee Labs a French startup that built a bracelet and solution capable of stimulating brain endorphin release, the body natural pain killer. The bracelet also helps increase sleep quality and decrease stress. Of note, Remedee Labs raised $12M to date. The bracelet is already being used by patients in hospitals in France.

Picture: Remedee Labs bracelet and app.

You can watch the video below to see how the Remedee Labs bracelet works.

Video: Remedee Labs, 2021.

We expect to see these types of new sleep tech form factors emerging in 2022 which will help teams improve athletes’ sleep, reduce stress and ultimately improve athletes’ performance.

5. GPS:

a. More GPS vendors in the US will focus on lower level sports (High schools, colleges, …) and offer GPS solutions with flexible and low cost solutions.

In 2022 we also expect to see more GPS vendors targeting lower level sports. As part of that, at the lower level, GPS solutions with pricing flexibility and monthly plans to become the norm in the lower leagues in the next 12 months. GPS vendors like McLloyd are well positioned there in the US market at the lower level (high schools, academies, colleges..). We also expect Catapult, one of the leading GPS vendors in the world, to focus more on this segment based on his recent announcements.

6. AMS:

a. Competition among AMS (Athlete Management Systems) vendors set to further intensify with some AMS vendors shutting bought or getting bought in 2022. In 2022, we also expect to see increased competition among AMS vendors (Kitman Labs, Kinduct, Smartabase, etc..). The AMS market has become extremely fragmented over the years. Sometimes teams are using and testing various AMS systems simultaneously, and AMS vendors often provide free trials to teams to get a foot in the door. With that in mind, in 2022 we expect to see consolidation in the AMS vendors space with several small AMS vendors getting bought or shut down. In our opinion, there are just too many players in this space. Of note, we will do a deep analysis on the AMS vendors market next month.

7. Injury prevention tools:

a. New types of injury prevention tools with advanced smaller sensors, and advanced biosensing capabilities will emerge in 2022. 2022 should also see the emergence of new types of injury prevention tools based on advanced and smaller sensors with advanced biosensing capabilities. For example, London based startup Neurocess offers services as a wearable technology product that increases the training performance and reduces the risk of injury. Its product provides a sports activity analysis platform through a wireless EMG-based sensor network optimized for athletes. The developed bio-sensors is assisted by advanced signal processing methods to capture physiological data from the muscles accurately. They are using the electrical signals to extract important physiological and biomechanical features such as localised muscular strength, force, fatigue level, dehydration, joint angular velocity, rotation and orientation. Of note, Neurocess is already working with top European soccer teams (Premier League..).

Picture: Neurocess, 2021

You can watch the video below to see how it works:

Video: Neurocess, 2021

This is the type of new injury prevention tools that we expect to see in 2022. More teams will use those types of solutions to help them better prevent injuries and fasten the rehab process.

8. Biofeedback/mental health:

a. More teams will hire mental coaches/biofeedback experts in order to help athletes get in the zone, reduce athletes’ stress, and improve their performance. Stress and the need for athletes to always be at the top of their game has put a tremendous amount of pressure on athletes over the past few years. On top of that, the pandemic has accelerated this trend. This is why in 2022 we also expect to see more teams hiring mental coaches for their athletes. The goal? Help their athletes get in the zone, reduce stress, and improve performance over time. This is why we believe that world’s class biofeedback experts/mental coaches such as Leonard Zaichkowsky, PhD (known as Doc Z) will continue to be in high demand. We also expect to see more teams create mind rooms in order to create the proper infrastructure and framework to enable this.

b. More teams will adopt mental health app and devices and make it part of training program. In addition to hiring mental coaches and as part of the mental training, in 2022 we also expect to see more teams adopt mental health apps and devices (e.g. Silentmode Powermask, Muse Band..) and meditation apps (e.g. Calm). The goal? Help their players get stronger mentally, and be more relaxed to ultimately perform better during games.

Picture: Muse’s EEG meditation band, Calm’s meditation app.

This was confirmed by the survey that we did back in 2020 where 44% of the 31 teams (NBA, MLS, NCAA, NFL, European soccer..) that we surveyed indicated to us that they were planning to invest in a mental health devices/solution. We expect this trend to continue in 2022.

9. M&As / IPOs:

a. M&As likely to accelerate among major vendors (Peloton, Whoop, Catapult, Kitman Labs, Oura..) to help them drive their top line and further differentiate their offerings. Some of the largest sports tech companies (Peloton, Whoop, Catapult, Kitman Labs, Oura..) need to show strong growth, momentum and further differentiate their offering. This is why we expect these companies to acquire some sports tech startups in 2022. They have the cash, they know how to scale businesses, so it is a no brainer. For example there has been increased pressure on companies like Peloton to reverse the trend and show strong growth moving forward. Other companies like Whoop, which recently acquired Push, will continue to acquire startups in order to offer new products and services. Kitman Labs which already acquired some startups (Bought Presagia Sports from Presagia last July, and acquired The Sports Office in 2020), will be another top buyer in 2022. Lastly Catapult, which is a public company, will look to acquire some startups in order to offer new products beyond their GPS, video analysis products. We believe that startups focusing on next gen biosensing capabilities (hydration, electrolyte, lactate..), advanced sleep tech, advanced analytics, will become prime M&A targets for those major tech companies. So expect consolidation in the sports performance space to accelerate in 2022.

b. Major sports performance startups (Whoop, Oura..) will file for IPOs. We also believe that some major sports tech vendors will file for IPOs and become public in 2022. Among the top candidates are Whoop, Oura, just to name a few. They need additional capital to continue to grow especially as they are looking to expand beyond sports and focus on new verticals.

c. A growing number of sports performance startups (Whoop, Oura, Kitman..) will focus on industrial, enterprise and healthcare space in order to generate additional revenue. As we noted earlier, major sports performance startups such as Whoop, Oura, Kitman, will look to further expand into new verticals such as healthcare, industrial and enterprise (construction, oil & gas, energy..). Why? Because instead of equipping a squad of 90 NFL players on an NFL team they could equip thousands of field workers at a major construction company in order to help them prevent workers injuries which costs billions of dollars every year to those companies. Now granted, based on our experience in this space, the enterprise/industrial space is a space with a longer sales cycle (9-12 months), which is also more regulated and where those startups will have to comply to specific standards (e.g. intrinsically certification required for wearables used in the oil & gas sector). The healthcare market also requires FDA approval for any devices set to be used in the healthcare space. The bottom line is that these verticals are much larger markets than the sports industry and those startups know that. This is why they will increasingly focus on those verticals. Investors and VCs are increasingly emphasizing to them the need to go beyond sports in order to get the biggest ROI and largest exits. A startup could end up having multiple exits by spinning off its industrial/enterprise business on top of its sports business.

C. VC/investment trends:

11. More clubs and sports organizations will launch their own VC tech fund. In the sports tech investment space, 2022 will see more sports organizations (teams, leagues, sports tournaments, etc..) launching their own tech funds. As we noted earlier, it is already happening. For example, Tennis Australia launched their own funds (e.g. Wildcard ventures). The 49ers also have their own tech fund called 49ers Enterprise where they invest in emerging startups. There are many examples like these and we expect this trend to carry on in 2022. These sports organizations are making big bets on who will be the next sports tech unicorns and they want to get a piece of the action, as it should be.

12. More athletes will launch their own micro funds (Carmelo Tech7, Serena Williams…). Team owners too. In 2021 we saw a growing number of athletes launching their own tech funds in order to back talented entrepreneurs, startups and leverage their large network and social media footprint. Athletes such as Serena Williams, or Carmelo Anthony have been pioneers in this space, launching their own tech VCs/funds (e.g. Serena Ventures, MeloTech7) many years ago. Some athletes such as Kevin Durant, even teamed up with Thirty Five Ventures partner Rich Kleiman and filed for a special purpose acquisition company in partnership with LionTree, a media-focused investment bank. The SPAC, Infinite Acquisition, seeks to raise $200 million in an IPO. We expect this trend to continue in 2022 with more athletes launching their own tech funds and micro VCs.

13. Vast majority of digital investment to go towards metaverse/NFT startups: As we noted in our last Upside sports tech newsletter, in November 2021, 88% of $405M raised by sports tech startups came from NFT/Metaverse startups. We expect this trend to continue with the majority of the sports tech investments coming from Metaverse startups in 2022. There is just too much excitement about the space right now. That being said we expect areas such as advanced biosensors (hydration, electrolyte..), advanced analytics, computer vision, sleep tech, AI, to be among other top areas of investments in 2022.

Bottom line: 2022 is set to be another exciting year in the world of sports and tech with new emerging segments such as advanced wearables, and NFT/Metaverse experiences further gaining traction. The pandemic will continue to be a major factor in the world of sports and tech. But this is where technologies can help mitigate the impact of the pandemic by improving players and fans safety, the fans experience, and driving teams and leagues’ top line. This is why we are excited about the sports and tech space even more than ever. Of note, next week we will be taking a break and we will not publish our Upside weekly newsletter. So for those of you who are taking a well deserved break, enjoy your time off! We will be back the first week of January. One last thing: we have a lot of new initiatives coming up in 2022. Stay tuned!

You may also like:

⭐Sports Performance Roles & Best Practices (Head of Performance, Head Athletic Trainer..)

🔥Upside Chat: Alexi Pianosi, Strengths and Conditioning Coach, Pittsburgh Penguins (NHL)

🔥Upside Chat: Pierre Barrieu, High Performance Director, Toronto FC (MLS)

🔥Upside Chat: Len Zaichkowsky, World-Class’ Sports Biofeedback Expert

⭐ Upside Startup Spotlight: Neurocess (Leading injury prevention startup)

⌚ 🏀 Upside Analysis: Sports Leagues' regulation towards wearables

🔗 Upside Analysis: The NFT Sports Market: Key Players, Trends, Recommendations to Teams.

You can check out our Upside Global platform here to start accelerating your business.