Here is a recap on their past investments:

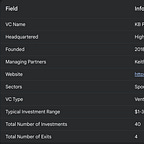

KB Partners is a venture capital firm focused on investing in early-stage companies at the intersection of sports, media, and entertainment technology. Based in Chicago, the firm primarily backs startups leveraging innovative technologies such as artificial intelligence, data analytics, gaming, and digital media to transform the sports industry. KB Partners seeks to support visionary entrepreneurs who are developing scalable solutions in areas like fan engagement, performance optimization, and sports betting. With a hands-on approach, the firm provides not only capital but also strategic guidance, leveraging its extensive industry network to accelerate growth and drive long-term success for its portfolio companies.

This week, we interviewed Matt Howard, the principal at KB Partners, a leading sport tech VC based in Chicago. We discussed his background, investment thesis, his area of focus, and what he is typically looking for when investing in startups. He also gave us his advice to raise money and to start a career in sports investment.

Here is a summary of the best quotes of our interview with Matt:

Q1. Can you please tell me about your background?

"I’m originally from Columbia, South Carolina, and played high school basketball at AC Flora before getting recruited by some of the Ivy League schools. That led me to play Division 1 basketball at the University of Pennsylvania while studying finance at the Wharton School."

"My love for sports grew not just from playing but also through studying sports management courses. That interest stayed with me, even as I initially pursued a career outside of sports."

"After college, I spent two and a half years in private wealth management, working with high-net-worth individuals. I then moved to Capital One in a more analytical role within their commercial banking division. That experience, combined with my background in sports and financial analysis, set me up perfectly for my role at KB Partners."

"I met Keith Bank, the founder of KB Partners, and realized it was the perfect fit. KB Partners was one of the first venture capital firms focused solely on sports tech, and that aligned with my passion for both sports and investing. My wife and I moved to Chicago, and I’ve been with KB ever since."

Q2. Can you please tell me about KB Partners?

"KB Partners is a venture capital firm based in Highland Park, a suburb of Chicago. It was founded by Keith Bank, who has been making angel investments for over 20 years. Keith started his career in movie production and real estate before shifting into sports tech investing."

"We saw a gap in sports tech investment around 2017-2018 and raised a $40 million fund, which at the time was one of the largest funds focused solely on sports tech. We followed that up with a $127 million fund, which we’re currently investing out of."

"We invest in a wide range of areas—fan engagement, media, ticketing, sports betting, esports, gaming, human performance, health tech, and ed-tech. We’re opportunistic investors, meaning if we see a deal we really like, we figure out how to make it work financially and strategically."

"Beyond capital, we’ve built an ecosystem where our portfolio companies benefit from the strategic advice and industry connections of our limited partners (LPs), many of whom are deeply embedded in the broader sports industry."

Q3. What is your sports tech investment philosophy?

"We invest primarily at the seed stage, writing checks between $1 to $3 million. We typically look for 15-30% ownership in companies we back."

"Our investment philosophy is pretty simple: We look for strong founding teams, companies operating in growing markets, and businesses that align with our sports tech thesis."

"We underwrite every deal with the goal of achieving a 10X return. Of course, in venture, some investments go to zero, some return 2-3X, and a select few hit 50-100X. But if we don’t see a clear path to 10X returns, we’re unlikely to invest."

"We also believe in ‘sports as a wedge.’ That means we invest in companies that may start in sports but have a pathway to expand into larger markets like industrial applications, healthcare, or government sectors. Sports is a great proving ground, but to truly scale, companies need to grow beyond it."

Q4. What are the things you are looking for when deciding to invest in a new startup?

"It always starts with the management team. A great team can pivot, solve problems, and adjust to market conditions. Some of our biggest misses have come from underestimating the importance of leadership, and some of our biggest wins have been because the team was exceptional."

"Beyond the team, we look at the market—Is it growing? Is there enough opportunity for this company to scale? Then we assess the product. Does it fit within our investment thesis? Does it have a real use case in sports?"

"Other important factors include competitive advantage, product differentiation, and whether the company has a viable go-to-market (GTM) strategy. A great product without a solid GTM plan is a red flag."

"We also consider financials—valuation, revenue growth, margins, and scalability. If a company has strong fundamentals and a clear growth trajectory, it makes it much easier for us to get behind them."

Q5. What advice would you give to anyone looking to start a career in sports tech investment?

"Breaking into venture capital, especially sports tech, is all about timing and persistence. Unlike private equity or investment banking, where there’s a structured hiring process, venture hiring is more opportunistic. You have to put yourself in a position where you’re top of mind when opportunities arise."

"I always encourage people to reach out to VCs on LinkedIn, ask for informational interviews, and build relationships. You never know when a firm will need to bring someone on board."

"Beyond networking, you need to develop your skills. Learn financial modeling, understand market trends, and become proficient in due diligence. Resources like Wall Street Prep can help sharpen your technical skills."

"If you’re in consulting, investment banking, or a startup, those are great stepping stones into VC. The key is to get experience evaluating businesses, working with management teams, and understanding how markets operate."

"Finally, if you want to be in sports tech investing, make sure you’re passionate about all sports, not just the big ones. This industry touches everything from basketball and football to pickleball, esports, and fitness tech. The broader your perspective, the more valuable you’ll be in venture capital."

Q6. Which sports tech sectors are the most promising right now?

“I think the fan engagement space is a big one. There's just so many ways that you can do it and look at it. There's more tech enabled fan engagement. There's more in venue type technologies now. There's out of venue type activations that can be done. There's AR and VR activations that can be done in stadiums and outside of stadiums. And it touches so many things. Fan engagement is sponsorships, how your fans engage with your sponsors, how fans engage with certain brands and when they're choosing what they eat and what they drink at games. So I'm just really bullish on the space overall”.

“And then I would say sports betting is still a big one. I think some of the nuanced ways that sweepstakes are starting to emerge, whether it's the flips of the world. We're looking at some other smaller, earlier companies in the space as well that are looking to use these coins and cash, different types of betting structures to basically allow for people to make picks on games outside of the more regulated states and things of that nature. So I think those are two things that I'm really high on right now and two things I've spent a lot of time on as well”.

You may also like: