📚 CSCCa - Upside Recap: Latest Trends in Tech, Training & Rehab in the NCAA

Dear colleague,

Last week we attended the 2025 CSCCa conference. It was a great opportunity to catch up with NCAA teams, vendors, local partners (Sports Tech HQ) and teams. You could feel the great energy among NCAA teams and vendors. So here is our recap:

CSCCa is the go to NCAA event in the college sports market

The CSCCa (Collegiate Strength and Conditioning Coaches association) Conference, which gathered 1600 NCAA practitioners, has firmly established itself as the premier NCAA event in the college sports market due to its unmatched focus on the development, education, and advancement of strength and conditioning professionals at the collegiate level. Drawing top coaches, sports scientists, and performance leaders from across all NCAA divisions, the conference serves as a critical hub for sharing best practices, cutting-edge research, and the latest innovations in athlete performance, recovery, and injury prevention. With its combination of elite-level networking, hands-on workshops, and exposure to the most trusted vendors and technologies in collegiate athletics, the CSCCa Conference is an essential destination for professionals dedicated to pushing the standards of college sports performance.

In a nutshell, the CSCCa conference gathered:

1600 NCAA practitioners

100+ exhibitors

Most NCAA teams assess student athletes twice a year

Based on the conversations we had with NCAA teams, most NCAA athletic programs assess their student-athletes at least twice a year—typically at the start of the fall and spring seasons—to track physical development, identify areas for improvement, and guide individualized training. These evaluations often include a combination of jump testing (such as vertical or broad jumps), countermovement jumps (CMJ) to analyze power output and asymmetries, movement pattern screenings to assess mobility and stability, bodyweight exercises like push-ups for upper body endurance, and basic strength or mobility assessments like squats. This biannual approach ensures that coaches have objective data to support performance programming, monitor progress over time, and reduce injury risk through early identification of movement inefficiencies or imbalances.

ACL injuries remain a major issue for NCAA teams. Practitioners are focused on bringing more awareness on ACL injury prevention

ACL injuries continue to be a major concern across NCAA sports, particularly in high-impact and cutting-based disciplines such as basketball, soccer, and football. These injuries not only sideline athletes for extended periods but also carry long-term implications for performance and health. In response, strength and conditioning practitioners, athletic trainers, and sports medicine teams are placing a growing emphasis on ACL injury prevention through targeted neuromuscular training, movement screening, and athlete education. Programs are increasingly integrating exercises that improve landing mechanics, strengthen the posterior chain, and correct movement asymmetries—especially in female athletes, who are at higher risk. This shift reflects a broader commitment within the NCAA to proactive injury prevention strategies that protect athlete longevity and performance.

The Transfer portal is affecting NCAA teams’ culture

The rise of the NCAA transfer portal has significantly reshaped the dynamics of college athletics, introducing both opportunities and challenges for team culture and continuity. With more student-athletes now exploring the option to transfer without penalty, programs are experiencing increased roster churn, which can disrupt long-established team chemistry, leadership development, and long-term athlete development plans. Coaches and performance staff are finding it more difficult to build multi-year progression models when athletes are entering and exiting programs more frequently. This fluid movement also places pressure on staff to accelerate onboarding processes and quickly assess the physical and psychological readiness of incoming transfers.

From a cultural standpoint, the transfer portal has introduced a more transactional tone to college sports, as athletes weigh options based on immediate playing time, NIL opportunities, or better program fit. While it empowers student-athletes with greater autonomy over their careers, it also challenges coaches to maintain cohesion and shared purpose within constantly evolving rosters. As a result, many NCAA teams are rethinking their leadership development models, investing more in team-building initiatives, and refining their communication strategies to foster a sense of belonging and resilience amid rapid change. Ultimately, the programs that adapt most effectively will be those that balance the fluidity of modern college sports with a strong, stable cultural foundation.

NCAA teams are tapping into tech budgets and private donations to help them recruit top athletes for millions of dollars

In an increasingly competitive collegiate sports landscape, some NCAA programs are strategically leveraging their technology budgets and private donations to gain an edge in recruiting top-tier athletes. Forward-thinking athletic departments are investing in state-of-the-art performance technology—such as force plates, GPS tracking systems, motion capture, and recovery tools—to showcase their commitment to athlete development and well-being. These tools not only enhance training and injury prevention efforts but also serve as powerful recruiting assets. Prospective student-athletes and their families are increasingly drawn to programs that can offer cutting-edge resources that mirror professional-level environments, highlighting a commitment to maximizing athletic potential and preparing for the next level.

Private donors and alumni networks are playing a growing role in this arms race, contributing funds earmarked specifically for performance, recovery, and facility upgrades that directly impact recruiting. Donor-backed initiatives allow programs to fast-track the integration of elite technologies and support services that may otherwise be out of reach within traditional athletic budgets. This trend is particularly evident in high-visibility sports like football, basketball, and track & field, where marginal gains can influence both wins and future professional opportunities. As a result, the intersection of donor engagement, advanced sports tech, and strategic recruiting has become a critical focus for NCAA teams seeking to stand out in a crowded, fast-evolving talent marketplace.

In addition, with the rapid evolution of Name, Image, and Likeness (NIL) policies, some NCAA programs are now spending millions of dollars—often through booster-backed collectives, private donations and sponsorship deals—to recruit top-tier student-athletes. These financial packages can include direct NIL compensation, endorsement opportunities, and lifestyle perks that rival professional contracts, especially in revenue-generating sports like football and basketball. As a result, the recruitment landscape has shifted dramatically, with financial incentives becoming a central part of the decision-making process for elite athletes.

In addition, based on conversations we had with a number of NCAA teams, we are now seeing top NCAA teams tapping into their tech budgets to help them recruit top student athletes for millions of dollars.

While this new era creates unprecedented opportunities for players, it also intensifies competition among programs and raises concerns about equity, sustainability, and the long-term impact on team culture and academic focus.

NCAA teams are discussing how to bring more regulation towards NIL

As the NIL era continues to evolve, some NCAA teams and administrators are actively discussing the need for greater regulation to address growing concerns around fairness, sustainability, and long-term athlete development. A key issue being debated is the influx of freshmen receiving substantial NIL deals before proving themselves at the collegiate level, which some coaches argue creates entitlement, disrupts team hierarchy, and undermines the merit-based progression traditionally valued in college sports. These discussions are exploring potential solutions such as tiered compensation models, performance-based incentives, or standardized NIL frameworks that promote accountability and alignment with academic and athletic goals. While preserving athlete rights remains a priority, many within the NCAA community believe a more structured approach is essential to maintain competitive balance, cultural cohesion, and the integrity of collegiate athletics.

NCAA football and basketball programs capture up to 80% of NCAA teams’ annual sports revenues

In most NCAA athletic departments, football and men’s basketball programs dominate both the revenue generation and budget allocation, often accounting for the vast majority of athletic income through media rights, ticket sales, sponsorships, and booster contributions. These high-profile sports not only fund their own operations but frequently subsidize non-revenue sports across the department. As a result, they command disproportionate resources for facilities, recruiting, coaching salaries, and performance support. While this model reflects the financial realities of modern college athletics, it also raises ongoing challenges around equity, resource distribution, and long-term sustainability—particularly as demands grow across all sports for better technology, medical care, and athlete development infrastructure.

As mentioned above in the NCAA it is common knowledge that typically football and basketball are the biggest programs. But how much revenue do those programs typically generate for NCAA teams?

As we mentioned in some previous analysis, and as shown in the table below, on average NCAA teams’ football program generate anywhere between $25M and $70M per year which is about 35%-50% of NCAA teams’ revenue. By comparison, NCAA teams’ basketball program usually generate $10M-50M per year in revenue which is about 20%-30% of the NCAA’s total revenue.

It is worth pointing out that these numbers reflect the average annual revenue per NCAA team based on sport type, primarily focusing on Division I programs. In addition, Football’s and Basketball’s dominance in terms of revenue generation is due to media rights, sponsorships, and high attendance. With that in mind this is why sports tech startups tend to focus primarily on NCAA’s teams football and basketball programs.

Source: Average annual tech revenue per NCAA team per sports type, confidential, 2024

Smaller NCAA programs are being impacted by the lack of resources

Smaller NCAA programs, such as volleyball, track and field, and swimming, are increasingly feeling the strain of limited resources as the bulk of athletic department funding continues to be funneled toward high-revenue sports like football and basketball. These non-revenue sports often operate with lean budgets, fewer scholarships, and limited access to advanced technology, recovery tools, and full-time support staff. As a result, coaches and athletes in these programs face challenges in recruiting, injury prevention, and year-round performance development. The disparity in resources not only impacts competitive success but also raises concerns about athlete experience, equity, and long-term program sustainability in an era where excellence in sports science and training infrastructure is becoming the norm across collegiate athletics.

Some public high schools have big tech budgets

In recent years, based on our conversations, a surprising trend has emerged: some public high schools—now operate with technology budgets reaching as high as $2.5 million. These significant investments are fueling the adoption of cutting-edge performance, recovery, and data analytics tools typically associated with top-tier athletic programs. In particular, some public high schools have been able to fund these sizable tech upgrades through local tax revenues generated from legalized gambling, such as sports betting or lottery programs.

What sets many of these schools apart is not just the funding, but also the operational agility—with less bureaucratic red tape and a faster approval process, they can evaluate, purchase, and implement new technologies in a matter of weeks rather than months. This flexibility enables them to stay ahead of the curve and respond quickly to new developments in sports science, reshaping the competitive landscape from the grassroots to the collegiate level.

NCAA teams present a great opportunity for startups to team up on studies and research side.

NCAA teams present a unique and valuable opportunity for startups to collaborate on research and validation studies, offering real-world environments with diverse, high-performing athlete populations. These partnerships allow startups to test and refine their technologies—whether in biomechanics, recovery, nutrition, or performance analytics—under the supervision of experienced sports science and medical staff. In return, collegiate programs gain early access to innovative tools that can support athlete development and injury prevention. The academic setting also makes NCAA institutions ideal partners for evidence-based research, often supported by university IRBs, which can lend scientific credibility to startups looking to enter the broader sports or health markets. This synergy between innovation and applied performance creates fertile ground for mutually beneficial breakthroughs.

Velocity training, resistance training, fitness equipments, AMS, and nutrition products, remain top tech categories among NCAA teams

Velocity training systems, resistance training systems, fitness equipment, nutrition products, and athlete management systems (AMS) continue to be top tech categories among NCAA teams as they seek to enhance athlete performance, optimize training, and prevent injuries. These technologies offer precise data on movement speed, force output, muscle activation, and overall athlete readiness, enabling coaches and performance staff to tailor programs that align with each athlete's specific needs. Velocity-based training (VBT) systems, for instance, provide real-time feedback on power output during lifts, helping athletes maximize strength gains while reducing the risk of overtraining. Similarly, advanced resistance training systems, such as isokinetic machines and flywheel devices, are gaining traction for their ability to target muscle groups in a more controlled and effective way.

Nutrition products play a complementary role by supporting recovery, energy availability, and muscle repair, while AMS platforms integrate data from various sources—training loads, biometric inputs, and recovery metrics—to give practitioners a holistic view of athlete health. As NCAA programs invest in these cutting-edge solutions, they help foster a more integrated, efficient, and data-driven approach to performance and recovery.

Most D1 NCAA programs have a more complex process than pro teams to adopt new technologies but the opportunity is massive for startups

Based on the conversations we had with a number of D1 NCAA teams, and as we mentioned before, there is a lot of red tape involved to get new technologies approved and deployed within NCAA teams. Now another thing to keep in mind is that the approver of new technologies within NCAA teams is not always the user (Head athletic trainer, head S&C..) of such technologies. So what is the typical process for NCAA teams to adopt new technologies? Which departments typically approve new technologies? The NCAA teams' approval process to adopt new technologies is typically as follow:

Step #1: Pilot phase: During that phase which can last several weeks, NCAA teams typically conduct pilots to test new technologies in the field. The idea here is to see if this technology is relevant for their programs, works as advertised, and if it fits the workflow of their teams.

Step #2: Sports science community approval: Once the field testing is done, most NCAA teams would have to get in front of the sports science community to get approval.

Step #3: University approval: Assuming that that the sports science community does approve a new technology, the next typical step would be to get approval from the whole university.

Step #4: IT approval: The 4th step typically consists in getting approval from the IT department as new technologies are often connected to an IT network. The IT department just wants to make sure that a new technology won’t affect the IT network and that there is the right IT protocol in place to support it.

Step #5: Procurement approval: The final step of the approval process within NCAA teams typically involves getting approval from the procurement team as they want to do their due diligence on new technologies and make sure that there won’t be any issues.

100+ sports tech startups were present at the 2025 CSCCa Tech Expo

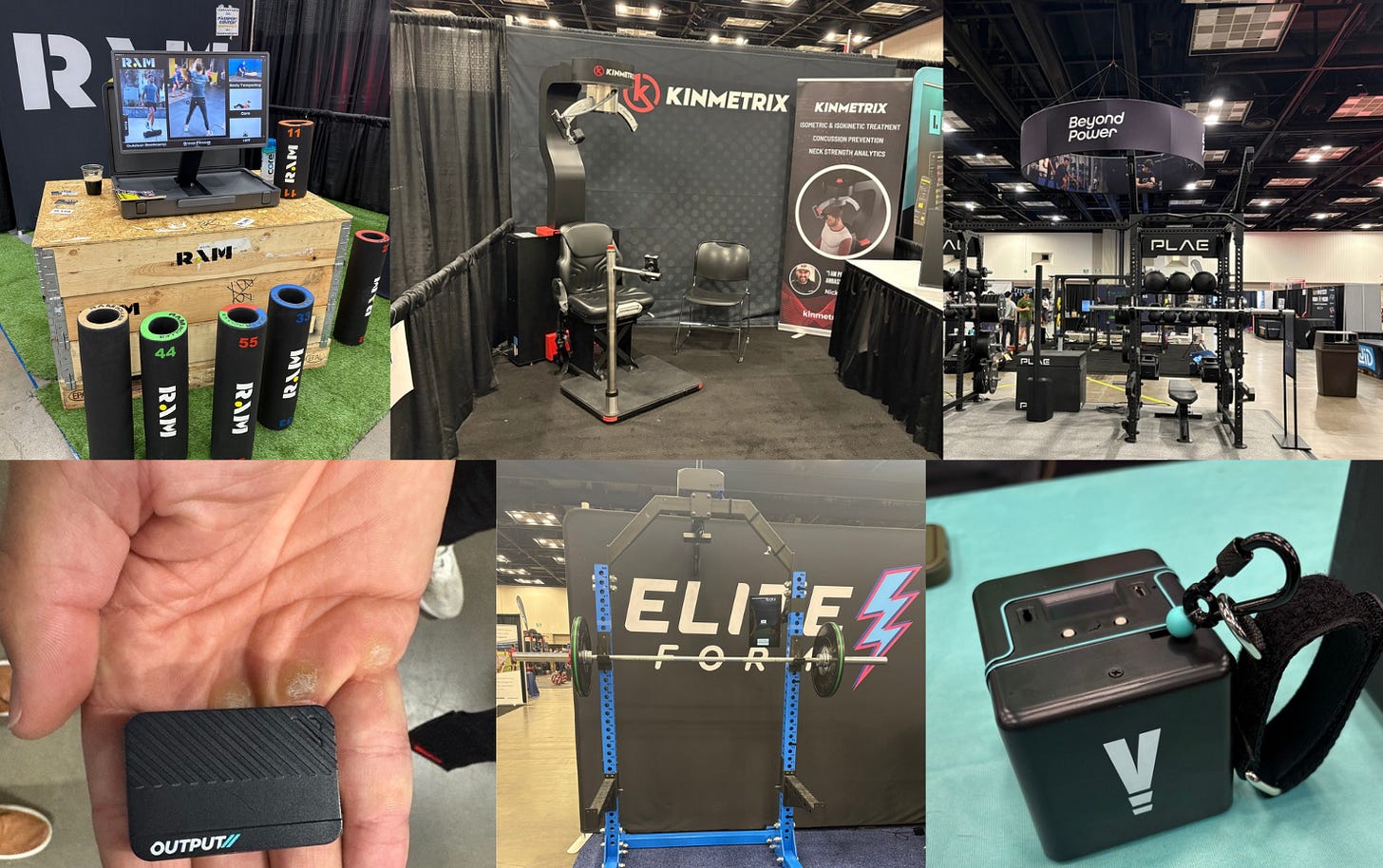

We came across a number of sports tech startups at the 2025 CSCCa. There was a great energy at the tech expo with a good variety of startups. Of note, this list is not a full list of all the startups that were present at the CSCCa conference last week:

Here is a list of some sports tech startups that we came across there:

AMS vendors: RockDaisy, Bridge athletic, Lumin sports, Teamworks, Teambuildr.

Nutrition (Protein, energy drinks..): 1st Phorm, AN Supps, BPN, Designs for Sport, Gatorade, DripDrop, Enduraphin, Diversified Food Inc, Essential Provisions, HBC

Fitness training app: GoArmy Edge,

Force plates makers: Hawkin Dynamics, Vald, KINVENT

Concussion assessment & prevention, neck training: Kinmetrix, Iron Neck

Foam roller maker: Brazyn Life,

Glute strength training equipment: Glute Slide, UltraSlide

Red light therapy device: Theralight,

Turf makers: AstroTurf,

Velocity training equipments: GymAware, Output Sports, Vitruve, Remaker

Biometrics monitoring devices: Firstbeat technologies,

Biomechanical assessment tools: KinetikIQ

Resistance training equipment: 1080 Motion, Kaiser, OxeFit, Maxxx-Force

Grip enhancer: Chalkless, Inc

Water dispenser: FlowWater inc,

Strength training equipments (belts, bench bar, weight blocks, sandbags, squad training, trademill..): 2POOD, ABMAT, Aesthreadics, BOLT Fitness Supply, DC Blocks, Defiant Strength, Grace Premier Fitness, INTEK Strength, Samson Equipment, Sorinex, UpSquad, Hyperwear, Power Lift, Matrix Fitness , Technogym, Eleiko, Ram Fit

Performance training services: Exos

GPS vendor: KINEXON Sports

Flywheel equipment makers: Exxentric, Exerfly (Recently acquired by Dynamic Fabrication and Finishing)

TENS & EMS maker: HiDow International

Climbing training machine: VersaClimber

Medicine ball maker: D-Ball,

Digital motorized strength training equipment: Beyond Power

Whole-body vibration training equipment: Power Plate

Sports performance (speed) testing equipment: SWIFT Performance

While all these startups had interesting technologies, here are the startups that caught our attention and that we decided to profile in this recap. If you are a startup and we did not profile you, feel free to reach out to us at julien@upsideglobal.co. thank you.

1. Kinmetrix

Company: Kinmetrix

Founded: 2014

HQ: Greater Sudbury, Ontario (Canada)

Website: https://www.kinmetrix.com

Amount money raised: TBD

Customers / partners: Primarily targets athletes and sports organizations (NFL, NCAA, NHL..) across various levels.

Company/product description: Kinmetrix is a sports technology company that develops advanced strength measurement and training devices for athletes. Their flagship product, the Kinmetrix Arc, is a first-of-its-kind digital device that uses robotics, sensors, and real-time analytics to measure and strengthen the neck across key movement patterns. Designed for professional and elite athletes, the Kinmetrix Arc provides iso-kinetic and iso-metric resistance, delivering detailed performance Metrics and insights that offer a new level of visibility into neck strength—helping reduce the risk of injury and optimize performance.

Picture: Kinmetrix Arc

Key features include:

Precision sensors for accurate measurement.

Robotic resistance for controlled strengthening.

360-degree range of motion capabilities.

Iso-kinetic and iso-metric exercise options.

Designed to improve athlete safety, and performance.

Here is a video that explains how it works:

Here is the podcast interview below that we did with Kim Brouzes, Kinmetrix CEO. Of note, Kim will be speaking at our 2025 Upside Sports Tech Summit on October 23 at a world’s class sports stadium in Sunrise FL:

2. Exerfly (Recently acquired by Dynamic Fabrication and Finishing)

Founded: 2017

HQ: Eau Claire, WI (USA)

Website: https://www.exerflysport.com/

Amount money raised: TBD

Total employees: TBD

Customers / partners: Exerfly products are trusted and used by teams across the NHL, NBA, MLB, NRL, Premier League, Super Rugby, Sports New Zealand, as well as Olympic teams.

Company/product description: Exerfly is a cost-effective flywheel-based system delivering eccentric overload for strength and power adaptations. It’s portable, easy to scale across teams, and backed by research in rugby, soccer, and basketball. It doesn’t offer native force diagnostics but is great for high-volume training blocks.

Here is the podcast interview below that we did with Thomson Remo and Chris Chase (Memphis Grizzlies/NBA):

3. 1080 Motion

Founded: 2013

HQ: Västerås (Sweden)

Website: https://1080motion.com/

Amount money raised: TBD

Total employees: TBD

Customers/partners: 1080 Motion products are currently being used by hundreds of pro teams (NFL, NBA, NHL, MLB, Premier League, Bundesliga, etc.) as well as universities, federations, Olympic facilities, high-performance centers, and sports medicine clinics all over the world.

Company/product description: Founded in 2013, 1080 Motion is the world leader in professional- and research-grade digital motorized resistance equipment for speed and strength training. As pioneers in their field, they push the boundaries of athletic performance, testing, rehab, and research. Their value lies in combining ultra-smooth resistance for high speed or high force, an intuitive user interface, comprehensive performance data, and a strong commitment to education and community.

The 1080 Sprint 2, 1080 Quantum, and 1080 Cable all run on the same software for device control, data collection, storage, and analysis. A public API allows easy integration with third-party platforms.

Resistance or assistance can be applied to any athletic movement: sprinting, change of direction, squats, jumps, pushes, pulls, etc. The motor and software enable training across the entire force-velocity curve: max strength with isokinetic resistance and eccentric overload, high speed with ballistic resistance, and overspeed with assisted load.

The 1080 Sprint 2, their most popular product, is a battery-powered, portable machine with a built-in touchscreen, making it easy to test and train anywhere, anytime. The Sprint 2, which is a battery operated, portable machine with a built-in screen that teams, athletes and coaches can easily travel with the device.

Picture: 1080 Motion’s Sprint 2

Here is a video explaining how the 1080 Motion Sprint 2 works:

Here is the podcast interview below that we did with Anna-Carin Månsson, CEO, and Ola Eriksrud, co-Founder at 1080 Motion:

4. KinetikIQ

Founded: 2021

HQ: Menlo, Galway (Ireland)

Amount money raised: TBD

Website: https://kinetikiq.com/

Amount money raised: $1.13M

Total employees: TBD

Company/product description: KinetikIQ, developed by Precision Sports Technology, is an innovative LiDAR based app that provides real-time, sensor-free movement assessments. Utilizing AI-powered computer vision, it analyzes movement patterns to deliver instant metrics on biomechanics, such as range of motion, velocity, and asymmetries. This technology aims to assist physiotherapists, strength and conditioning coaches, and athletic trainers by offering objective data for performance optimization and injury prevention, eliminating the need for traditional wearable sensors. Essentially, it brings biomechanical analysis into a mobile platform.

Pictures: KinetikIQ tablet app

Here is a demo video showcasing KinetikIQ product:

Here is a video that explains how ATU Donegal lecturer and St. Eunan's GAA Head of Performance utilises KinetikIQ with his students and athletes.

Video: KinetikIQ

Here is below the podcast interview we did with Emma Meehan the CEO of KinetikIQ. Of note, Emma will be speaking at our 2025 Upside Sports Tech Summit on October 23 at a world’s class sports stadium in Sunrise FL:

5. Maxxx-Force

Founded: 2016

HQ: Florida

Website: https://maxxxforce.com/

Amount money raised: TBD

Total employees: 8

Company/product description: MaXXX-Force enhances athletic performance to levels that can never otherwise be achieved. Unlike ANY other strength equipment in the industry, MaXXX-Force adaptive resistance provides athletes the ability to safely train at their maximum concentric, isometric, and most importantly eccentric load capacity curves within the same rep. This is simply NOT possible with any other machine in the market today.

This unparalleled and intense method of resistance maximizes athletes force outputs, explosive power, neuromuscular recruitment (Type II), muscle mass, flexibility and injury prevention. MaXXX-Force is raising the ceiling of athletic performance higher than ever before!

Here are some videos explaining how the Maxxforce machine works:

6. RAM Fit

Founded: Date not publicly disclosed

Headquarters: Gallinagh, Monaghan, Ireland

Website: www.ramfit.com

Amount money raised: TBD

Total Employees: Not publicly disclosed

Customers / Partners: Utilized by military units, professional sports teams, fitness racing organizations like DEKA FIT, and fitness centers including 9 Fitness founded by Fernando Torres.

Company/Product Description: RAMfit is a fitness equipment company specializing in functional training and body tempering tools made from 100% recycled materials, primarily repurposed tires. Their flagship products, including the RAMroller and RAM Log, are designed to serve multiple purposes—ranging from strength training and rehabilitation to recovery and mobility work. These tools are engineered for durability and simplicity, making them suitable for various training environments such as military programs, group fitness classes, and professional sports teams.

Committed to sustainability, RAMfit has initiated programs like the monthly giveaway of RAMs to gym owners across the USA, UK, and Europe, promoting eco-friendly fitness solutions . Their products are also integrated into fitness racing events, notably DEKA FIT, where they are used in specific challenge zones to test participants' strength and endurance.

7. RockDaisy

Founded: 2014

HQ: New York, NY (USA)

Website:www.RockDaisy.com

Total employees: 10

Amount money raised: TBD

Customers / partners: 100 organizations including sports organizations (NFL, NBA, NCAA teams).

Company/product description: Founded by a pair of former NFL technologists who built and ran the NFL League Office’s analytics department for a combined 20+ years, ROCKDAISY is a data analytics and visualization platform designed specifically for the non-tech user. ROCKDAISY incorporates information (data, images and video) from multiple sources to provide an effective solution directly to decision makers. Information is presented on a dashboard via customized reports that are continuously updated, easy-to-understand, easy-to-use and lightning fast in operation. RockDaisy operates stand alone, or can be completely re-branded as a white-label product.

Picture: RockDaisy

Here is a video explaining how the RockDaisy AMS platform works:

8. Kinvent

Founded: 2017

HQ: Montpellier (France)

Amount money raised: €23M

Website: https://physio.kinvent.com/

Total employees: TBD

Company/product description: Founded in 2017, KINVENT is a leading player in the fields of physical rehabilitation and sports biomechanics producing innovative measuring and training devices for the facilitation of every day and athletic movements. Of note, Raphaël Varane, who is a defender on the French national soccer team, 2018 World Cup Champion, and current Manchester United player, is one of their investors.

Kinvent offers a comprehensive solution combining an intuitive app, KINVENT PHYSIO, with a range of connected sensors, measuring strength, balance and range of motion of athletes. KINVENT solution helps fasten teams’ rehab process, and assess athletes in one minute. What is also unique about the KINVENT PHYSIO app is that it can understand the baseline of each individuals and uses data from 600,000 patients globally to compare individual data against similar demographics.

Pictures: KINVENT 11 sensors in 1 ecosystem

The display of the data recorded by the device sensors is transcribed by the KINVENT PHYSIO App, installed on any iOS or Android terminal. All sensors are capable to assess powerful muscular groups and record in real time, giving an instant biofeedback data on the app.

Picture: KINVENT products in action

Here are some pictures of the KINVENT mobile app and dashboard:

Picture: KINVENT mobile app and dashboard

Here is a video showcasing KINVENT products:

Here is a video showcasing KINVENT’s 3D Force plates, which are 3 Dimensional force plates combined with MOCAP bringing lab-level precision directly to the field. Unlike traditional force plates that only capture vertical force, 3D Deltas measure movement in all directions, providing a complete picture of an athlete’s or patient’s biomechanics. By combining 3D force plate technology with motion capture, it allows for real-time insights into (1) Change of direction efficiency, (2) Lateral movement & performance metrics (3) Injury risk assessment & rehab progress and (4) Sport-specific movement analysis.

Here is a video showcasing KINVENT’s K Power, an innovative hybrid sensor that combines IMU (Inertial Measurement Unit) and UWB (Ultra-Wideband) technology to deliver wireless and highly precise measurements of speed, distance, acceleration, and power in sports and rehabilitation settings.

KINVENT has developed advanced sensors and an application used by over 22,000 professionals across more than 75 countries. KINVENT has also built the world’s biggest database of grip assessments as they have collected between 50,000 and 70,000 grip assessments. As shown in the picture below, many other elite teams such as PSG, the Brazilian national soccer team, the French national soccer team, SD Padres (MLB), Houston Dynamo (MLS), Houston Texas (NFL), UFC, INSEP, just to name a few, are using their product today.

KINVENT products are also used by leading healthcare organizations and universities such as Mayo Clinic, HSS, Brooks Rehabilitation, Aspetar, Princeton University, just to name a few.

Here is below the podcast interview we did with Athan Kollias, KINVENT CEO. Of note, Athan will be speaking at our 2025 Upside Sports Tech Summit on October 23 at a world’s class sports stadium in Sunrise FL:

9. Kinexon Sports

Founded: 2012

Headquarters: Munich, Germany

Website: www.kinexon.com

Amount money raised: $130M

Total Employees: 201–500

Customers / Partners: Trusted by over 500 sports teams globally, including 80% of NBA teams, European Handball Federation, and elite organizations in American football, soccer, hockey, and volleyball.

Company/Product Description: KINEXON is a global leader in real-time sports analytics and IoT solutions, specializing in ultra-precise tracking technologies for athletes, teams, and leagues. Their flagship platform, KINEXON PERFORM, delivers over 300 real-time performance metrics with 10 cm accuracy and 20 ms latency, enabling coaches to optimize training, manage player load, and reduce injury risk.

KINEXON's technology is sport-specific and integrates seamlessly with GPS, UWB, IMU, and computer vision systems. Their solutions are widely adopted across basketball, football (soccer), American football, handball, and hockey. As a FIFA Preferred Provider for Live Player & Ball Tracking, KINEXON also powers immersive fan experiences and officiating support through its ENGAGE platform.

In addition to sports, KINEXON offers AI-powered IoT platforms for manufacturing and logistics, serving clients like BMW, Siemens, and Airbus with real-time asset tracking and automation solutions.

10. Output Sports

Founded: 2018

Headquarters: Dublin, Ireland

Website: www.outputsports.com

Amount money raised: $4.8M

Total Employees: 11–50

Customers / Partners: Utilized by hundreds of sports organizations globally, including teams in the NFL, MLB, NHL, MLS, PGA, NWSL, and EPL.

Company/Product Description: Output Sports is a University College Dublin spin-out that specializes in wearable sensor technology for athlete performance optimization. Their flagship product, the Output V2 system, combines a matchbox-sized Inertial Measurement Unit (IMU) with advanced signal processing and machine learning to deliver over 200 validated assessments across 12 modules, including velocity-based training (VBT), strength, power, mobility, and rehabilitation.

The system is designed for simplicity and portability, allowing coaches and practitioners to conduct comprehensive performance evaluations without bulky equipment or complex setups. It operates offline and integrates seamlessly with existing workflows, enabling real-time data collection and analysis in various environments, from the gym to the field.

Output Sports has raised a total of $6.21 million in funding, including a $4.8 million pre-Series A round in January 2025, with investors such as University Bridge Fund, Apex Capital, and Atlantic Bridge.

Of note, Output Sports CEO will be speaking at our 2025 Upside Sports Tech Summit on October 23 at a world’s class sports stadium in Sunrise FL:

11. Vitruve

Founded: 2017

Headquarters: Madrid, Spain

Website: www.vitruve.fit

Amount money raised: 998k euros

Total Employees: 11–50

Customers / Partners: Trusted by over 7,000 coaches and 40,000+ athletes worldwide, including high schools, universities, professional teams, health facilities, and tactical units.

Company/Product Description: Vitruve is a Spanish technology company specializing in Velocity-Based Training (VBT) solutions for strength and conditioning. Originally launched as Speed4Lifts, the company rebranded to Vitruve to reflect its broader mission of making VBT accessible to a wider range of athletes and coaches.

The core of Vitruve's offering is a compact, durable linear position transducer (encoder) that measures barbell velocity with high precision. This device is complemented by the Vitruve App, available on iOS, Android, and Web platforms, which provides real-time feedback, tracks progress, and offers features like auto-regulation, fatigue monitoring, and leaderboards.

Vitruve's technology is designed to be user-friendly and affordable, making it suitable for various settings, from individual athletes to large teams. The system supports multi-encoder connectivity, allowing coaches to manage multiple athletes simultaneously, and offers different subscription plans to cater to varying needs.

12. OxeFit

Founded: 2019

HQ: Plano, Texas

Amount money raised: $70M+

Website: https://www.oxefit.com/

Total employees: TBD

Customers / partners: 10 NFL teams, 2 MLB, 30+ NCAA teams, NY Liberty.

Company/product description: OxeFit is a fitness technology company founded in 2019 and headquartered in Plano, Texas. It specializes in developing AI-powered strength training systems that integrate robotics, movement tracking, and performance analytics to provide personalized and effective workouts. Their flagship products, the XS1 for home use and the XP1 for commercial settings, offer a comprehensive range of exercises, including strength training, cardio, Pilates, and aquatic sports simulations.

These systems feature dynamic variable resistance, real-time feedback, and a growing library of on-demand classes, aiming to enhance user engagement and performance. OxeFit's innovative approach has attracted investments from notable athletes and has been adopted by various fitness centers, sports teams, and rehabilitation facilities.

Picture: OxeFit XP1

Here is a video with the Dallas Cowboys QB Dak Prescott using the OxeFit XP1:

13. Remaker

Founded: 2020

Headquarters: London, United Kingdom

Website: remaker.co.uk

Amount money raised: TBD

Total Employees: 10-49

Customers / Partners: Utilized by strength & conditioning coaches, health professionals, and fitness organizations seeking portable performance tracking solutions.

Company/Product Description: Remaker is a UK-based fitness technology company specializing in portable strength tracking systems designed to enhance athletic performance and rehabilitation. Their flagship products, the Remaker Link and Remaker Move, are compact, Bluetooth-enabled devices that attach to equipment or the body to measure tension, force, power, and velocity in real time. These tools provide immediate feedback to smart devices, facilitating data-driven training and recovery programs. Evidencing the impact of every session, driving in-session intent and unlocking motivation as progress is tracked across programmes.

Co-Founded by Max Stevenson, Remaker aims to revolutionize the workout and injury rehabilitation sectors through innovative technology.

Video: Remaker Move

13. Hytro

Founded: 2019

Headquarters: London, United Kingdom

Website: hytro.com

Amount money raised: £1M

Total Employees: 11–50

Customers / Partners: Trusted by elite sports teams and organizations including Red Bull Racing, Saracens RFC, Leeds Rhinos, and numerous performance institutes across global football, rugby, and Olympic sports.

Company/Product Description: Hytro is a pioneering UK-based sports technology company specializing in the application of Blood Flow Restriction (BFR) training through its patented, wearable BFR-integrated garments. Designed for performance, recovery, and rehabilitation, Hytro's garments enable safe, effective BFR without the need for external equipment or constant supervision. Their flagship product, the Hytro BFR wearables, allow athletes to unlock muscle growth, accelerate recovery, and enhance readiness using scientifically-backed protocols.

The garments feature integrated, adjustable straps positioned on the limbs to occlude blood flow in a controlled manner. This practical, user-friendly approach to BFR has led to rapid adoption by high-performance practitioners seeking to implement time-efficient and research-driven strategies for load management and tissue adaptation.

Founded by Dr. Warren Bradley, a performance scientist and former elite sport practitioner, Hytro is at the forefront of translating complex exercise physiology into scalable, easy-to-use solutions. The company is advancing both academic research and real-world implementation of BFR across sport, tactical, and wellness domains.

Bottom line: The CSCCa conference was a great event. It was a great opportunity to catch up with NCAA teams, vendors and local teams and partners. From our trip and discussions with practitioners there, it became quite clear that NCAA practitioners are always looking for new cutting technologies to help them reduce injuries, improve load management, sleep management, training and recovery. Velocity training, resistance training, fitness equipments, AMS, and nutrition products, remain the top tech categories among NCAA teams. Despite the long sales cycle for some of the top D1 programs, the collegial / NCAA market present a significant opportunity for any sports tech startups looking to scale in the world of sports and tech.

As always, if you have any questions, feel free to reach out to me.

Best,

You may also like: