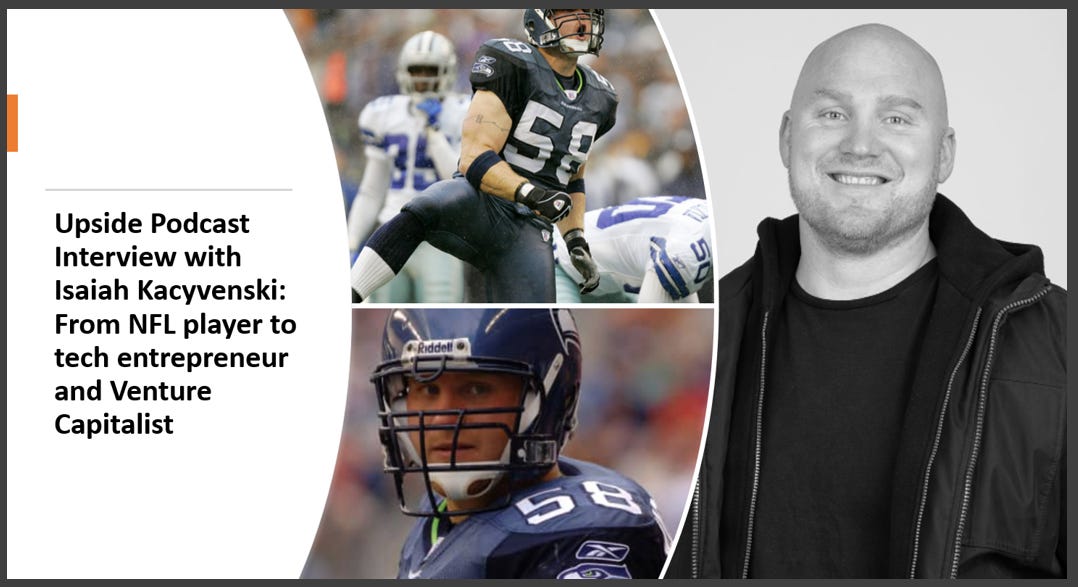

This week we have the honor to interview Isaiah Kacyvenski, the Co-Founder and Managing Partner of Will Ventures, a venture capital investment fund focused on sports technology opening up adjacent markets primarily in Consumer, Health and Media. Isaiah is also a former NFL player who played for the Seattle Seahawks, St. Louis Rams and Oakland Raiders.

Before we get into the podcast interview with Isaiah, here is some quick background about Will Ventures.

Company name: Will Ventures

Description: Will Ventures is an early-stage venture capital firm that leverages the power of sport to change the world. The reach, demands and allure of the sports market make it an ideal proving ground for innovations that will scale beyond the category. That’s why Will Ventures is the first venture firm to use sports as a lens to identify novel technologies in large, adjacent markets.

Headquartered: Boston (USA) and NYC (USA)

Founded: 2018

Website: https://willventures.com

Sectors: Sports, media & entertainment

Investment stage: Early Stage Venture

Total number of investments: 25 investments.

Recent investments: National Cycling League (Dec 2022); Street FC (August 2022), Ness (May 2022), Player’s Health (March 2022), Elo Health (Feb 2022).

Source: Will Ventures

📝Show Notes: Through this interview, we touched on his background, his NFL career as well as his sports tech VC Will Ventures, and his investment thesis. Isiah also shared his advice for young entrepreneurs looking to raise money as well as anyone looking to start a career in the sports investment world.

🚀Best Quotes: Here’s some of the key discussion points and best quotes from our conversation with Isiah:

On his background and difficult childhood:

“I grew up in upstate New York in poverty. I was the youngest of five kids. I realized early on in my life that sports and academics were my way out. I did not want to live like that. I wanted to have a family, and I didn't want them to live like that either (…) Poverty for me was a really big motivator”.

“I also realized early on that we lived in an amazing country where I could really define my own path, blaze my own trail, and make my own decisions. I realized that super early and a lot of that was through the help of my mother”.

On how he got accepted into Harvard University:

“Fast forward, I made up my mind and at that point I worked extremely hard in school and sports. I ended up going to school at Harvard University as an undergrad. I would say that this was the last place in the world I ever thought I would've found myself (..) It really changed how I looked at the world. It was an amazing experience”.

“I knew that I wanted to play in the NFL. My backup plan was to be a doctor. And I was a pre-med undergrad, I held down four jobs, and I lived the life of an hermit during my four years there”.

On how he ended up playing in the NFL:

“I ended up being drafted by the Seattle Seahawks in 2000. I played in the NFL for eight years. From 2000 to 2008 I was primarily with the Seahawks as the three-time captain. I was one of the captains of the first Super Bowl team. I was never a superstar though. I barely survived every single week. In the NFL, there are no guaranteed contracts (..) When I was drafted in 2000, I got a signing bonus of $275,000”.

On how he started as an angel investor in 2003:

“I had zero understanding background around finance and economics. I was always kind of science-based in all my studies. And to put this in context, my father made somewhere around $7,000 a year in my senior year of high school”.

“For the first time in my life though, when I was drafted in 2000 I realized that I had free time and that I never had free time before during the off seasons. So I spent my first three years in the NFL in my off seasons learning everything I could about public and private markets, finance, economics, whatever book I could read. And I would talk to as many people as I could so I could learn. Then in 2003 I started as an angel investor”.

On when he realized he wanted to launch his own investment fund:

““By the time I retired in 2008, I decided that I didn't want to be a doctor. I eventually wanted to get into venture capital. I wanted to start a venture capital fund. I did not know how to do it so I figured that I needed a formal base of knowledge. So I went to Harvard Business School, got my MBA and I figured that it would give me the right kind of skillset that I needed to go out there”.

“I always thought that to start a fund, you had to start as an associate and you had to work your way up and then go start your own fund. That's typically what people advise you. And then a great mentor, Rick Frisbie, who's one of the founders of Battery Ventures, said to me “Don't do that. My recommendation for you is to be an entrepreneur so you have this authentic understanding of how difficult it is to be an entrepreneur, to put yourself in those shoes and understand how to face those events. And he was one hundred percent correct. It was an amazing piece of advice (..) We started the Will Ventures fund one in 2019. We just closed our second fund”.

On his areas of focus when investing in startups:

“We can really cut across from creator economy to communities to physical therapy, to fan engagement, to health and wellness to longevity, as well as ports betting, gaming, e-commerce, FinTech (..) We've taken a research back thesis driven approach. We do deep dives into our research, and we really get a prepared mind for the markets. And we really look for talented entrepreneurs pushing into these markets”.

On what they are looking for when deciding to invest in startups and especially entrepreneurs":

“When we look at companies, and especially entrepreneurs. And it could come in a variety of factors, but we look at multi-decade tailwinds and the opportunity for this company to be a market leader. We also look at the quality of the entrepreneur, and we try to answer the question: “ Is this entrepreneur the right person to take this company to the promised land and to go execute against a strategy”.

On his advice to sports tech entrepreneurs in the current challenging macro environment:

“The biggest piece of advice that we give to entrepreneurs in our portfolio or to the entrepreneurs that we know, is to really try to extend their runway as much as possible”.

“It is important to make it through, ideally over the next year and a half, or even two years. Now I know that might be tough in some situations as well”.

On the current state of the venture capital market:

“You're starting to see that the blue chip funds were able to raise. So there's a lot of captive capital out there. But the other end, if you are not a blue chip fund, you have to go raise in a unbelievably difficult environment right now”.

“A lot of those emerging funds will disappear as well. And then a lot of that high net worth and family office money will stop too. So there are many of these things being eliminated, and it makes it more challenging for the entrepreneurs to raise”.

“But if you have strong fundamentals, your ability to continue to raise will still be there because there is still capital out there. Even if some people are putting a pause right now, there's still gonna be capital for entrepreneurs”.

On his belief that we will see some great companies being funded in our current challenging macro environment:

“I think there is a real opportunity right now where you have a ton of talent that are back into the entrepreneur pool (due to the layoffs). And I think that you could see some amazing companies coming out of there as well.”

On his advice to anyone looking to get into the world of sports investment:

“It's a tough field to break into. It's just historically been tough. I realized that early on as well where it was just going to be really tough to break through without a background in finance. Although I did have a background in sports I eventually had to realize that I was going to have to bet on myself”.

“And Brian and I both had to bet on ourselves. But I think there are a lot of different ways to get into the sports investment world anywhere from starting a business, which is where I started as an entrepreneur (after my NFL career) or getting general investment experience and then turning a passion towards sports”.

You may also like:

Upside chat: Fabien Allègre, Chief Brand Officer at PSG (Ligue 1).

Upside Chat: Eddie Jones, the head coach of England National Rugby team.

Upside Chat: Sebastien Audoux, head of Digital Sports Content at Canal +.

Upside Chat: Padraig Harrington, a world class European professional golfer

and former world’s #3.⭐Upside: Top 12 Emerging Sports Performance Startups to Watch in 2H22

🔥 Upside Chat: Dave Hancock, CEO, Apollo (Leading Athlete Management

Systems (AMS) vendor)

⭐Sports Performance Roles & Best Practices (Head of Performance, Head Athletic Trainer..)