📈 Upside Special M&A Report: Teamworks and the Rise of the Athlete Operating System

Over the past decade, Teamworks has evolved from a digital communication tool for college athletes into a global SaaS powerhouse supporting over 6,000 sports organizations across the NCAA, NFL, NBA, NHL, MLB, Premier League, and military/tactical sectors. Founded by former Duke football player Zach Maurides, the company has pursued an aggressive M&A strategy designed to transform Teamworks into a unified "Operating System for Sports"—streamlining performance, recovery, communications, compliance, and career development into one seamless platform.

At the core of this strategy is a clear vision: eliminate the fragmentation plaguing athletic departments and professional organizations by acquiring best-in-class tools and deeply integrating them into a single, data-rich ecosystem. Below, we break down Teamworks’ most important acquisitions, their rationale, and their far-reaching implications for sports teams and institutions.

🔁 Major Acquisitions by Teamworks

1. 📸 INFLCR (Oct 2019)

Focus: Athlete brand building, social media distribution, NIL compliance.

Rationale: Address the growing importance of athlete branding and NIL rights.

Implication: Provided teams with compliant, scalable tools to help athletes build personal brands and unlock sponsorship opportunities.

2. 🍽️ Notemeal (Oct 2021)

Focus: Nutrition planning between dietitians and athletes.

Rationale: Integrate performance nutrition into the core platform.

Implication: Improved athlete health tracking and diet compliance, bridging the gap between performance staff and athletes' day-to-day fueling.

3. 🧠 Smartabase, Retain, Grafted, NextPlay (Jan 2023)

Focus: Performance data (Smartabase), academic advising (Retain), alumni connections and mentorship (Grafted, NextPlay).

Rationale: Expand the platform across the entire athlete lifecycle—before, during, and after competition.

Implication: Teams gained tools for injury recovery, cognitive benchmarking, academic eligibility, and post-career support in one place.

4. 📋 ARMS Software (Apr 2023)

Focus: Recruiting, compliance, and camp operations for college sports.

Rationale: Add administrative efficiency and compliance management.

Implication: Institutions could streamline recruiting and maintain full NCAA compliance without toggling between separate systems.

5. 📱 Kairos (Jan 2024)

Focus: Communication and scheduling for pro teams.

Rationale: Bolster communication tools especially for elite professional teams.

Implication: Centralized calendars, travel logistics, and staff-athlete messaging—critical for time-pressed pro organizations.

6. 🧬 ZoneIn (Jul 2024)

Focus: AI-powered personalized performance nutrition.

Rationale: Deepen nutrition insights beyond Notemeal’s foundation.

Implication: Predictive, individualized nutrition planning to support peak physical performance.

7. 📊 Zelus Analytics (Sep 2024)

Focus: Sports analytics and predictive modeling.

Rationale: Add data science and performance insights into the core platform.

Implication: Front offices and coaching staff gain tools for roster optimization, workload planning, and talent identification.

8. 🧠 Telemetry Sports (June 2025)

Teamworks’ initial rise was fueled by solving logistical headaches—calendar syncs, team messaging, and travel planning. But with the Telemetry Sports acquisition, it’s signaling a shift from logistics provider to strategic performance layer.

Telemetry Sports’ expertise lies in game modeling, play tagging, and predictive analytics, particularly within the NFL. Its IP allows coaches and analysts to generate more accurate game plans and scouting reports using historical data and opponent trends.

Impact of this move:

Full performance-stack consolidation: Teamworks now touches the daily schedule, medical notes, and game plan intelligence all in one platform.

Data intelligence as a differentiator: This signals a clear intent to become more than an ops tool—more like a unified control tower for team management and performance insights.

This deal could be a signal of where the next frontier is headed: toward data-enabled decision-making that spans the entire organization—from GMs to performance coaches to operations directors.

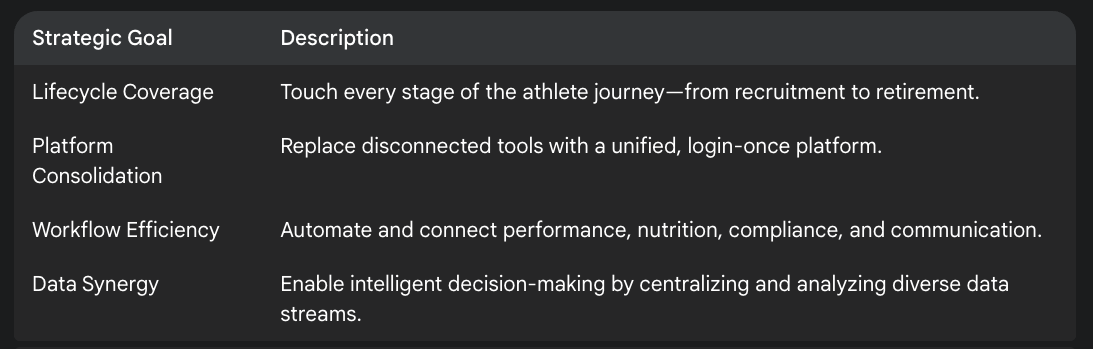

🎯 Strategic Rationale

Teamworks’ acquisition roadmap has been guided by four strategic goals:

Source: Upside Global, June 2025

Each acquisition also unlocks cross-selling potential—schools or teams using Teamworks for communication are offered complementary tools for nutrition, compliance, or analytics.

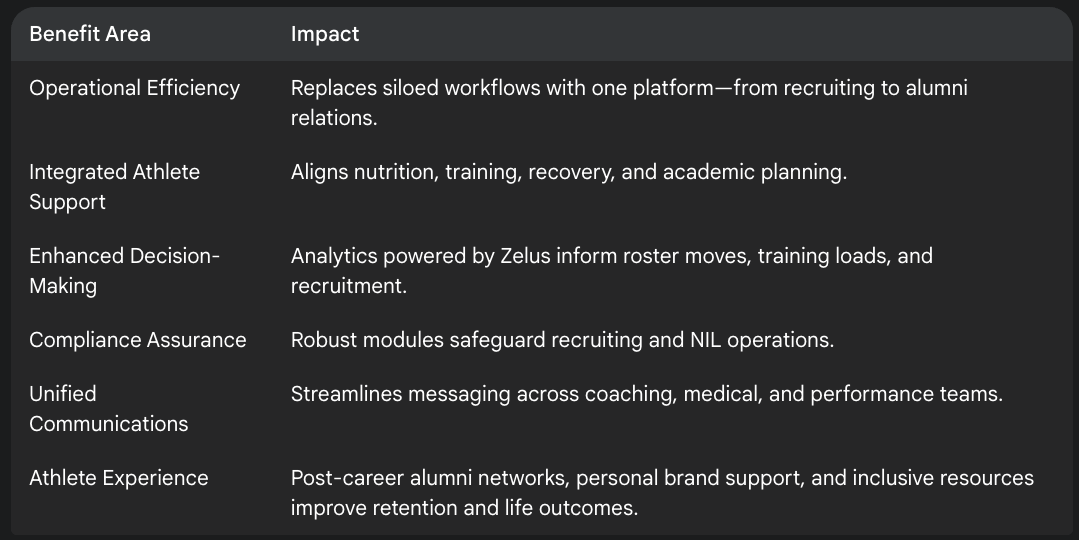

🏟️ Implications for Teams & Institutions

For elite organizations, the shift toward a centralized platform provides:

Source: Upside Global, June 2025

⚠️ Challenges for Teams from Teamworks’ M&A Strategy

While Teamworks’ integrated “Operating System for Sports” offers significant value, its rapid expansion through acquisitions has also introduced important challenges that elite sports organizations must navigate:

1. Platform Overload and Complexity

Issue: Teams may struggle to onboard and train staff across multiple new modules (e.g., Smartabase, Zelus, ARMS, Notemeal), especially when transitions occur rapidly.

Impact: Staff may face steep learning curves, operational friction, and duplicated efforts while navigating overlapping or evolving toolsets.

2. Vendor Lock-In Risk

Issue: As Teamworks consolidates more verticals—communications, compliance, nutrition, analytics—it reduces the need (and sometimes the ability) to use alternative vendors.

Impact: Teams may lose flexibility or negotiating power, especially if Teamworks' pricing changes, features are deprecated, or certain acquisitions don’t evolve as expected.

3. Integration Growing Pains

Issue: Despite promises of unified workflows, merging disparate platforms (e.g., Kairos and Smartabase, or Notemeal and ZoneIn) takes time and may result in incomplete integration.

Potential Impact: Data silos, bugs, or inconsistent user experiences can disrupt operations and reduce user trust in the platform.

4. Cost and Licensing Complexity

Issue: As Teamworks rolls out bundled packages, costs may increase—or become harder to predict and manage across departments (e.g., athletic trainers, compliance officers, S&C coaches).

Potential Impact: Budget planning becomes more complex, especially in college programs where departments may have historically managed their own tools.

5. Dependence on a Single Tech Stack

Issue: Relying heavily on a single provider for everything from recruiting and scheduling to performance and analytics increases exposure to system outages, contract disputes, or strategic shifts at Teamworks.

Potential Impact: Any major platform failure or abrupt change in Teamworks’ direction (e.g., M&A, investor pressure) could disrupt multiple critical functions at once.

6. Uneven Adoption Across Stakeholders

Issue: Different groups (coaches, athletic trainers, dietitians, compliance officers) may have varying levels of digital maturity or openness to using new tools.

Potential Impact: Inconsistent adoption can dilute the platform’s intended benefits and introduce communication gaps or data errors across departments.

🎯 Strategic Recommendation

To mitigate these challenges, teams and institutions should:

Designate an internal “Teamworks Champion” to manage onboarding, training, and cross-department implementation.

Push for open APIs and data portability to avoid over-dependence on Teamworks’ stack.

Regularly audit value received from each module to ensure ROI aligns with organizational goals.

Participate in product feedback loops with Teamworks to shape feature roadmaps and improve usability.

🔮 Conclusion: Teamworks as Sports' Digital Backbone

Teamworks has executed one of the most methodical and strategic acquisition sprees in the sports tech ecosystem. Each deal reinforced its mission to become the central nervous system for athlete operations—a single pane of glass through which performance, communication, nutrition, analytics, and compliance flow together.

For teams and institutions, this consolidation means more than just convenience—it provides strategic leverage. A well-integrated ecosystem enables better outcomes on the field and in the boardroom, from minimizing injuries and managing workloads to optimizing talent development and improving athlete well-being.

As the performance arms race continues across collegiate and professional sports, Teamworks is positioning itself not just as a vendor, but as a critical infrastructure layer—the operating system that powers the future of athlete-centered performance.

However as mentioned above, for some teams some challenges may remain to fully adopt Teamworks’ full suite of solutions. And let’s face it! M&As are not easy and successfully integrating various technologies is hard. And some teams like flexibility and they may not all want to use everything from Teamworks.

You may also like: